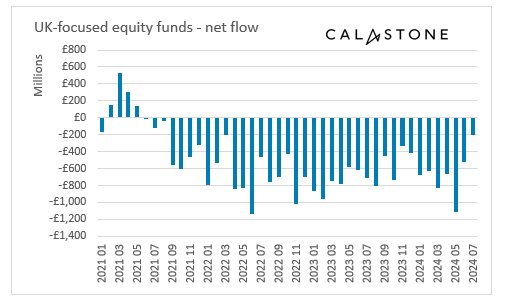

Investors pulled a net £207m out of UK equity funds in July, the smallest monthly outflows in three years. A reduction in selling as well as an increase in buying turned the tide for domestic funds, with outflows dropping below a third of this year’s monthly average.

The day after Labour won the general election, Friday 5 July, was the best day for UK equity inflows, with investors committing a net £59m.

Edward Glyn, head of global markets at Calastone, said: “The improvement is consistent with the groundswell of positive commentary surrounding the investment case for UK equities. Growth indicators suggest the economy is outperforming its peers, while the arrival of a new government with a huge majority is in stark contrast to political turmoil in many other major G7 countries and in the UK’s recent past.”

Attractive valuations were also a draw, with UK stocks trading at a significant discount to US equities, Glyn added.

Investors gravitated towards equities in general last month. Inflows into all types of equity funds reached £2.2bn, the highest monthly tally since March, taking the year-to-date total to £13.6bn – the best seven-month period of Calastone’s 10-year record.

July was one of 10 best months for equity inflows during the past decade, four of which occurred this year.

Investors flooded into North American equities and emerging market funds during the second half of July, spotting a buying opportunity after sharp corrections in these markets. July inflows totalled £1.1bn and £424m for the US and emerging markets, respectively.

Elsewhere, money market funds raked in £432m in their best month of the year so far, while bond funds reversed their two-month run of outflows to bring in a modest £84m as investors anticipated interest rate cuts.

Meanwhile, selling pressure on property funds slowed to a trickle with £19m of outflows – the sector’s best month since September 2023.