Tech companies and investors have just endured a rollercoaster week. Almost all of the Magnificent Seven have now published their results – and it’s been brutal.

Nvidia reports at the end of this month and is the notable absentee, although it made headlines by slipping more than 6% last Thursday amid signs of a cooling economy and capital expenditure concerns.

The narrative has been changing around the tech giants, according to Dan Coatsworth, investment analyst at AJ Bell, after a sell-off originating from precisely those stocks that have contributed to much of the US market’s gains in recent years.

“It’s no longer enough for the big tech companies to beat earnings or sales expectations. Each part of a business has to be moving with strength and stamina, otherwise the market will start finding fault,” he said.

“Euphoria around artificial intelligence (AI) is now at risk of spluttering if more people ask when companies are going to generate positive returns from the significant investments made to support AI technology. It’s no longer good enough to simply say AI will be deployed.”

The increased likelihood of US rate cuts has ignited a great rotation, benefitting small-caps and value names, said Lewis Grant, senior portfolio manager for global equities at Federated Hermes.

“The market broadening has been brutal for large and mega-cap tech stocks that were flying high before July, as investors began to question if forthcoming earnings announcements could live up to the hype,” he said.

“Earnings announcements have wrestled against the bubble narrative, bringing the AI trade back to the fore. As earnings season rumbles on, we note the magnitude of price reactions: investor sentiment is fragile and each new set of data prompts rapid swings from jubilation to despair.”

But the mega-caps have largely fought back, especially Amazon.

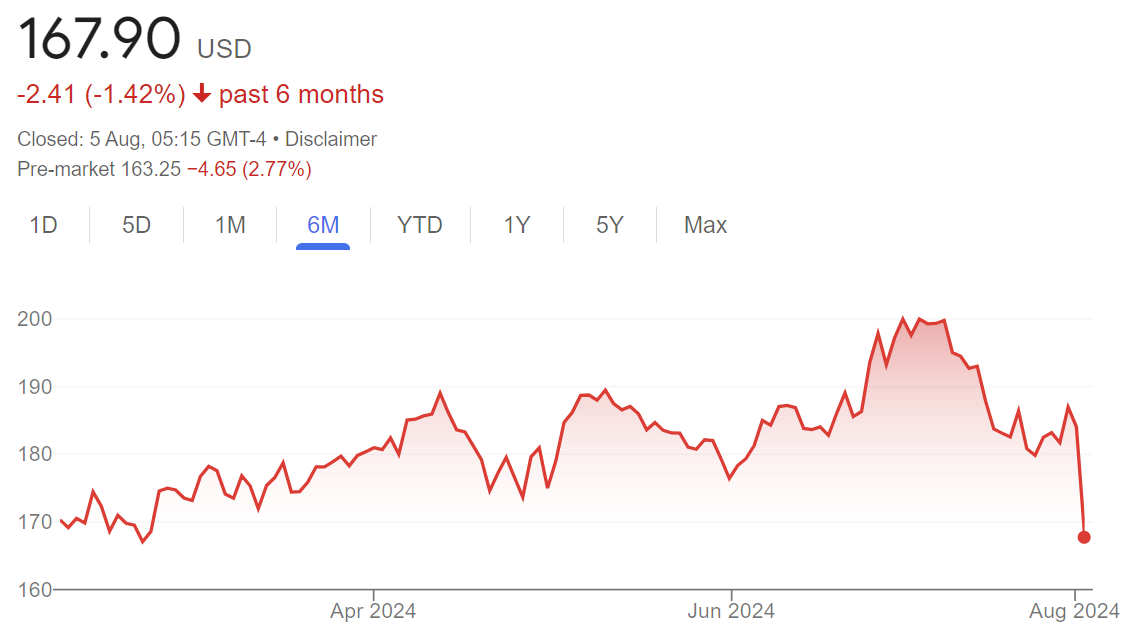

Amazon

Amazon had “stellar” results on all important fronts, according to Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund. Amazon Web Services (AWS), the cloud computing business is highly profitable and enjoyed revenue growth of 17%.

Performance of stock over six months

Source: Google Finance

“The strong combination of high organic growth and continuing margin expansion is the best scenario shareholders could have wished for,” Smit said.

"With all its capacity in place, it is the one in ecommerce to beat, with the further benefit of the structural boost to AWS from AI."

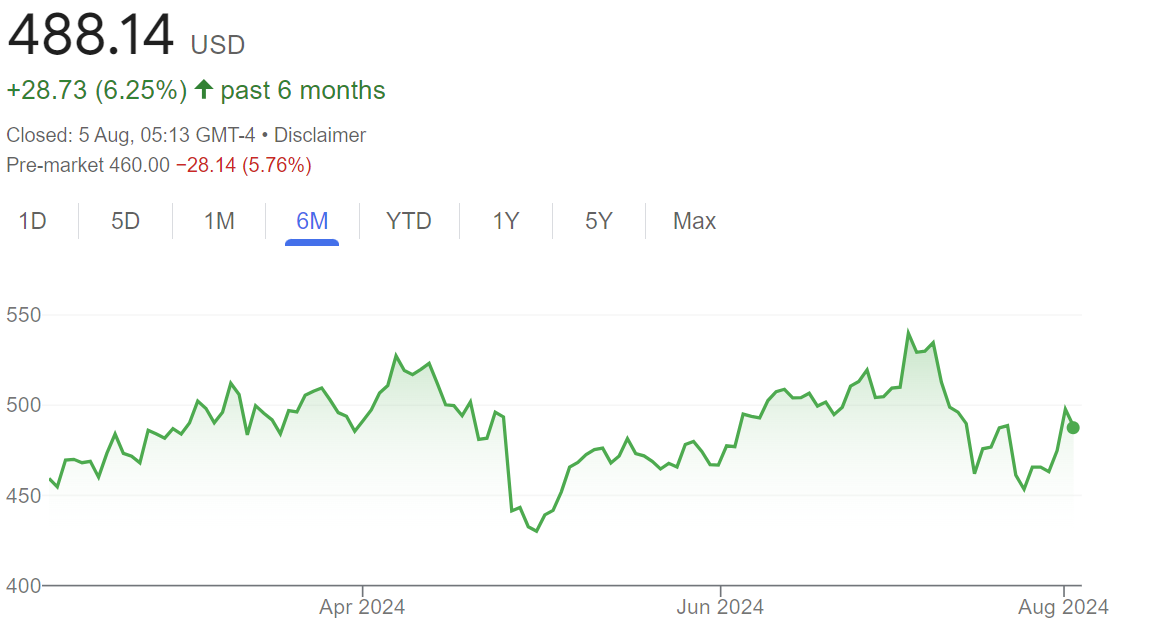

Meta

Meta was also a winner, with shares jumping in after-hours trading after strong second-quarter results.

Performance of stock over six months

Source: Google Finance

Ismail Rashid, equity analyst at Charles Stanley, said its performance “demonstrated effective execution with robust user monetization and engagement metrics”.

"Meta’s 2024 capex should be in the $37-40bn range from the prior $35-40bn, but investors have responded differently to Meta’s capex hikes compared to other Magnificent Seven stocks,” he continued.

“This could be down to its showcasing of its new AI model, Llama 3, which is the largest of its kind, as well as Meta AI tipped by management to be the most used AI assistant by year-end, if not sooner. This should support further pricing power and Meta’s continued dominance of social media.”

However, Coatsworth saw some warning signs, including rising costs, “gigantic” AI-related infrastructure spending levels and ongoing losses for its Reality Labs hardware division, as well as growing pressure from regulators to stop big tech companies like Meta stifling competition.

“What separates Meta from the crowd is that it already has proof that AI is supporting the business. AI has helped its social media platforms to better predict the type of video content that will keep viewers engaged,” he said.

“Meta hopes to be crowned king of AI. Mark Zuckerberg might have been obsessed with the metaverse for a long time, but cementing the company’s position at the top of the AI tree is now his priority.”

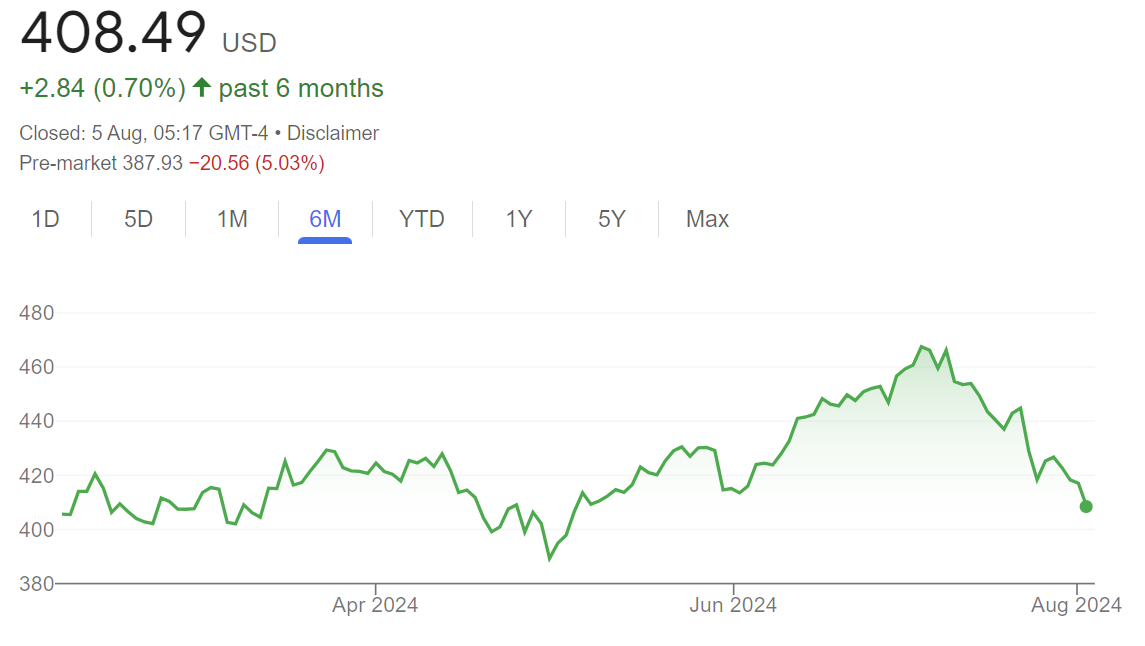

Microsoft

Microsoft also convinced, according to Ben Barringer, technology analyst at Quilter Cheviot, despite a 7% after-hours slip due to “a slight miss” in cloud growth. Nevertheless, the company’s total revenue increased by 16%, with “solid” bookings and backlog.

Performance of stock over six months

Source: Google Finance

“Microsoft reassured it is making investments driven by demand and ensuring solid returns on these investments. The guidance provided was strong, reflecting confidence in its comprehensive product offerings. While growth is strong, it is levelling out rather than accelerating, which is good but does not necessarily translate into big moves on its share price”, he said.

“Patience is required as data preparation and AI integration into business processes take time. Overall, this set of numbers should be reassuring and help alleviate some fears of a significant AI downturn.”

Apple

Anything less than spectacular hasn’t been cutting it this earnings season, as AJ Bell head of financial analysis Danni Hewson put it, and for Apple investors it’s going to be all about the next generation of the iPhone.

Performance of stock over six months

Source: Google Finance

“How can the company persuade people they don’t just fancy a new handset, but that they simply must have one? If Apple can convince investors that the next ‘super cycle’ is around the corner, that should be more than enough to offset the current iPhone sales decline and concerns about Chinese consumers,” she said.

Alphabet

Alphabet has been firing on all cylinders, according to Smit, with group revenue growing at 14%, on the back of Search, YouTube and especially Cloud, with accelerating growth of 29%.

But Coatsworth noted that while the business might have found the right ingredients to stay strong, it hasn’t all been plain sailing and investors were quick to find fault in a slowdown in Google’s advertising growth (11.1% in the second quarter versus a 13% gain in the previous three-month period year-on-year) and YouTube’s advertising revenue was also slightly below forecasts.

Performance of stock over six months

Source: Google Finance

“That triggered volatility in the share price in after-hours trading, despite a strong showing from the cloud arm and overall earnings beating expectations. The fact the stock was initially down one minute and up the next after the results implies that investors might be losing conviction in Alphabet,” he said.

“Alphabet still has plenty of ideas for how to innovate and the financial strength to try lots of new things. Not everything will work, but its willingness and capacity to have a go is a major advantage. Beating earnings expectations for six quarters in a row also shows the business still has plenty of fuel left in the tank.”

Tesla

The most challenged of the Magnificent Seven, Coatsworth said Tesla seems to be “desperate to work on the next initiative rather than making sure the existing business is running smoothly”.

Performance of stock over six months

Source: Google Finance

“The stark reality is that Tesla’s profits have plummeted and that’s not what investors should expect from a business. Slashing prices certainly helps to address concerns about affordability, but that has led to lower profit margins,” he explained.

“Tesla needs to find a better way to thrive in a more difficult environment for electric vehicles now rather than later. It’s clear that the pace of adoption is slower than expected. Competition is also increasing and Telsa’s first mover advantage is fading away.”