BlackRock has launched five enhanced active exchange-traded funds (ETFs) for investors, aiming to consistently generate alpha and outperform a relevant benchmark by making hundreds of evidence-based positions in real time.

Run by BlackRock’s’ systematic investment team, this new range includes the iShares World Equity Enhanced Active UCITS ETF, iShares Equity Enhanced Active UCITS ETF, iShares Europe Equity Enhanced Active UCITS ETF, iShares Emerging Markets Equity Enhanced Active UCITS ET, and iShares Asia ex Japan Equity Enhanced Active UCITS ETF.

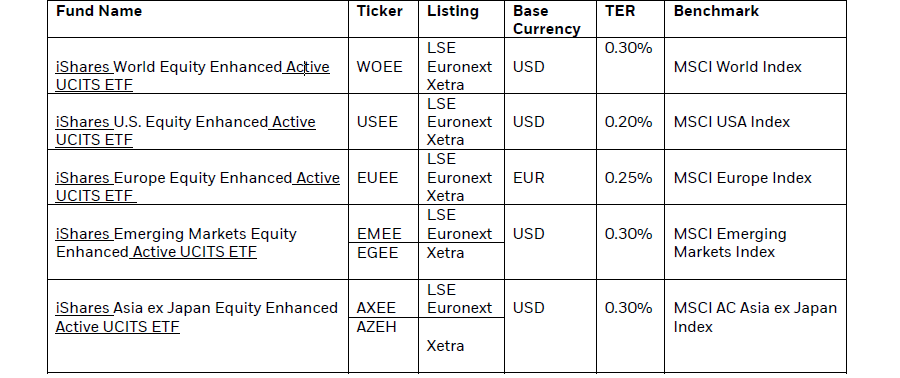

New ETFs launched by BlackRock

Source - Blackrock

As market and macroeconomic volatility has grown, particularly in this year of elections, investors need a more dynamic investment strategy, the firm said.

With client needs evolving, Blackrock’s experts believe active ETFs are now set to become a much more integral part of global investment portfolios.

In a statement, Jane Sloan, EMEA head of iShares & global product solutions at BlackRock, said: “The active ETF industry is expected to reach $4trn by 2030 as investors seek efficient risk-taking through ETFs in a way that is scalable and repeatable.”

“This ETF range can bring alpha-seeking strategies to the core of client portfolios,” Sloan concluded.