The UK used to be a good market for income seekers before investors turned their backs and sought opportunities elsewhere.

Now that’s changing, according to James Harries, manager of the £657m Trojan Global Income fund, whose 31.4% allocation to the region is at its highest level in two decades.

The manager expects the UK to prosper under a more stable left-to-centre government rather than “the psycho-drama that has been going on post-Brexit”. Relative performance versus the US could also improve as “exuberance” around artificial intelligence (AI) comes off the boil.

Below, he explains why his fund’s performance has picked up materially in recent weeks.

What process does the fund follow?

We invest in exceptional, resilient companies and allow them to compound over time by having very low turnover in our portfolios.

We pay an income that’s generated through genuine cash flow, which leads us towards businesses that have limited capital requirements to enable them to invest to entrench their competitive advantages whilst also paying a dividend.

We seek to deliver – although we haven’t recently – above-average returns with below-average volatility.

What has gone wrong recently?

We have very low turnover in the portfolio, about 9%, and therefore the market can move around us and we keep plodding along.

As recently as August 2022, we had some of the best risk-adjusted returns in the sector, but since then we've gone sideways while others have done much better, driven by AI exuberance that might be somewhat short-lived.

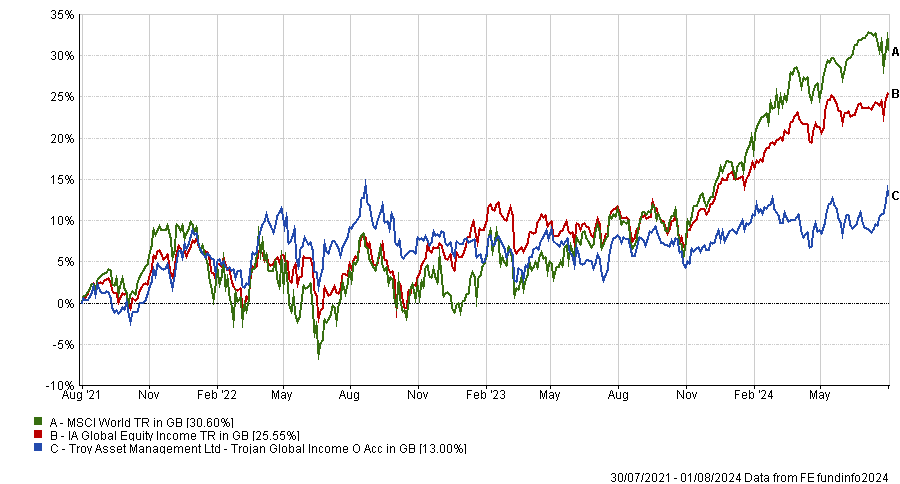

Performance of fund against sector and index over 3yrs

Source: FE Analytics

What’s your view on AI and tech companies?

Some of them are quite fully valued and their amazing dominance may not continue. These companies are spending an awful lot of money, as if they are in a capital-expenditure arms race. That’s based not upon expected return or returns on capital but upon the fact that their peers are also doing it, which tends to end badly.

People might be overestimating the effect of technological change in the short term and underestimating it in the long term. Markets seem to have priced in a strong productivity effect without much evidence of that yet, in which case the current exuberance may turn out to be somewhat short-lived.

That's what happened after 2000. Today is not exactly like it, because some of the technology companies aren’t nearly as expensive and some of the more defensive companies are not nearly as cheap, but there are echoes.

Who is this fund for?

Our core cohort is people who have irreplaceable capital and are in need of income. Those two things tend to coincide in retirement, so not only do we want to generate a decent return, balanced between income and capital, but we want limited drawdowns too.

What sectors do you favour?

We like sectors and businesses that are sustainable, have competitive advantages and will persistently grow and deliver returns both in income and capital.

One of them is consumer goods, which we continue to like although it hasn't done very well recently. Partly, that’s because of concerns relating to GLP-1weight loss drugs, but we don’t think that their business models are broken as a result. People will still enjoy a snack every now and then and that dependability and brand resiliency gives them the predictability that we like.

It's somewhat ironic that if we are moving into a more difficult period, these businesses could be exactly what you need to own, and yet they’re out of favour.

Secondly, we favour healthcare companies, which tend to be high quality and are relatively inexpensive.

We do have some decent exposure to enterprise IT spending – we own Accenture and Microsoft and a couple of HR outsourcing software businesses, as well as RELX.

What were your best and worst calls of the past year?

The area that's been painful in the past 12 months is spirits companies, in particular Pernod Ricard and Diageo. We like spirits as a category because people tend to be very loyal to the spirit brand that they buy. Also, we're in a world where people drink less but better and the spirits companies are able to premium-ise their products.

After Covid, they have been suffering from slightly inconsistent demand and an inventory overhang – the consumer is going through a weak spot and consumption is coming off the back of a very strong period during Covid. But the reality is, you need to divorce short-term trading from the long-term competitive advantages.

We initiated a holding in Pernod during this year, which hasn't done particularly well yet, but our job is to buy excellent businesses when they're out of favour, and we think that these are two very good examples of that.

Between them, Pernod and Diageo have detracted about 1.6% on an equity contribution basis.

RELX was our best performer and added about 1.5% after the market had a change of heart and reframed its thinking around the stock from an AI loser to an AI winner.

Are you seeing opportunities in any particular geography?

We have the highest allocation to the UK in 19 years.

The UK has been in the global capital markets doghouse for a while, but now that we have a stable left-to-centre government who can think a bit more strategically, rather than the psycho-drama that has been going on post-Brexit, we might attract global investors back to the UK.

There has been a recovery in sterling which suggests that may be happening.

What do you do outside of fund management?

I've got two boys, so I spend most of my free time with my family. Every now and then I visit Scotland and go fishing.