Investment trust discounts (excluding 3i) expanded from 2% in November 2021 to 18.5% by October 2023, the widest level since the global financial crisis. Alternative investment trusts bore the brunt of that derating but they now stand to gain substantially from interest rate cuts.

As the income from cash, money market funds and government bonds falls, investment trusts should become comparatively more attractive to investors, said Richard Stone, chief executive of the Association of Investment Companies.

“Lower interest rates could see investors looking beyond fixed income and towards alternative asset classes such as infrastructure, renewable energy and property, which have the potential to pay attractive levels of income,” he said.

Anthony Leatham, head of investment trust research at Peel Hunt, believes investors were waiting for cuts before moving back in.

“As we have travelled the country speaking to those investors that have suffered an uncompromising derating across the alternatives, long duration and growth sectors, we have heard the expression ‘we are all rates traders’ on a number of occasions,” he said.

“Many have commentated that it would take interest rate cuts to actually materialise for them to start reallocating to certain asset classes and strategies.”

Below, experts analyse which alternative investment strategies stand to gain from monetary easing.

Infrastructure

Infrastructure trusts, which by their very nature own long-duration assets, look particularly attractive, said Emma Moriarty, a portfolio manager at CG Asset Management. Transactions have been taking place in the infrastructure sector, which is enhancing investors’ confidence in valuations, in stark contrast to the property market where transactions have ceased up, she said.

“The equity market confidence dynamic overlaps that” and should push up trusts’ share prices as sentiment improves, she added.

CG Asset Management has substantially increased its allocation to core infrastructure and renewable energy trusts within its multi-asset portfolios. “We started increasing in October last year and then added again in earnest beginning in March this year, when investment trust discounts looked particularly wide,” Moriarty explained.

CGAM holds 3i Infrastructure, HICL Infrastructure, International Public Partnership, The Renewables Infrastructure Group (TRIG) and Greencoat UK Wind.

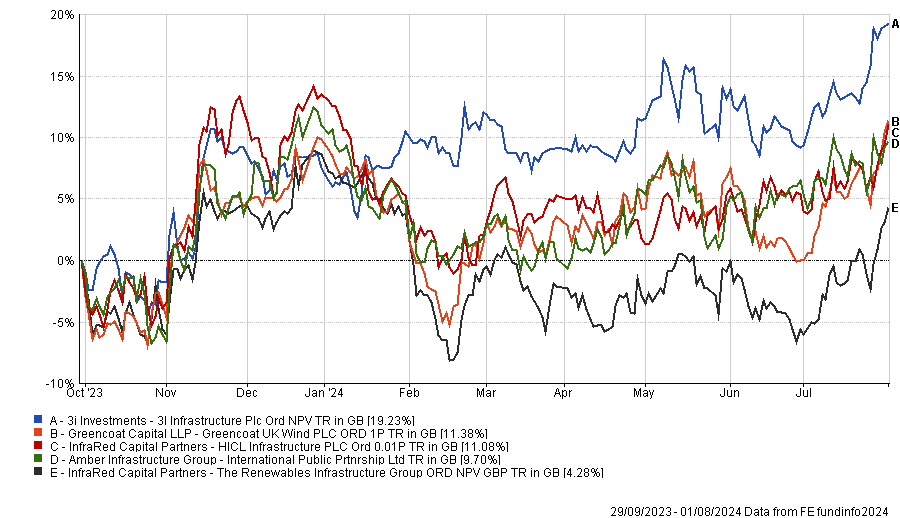

Performance of trusts since October

Source: FE Analytics

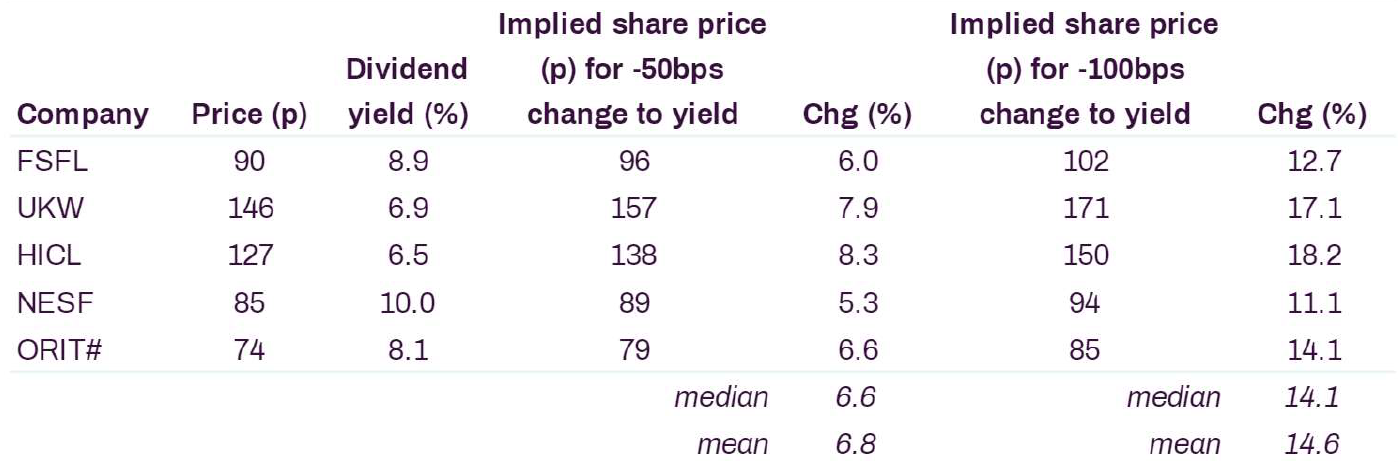

Peel Hunt estimates that if investor demand for infrastructure trusts were to push dividend yields down by 50 or 100 basis points, and if benchmark yields were to fall by a similar level, this would result in a median implied share price gain of 7% or 14%, respectively, as the table below shows.

The valuations of trusts’ underlying asset should also rise. For instance, Greencoat UK Wind has stated that a 0.5 percentage point fall in the discount rate would lead to 7p gain in its net asset value (NAV) per share.

Implied share price movements

Sources: Company data, LSEG Workspace and Peel Hunt. The trusts in the table are Foresight Solar Fund (FSFL), Greencoat UK Wind (UKW), HICL Infrastructure, NextEnergy Solar Fund (NESF) and Octopus Renewables Infrastructure Trust (ORIT).

Leatham highlighted Greencoat UK Wind’s “explicitly inflation-linked dividend policy, strength of cash flow generation providing firepower for dividend growth, share buybacks and funding flexibility”.

“Whilst the company’s current share price discount of circa 9% is the narrowest of the renewables peer group, the company’s relatively simple strategy still offers a competitive dividend yield of circa 6.9% based on FY24 target dividends of 10p,” he said.

At the other end of the spectrum, Octopus Renewables Infrastructure is trading on one of the widest discounts in the peer group of 29%, “despite its pan-European portfolio’s performance being robust and the company having successfully executed upon its capital recycling programme”, Leatham pointed out. It also offers an above-average 8.1% dividend yield.

In the infrastructure debt space, Sequoia Economic Infrastructure Income (SEQI) yields 8.4% and has diversified global exposure across a range of sectors, including power, transport, renewables, technology, media and telecoms.

“We expect SEQI to benefit from falling rates as the pull-to-par gets accelerated on fixed-rate loans. Decreasing interest rates also helps to de-risk the portfolio, particularly for borrowers with floating-rate loans,” Leatham explained.

Private equity

Private equity has had a tough couple of years. From January 2022 to October 2022, the private equity (ex-3i) sector average discount widened from 13% to 44%.

“This is perhaps unsurprising, given the nervous reaction from listed equity markets, the perceived impact on relatively opaque and infrequent valuations of long duration, private growth companies and the implications of a rising cost of debt on leveraged structures,” Leatham explained.

The ex-3i sector average discount is still wide at 25% and performance “has been more robust than many anticipated”, he added.

Yesterday’s initial Bank of England rate cut signals confidence that both inflation and rates are heading lower in the UK, said Andy Lund, global co-head of Houlihan Lokey’s private funds group. He hopes this will “help to unlock the historically high back log of private equity companies seeking exits and in turn deliver much needed liquidity to limited partners”.

Oakley Capital Investments is one of the top-performing trusts in the sector and it trades on a 27% discount, Leatham said. “The pan-European portfolio focuses on the consumer, technology, education and business services sectors. The portfolio benefits from recurring revenues and an attractive maturity profile, as well as a strong track record of organic growth and uplifts on exits.”

On a more tactical basis, Apax Global Alpha is trading on a 28% discount and offers an “eye-catching” yield on the shares of 7.1%, he noted. In June, it announced the creation of a €30m distribution pool to fund buybacks. “APAX has reported a number of exits from the portfolio with high internal rates of return,” he added.

In the private equity fund-of-funds sector, Leatham tipped HarbourVest Global Private Equity, which is on 36% discount. “We see scope for further narrowing,” Leatham said. Performance has been robust and the portfolio is highly-diversified. Furthermore, the trust recently increased its credit facility and established a distribution pool of $40m.

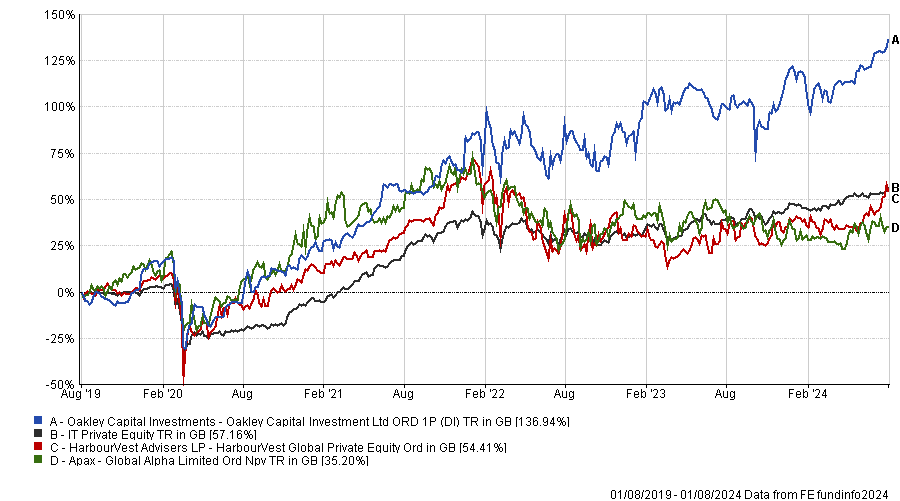

Total returns of trusts vs sector over 5yrs

Source: FE Analytics

Flexible investment

RIT Capital Partners and Caledonia Investments blend public and private investments and have suffered from investors’ scepticism about the valuations of private assets. They are trading on discounts of 24% and 33%, respectively.

“Should the cost of capital decline and the negative sentiment towards private equity valuations ease, we see both of these trusts as set to benefit,” Leatham said.

CG Asset Management rebuilt a substantial position in RIT Capital Partners from March 2024 onwards, Moriarty said. “The discount was so wide that even if we put a red line though all the private assets, it would be trading at par”, she pointed out.

Total returns of trusts vs sector over 5yrs

Source: FE Analytics

Real estate investment trusts

“Reducing interest rates and greater political stability should lead to additional capital flowing back into the UK real estate markets and we believe London is likely to be amongst the biggest winners,” Leatham said. To that end, he tipped Primary Health Properties and Shaftesbury Capital.

The share price of Primary Health Properties is highly correlated to risk-free rates. Almost all (90%) of its rental income is directly or indirectly funded by the UK and Irish governments, and investors tend to view it as a bond proxy. It yields 7.4% and is on a 15% discount to NAV.

Shaftesbury Capital, which “arguably owns the most prime portfolio in the listed sector”, should be well positioned to benefit, he continued. “With interest rates falling, we anticipate that the portfolio and its rental growth prospects will likely receive renewed interest from investors, especially given the relatively wide discount of 25%.”