Global fund managers Richard Saldanha, Francois De Bruin and Matt Kirby are set to leave Aviva investors to pursue other market opportunities.

Combined, the trio managed nearly £2bn in assets under management (AUM) and have been responsible for some of the top-performing funds within their respective sectors.

FE fundinfo Alpha Manager Saldanha has almost 18 years of experience at the firm and co-manages funds including the Aviva Global Equity Income Fund and Global Equity Endurance, which have an AUM of £581.2m and £515.7m respectively.

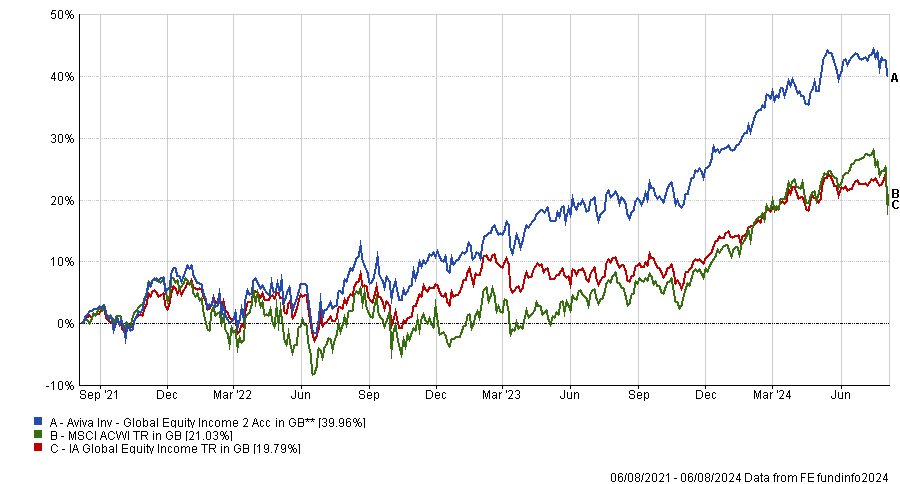

Kirby also serves as co-manager of the Global Equity Income and Social Transition Global Equity funds alongside Saldanha. Under the duo, the Global Equity Income fund has proven to be a consistently strong performer.

Indeed, the five FE fundinfo Crown-rated fund has been the third-best performer in the IA Global Equity Income sector over the past five years.

Performance of fund over 3yrs under Saldanha and Kirby

Source – FE Analytics

Despite only being launched in November 2021, the Social Transition Global Equity fund also proved successful, ranking within the top quartile of the wider FO-Equity-ethical sector over one year.

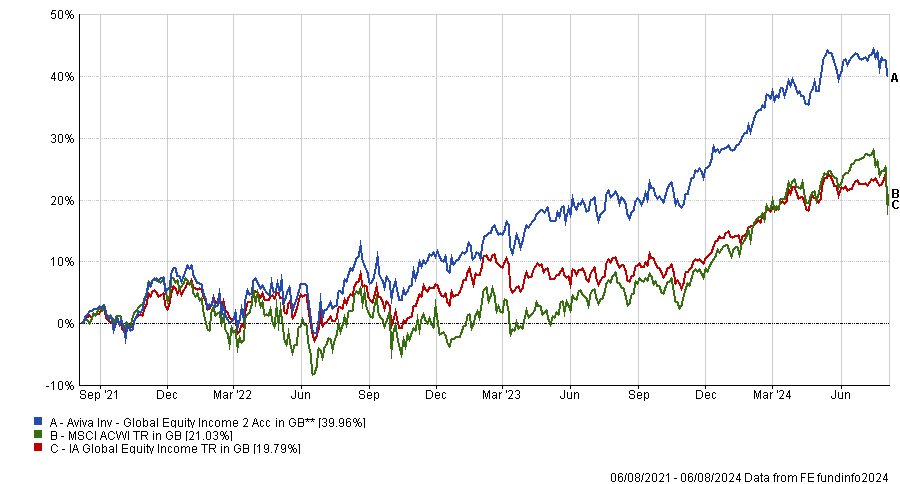

Francois De Bruin has been with Aviva since 2014, acting as co-manager for the Global Equity Endurance Strategy alongside Saldanha, and for the £91.8m Aviva Pension Sustainable Stewardship International fund.

Performance of fund over 1yr under Saldanha and De Bruin

Source – FE Analytics

Under De Bruin, the Sustainable Stewardship International Fund generated strong returns, ranking within the top quartile of the PN Global equities sector over the past year.

In a statement from Aviva, a spokesperson said: “Aviva Investors remains fully committed to its equity franchise. We have already commenced the process to replace the individuals and put in place an interim management plan to minimise disruption for clients and maintain the high level of service and investment performance they have come to expect.”