National Savings and Investments (NS&I) has launched new two-year and five-year fixed-rate British Savings bonds for the first time in a decade and a half.

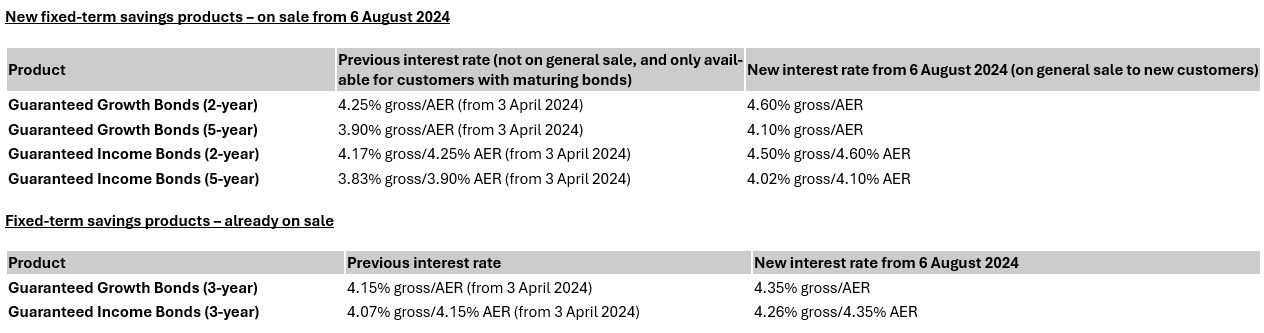

Savers have two options for each: growth and income. Those investing in the two-year growth option will receive 4.6% gross/annual expected return (AER), with savers investing in the Income option receiving 4.5% gross/4.6% AER.

For the five-year bonds, the growth and income options offer 4.1% gross/AER and 4.02% gross/4.1%AER respectively. The bonds will demand a minimum investment from savers of £500, with a maximum investment of £1m.

Commenting on the launch of these new bonds, Dax Harkins, chief executive at NS&I, said: “Today’s changes will help us to meet our net financing target while continuing to balance the interests of savers, taxpayers and the broader financial services sector.”

In addition, the NS&I is also raising interest rates on its existing three-year fixed-term bonds for new investors. Following this rate increase, the three-year growth option will offer savers 4.35% gross/AER, with the income option offering 4.26% gross/4.35% AER.

Source – NS&I

Laura Suter, director of personal finance at AJ Bell said these bonds are likely to be highly popular, pointing to the success of the one-year version of the bond, which went on sale last year selling out in only five weeks. Notably, the sale of these bonds generated more than £10bn of the total £11.3bn the firm raised in the last financial year.

Harkins concluded, “The two new issues, along with a rate increase for our three-year bonds, provide NS&I savers with increased choice and longer-term security in a changing market”.

However, Suter said investors should not be swept up by the popularity of these bonds, noting that NS&I’s offerings have lower interest rates than many of their leading competitors.

For example, the two-year bond’s interest rate of 4.6% is below the market leader of nearly 5%, meaning a saver would sacrifice almost £20 a year on a pot of £5,000.

What to consider when selecting bonds

Suter identified five criteria which may help investors determine which NS&I bond is the right investment for them. Firstly, unlike previous versions, there is no ability to withdraw money early from the fixed-term options in exchange for interest.

This means that money held in NS&I's two- and five-year bonds must remain there for the full duration, which may discourage investors looking for more flexibility.

Secondly, while the NS&I is one of the UK’s largest savings organisations and has government backing, it is not the only financial organisation to offer protection on investment.

While NS&I’s backing does mean that large-sum investments are quite safe, there are many other providers which are protected by the Financial Services Compensation Scheme (FSCS), covering up to £85,000 per institution. Such investments are theoretically just as safe as they would be with the NS&I, proving the total saved is within this threshold.

Perhaps most significantly, these new bonds are not part of the NS&I's Premium Bond range. This means they are taxable and can present investors with unexpected tax bills if they do not choose carefully.

“With the growth version of the bond, you will be taxed on all the interest you receive when it’s paid out at the end of the term – which could mean you breach your tax-free personal savings allowance” Suter said.

By contrast, while the income version of the bond pays out monthly, investors will not benefit from compounding interest on their accounts, which may limit their returns.

Finally, Suter noted investors should consider when they wish to receive their interest. For savers on an income bond, interest will be paid out each month to their bank account, making it ideal for retirees who need the money to live.

For those investing in NS&I’s growth bond options, interest is rolled up and is only accessible at the end of the fixed term, making it suitable for an investor looking for a more long-term option.

“It’s tricky for NS&I to get the interest rate right on these products: too high and it’ll attract swathes of cash and have to pull the accounts from sale, too low and savers will go elsewhere, meaning NS&I will have to crank up the interest rate later”, Suter concluded.