All the funds in the IA North America and IA North American Smaller Companies sectors have posted a loss since Donald Trump returned to the White House in January, FE fundinfo data shows.

When Trump won the US election in November 2024, there was an immediate market rally as investors expected his ‘America First’, tax-cutting and deregulation agenda to bolster areas such as US tech, financials and energy stocks, smaller companies and cryptocurrencies.

However, sentiment has soured in recent weeks. Trump’s imposition of tariffs on key trading partners as well as economic worries stemming from layoffs of federal employees and the inflationary nature of some policies have spooked markets.

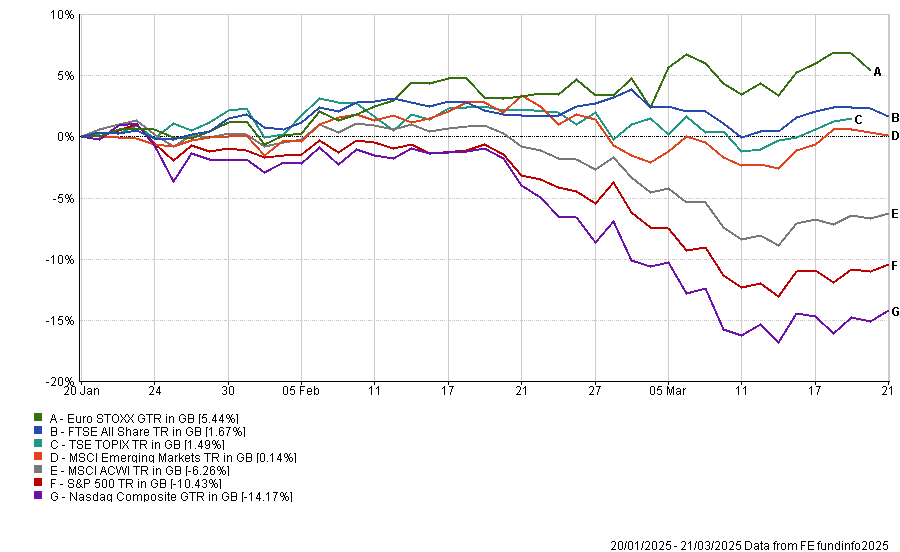

Performance of equity indices since Trump’s inauguration

Source: FE Analytics. Total return in sterling between 20 Jan and 21 Mar 2025

Between Trump’s inauguration on 20 January and the time of writing, the S&P 500 was down 10.4% in sterling terms while the tech-heavy Nasdaq had fallen 14.2%. In contrast, the MSCI AC World index was down just 6.3% while UK, European, Japanese and emerging market stocks were still in positive territory.

All of the ‘Magnificent Seven’, which led markets in recent years and have become common holdings in US and tech funds, have fallen since Trump took office. Tesla, whose chief executive Elon Musk is heading the controversial Department of Government Efficiency and its cost-cutting drive, has dropped more than 40% between the inauguration and 21 March.

In this environment, fund managers have struggled to make gains. Indeed, FE Analytics shows that all 250 funds in the IA North America sector have made a loss since January’s inauguration (to up 21 March).

Hardest-hit are iShares S&P 500 Consumer Discretionary Sector UCITS ETF, Xtrackers MSCI USA Consumer Discretionary UCITS ETF and SPDR S&P U.S. Consumer Discretionary Select Sector UCITS ETF with losses of close to 20%. US consumer discretionary stocks are down on concerns that tariffs, inflation and shaky consumer confidence could dampen spending.

Active funds with the highest losses include iMGP US Small & Mid Company Growth (down 17.6%), Nomura American Century US Focused Innovation Equity (down 17.3%) and Lord Abbett Innovation Growth (down 16.9%).

All 36 funds in the IA North America Smaller Companies sector have also made a loss since 20 January, according to FE fundinfo data. Artemis US Smaller Companies fell the hardest, down 21.2%, followed by Alger Weatherbie Specialized Growth (down 20.7%) and New Capital US Small Cap Growth (down 19.6%).

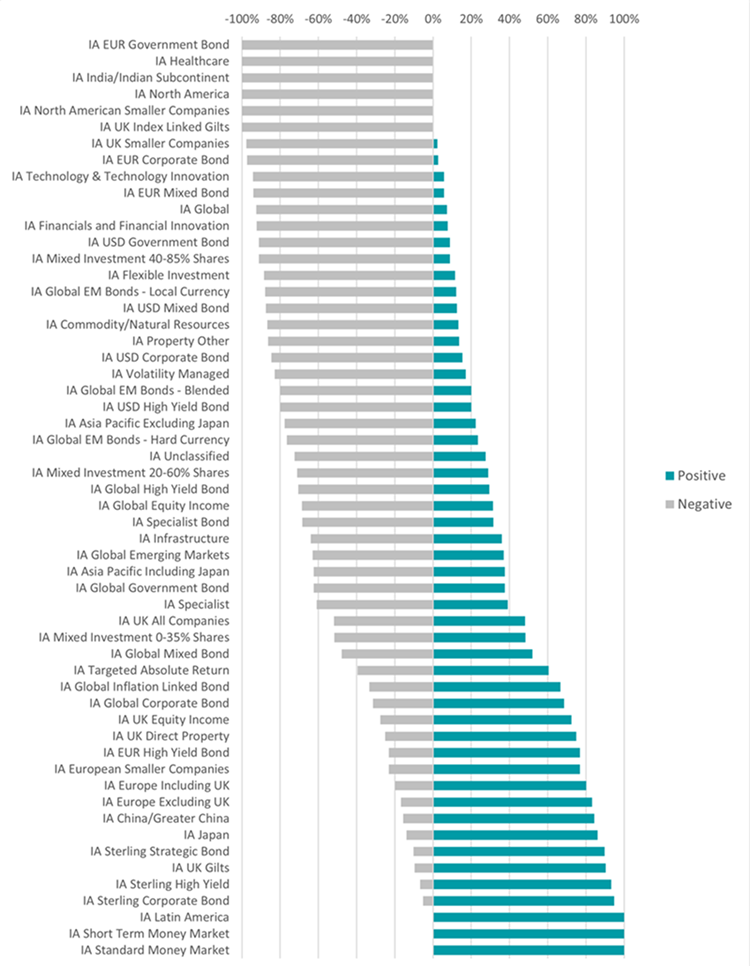

Split between positive and negative funds since Trump’s inauguration

Source: FinXL. Total return in sterling between 20 Jan and 21 Mar 2025

Just 23 US funds – all of which are in the IA North America sector – are down by less than 5% for the period under consideration.

Common themes among these funds include value investing (MFS Meridian US Value, BlackRock GF US Basic Value, T. Rowe Price SICAV - US Select Value Equity), equity income (WisdomTree US Equity Income UCITS ETF, Aviva Investors US Equity Income), healthcare (SPDR S&P U.S. Health Care Select Sector UCITS ETF, iShares Nasdaq US Biotechnology UCITS ETF), staples (Xtrackers MSCI USA Consumer Staples UCITS ETF, SPDR S&P U.S. Consumer Staples Select Sector UCITS ETF) and low volatility strategies (Invesco S&P 500 Low Volatility UCITS ETF).

Of course, it remains to be seen whether the US sell-off represents a major shift in market direction or just a blip.

Russ Mould, investment director at AJ Bell, said: “Dyed-in-the-wool bulls will assert that the S&P 500 is down by just 8% from its high and the Nasdaq by just 12%. The S&P 500 is back to where it was in late August, the Nasdaq in mid-September, but such pullbacks, in recent times, have simply been chances to ‘buy on the dip,’ goes the bullish thesis.

“Bears will have a different take. They will point to the almost parabolic gains of the past two years and the accompanying rise of meme stocks, one-day options trading, a new all-time high in margin debt in the US and what they would assert are many other classic features of markets that are becoming overheated – complexity, opacity and leverage, right up to a leading figure in the cryptocurrency world buying and then eating a piece of art for which he paid $6.2m as he argued that the value lay in the concept of the design.”

In all, 67.5% of funds in the Investment Association universe have made a loss since Trump returned to the White House, leaving less than one-third in positive territory.

US funds are joined by IA EUR Government Bond, IA Healthcare, IA India/Indian Subcontinent and IA UK Index Linked Gilts in the list of sectors where every fund has made a loss since the inauguration.

More than 90% of funds in the IA Global, IA Technology & Technology Innovation, IA Financials and Financial Innovation and IA Mixed Investment 40-85% Shares sectors are in the red.

Meanwhile, the only peer groups where every fund has made a positive return since Trump’s inauguration are the IA Standard Money Market, IA Short Term Money Market and IA Latin America.

A high proportion of the IA Europe Excluding UK, IA China/Greater China, IA Japan, IA Sterling Strategic Bond and IA UK Gilts sectors have made money over the period.

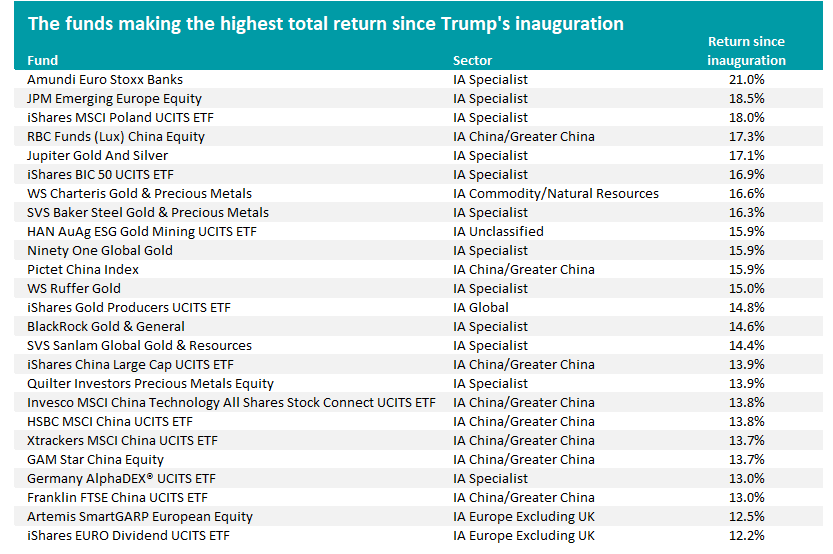

However, the largest gains of the Investment Association universe tend to come from specialist funds investing in gold –shown in the table below – reflecting the strong gains in the yellow metal as investors flee to safe havens amid the market uncertainty.

Source: FinXL. Total return in sterling between 20 Jan and 21 Mar 2025

NOTE: All fund, sector and index data is accurate to Friday 21 March 2025 but does not reflect the market movements of Monday 24 March.