Asia is the only region where it makes sense to use defensively-positioned equity managers, according to Ernst Knacke, head of investment research at Shard Capital, making a cautious and aggressive pairing worthwhile in the region.

In Asia, both defensive and higher-octane growth managers have a decent chance of outperforming their benchmarks in all market conditions, whereas in Europe, the US and the UK, cautious managers tend to lag in rising markets.

Knacke said that, in Asia, defensive-orientated strategies can deliver a lot of alpha because of favourable demographic trends.

For instance, the $702m Prusik Asian Equity Income fund invests in infrastructure, telecommunications and transport companies whose underlying cashflow streams are growing in the high single-digits or low double-digits due to population expansion, whereas their counterparts in the West might be considered “ex-growth”, he explained.

Therefore, value managers in Asia who invest in high-quality companies but bake in a margin of safety by focusing on valuations can deliver strong returns in rising markets, as well as protect on the downside during volatile periods.

That is not the case in developed markets, he asserted, so from a portfolio construction perspective, this begs the question of whether it is worth investing in defensive equities at all, outside of Asia.

Equity markets tend to rise more often than they fall, so it makes sense to invest in strategies that capture all the upside. Conversely, “if we’re going to go into a bear market, why own equity at all? Why not just buy long-duration Treasuries or volatility-type products?” he argued.

“We do believe that in Asia, there is a good argument for owning a defensive and an aggressive manager, meaning something that is low beta through the cycle and something that is high beta because you can generate very meaningful alpha with both approaches so that your total return through the cycle is well above that of the benchmark.”

Knacke offsets Veritas Asian, which has a long-term beta slightly below one and generates most of its alpha in rising markets, with Prusik, which shines during downturns.

Nick Wood, head of fund research at Quilter Cheviot, follows a similar approach, also using Veritas Asian alongside Stewart Investors Asia Pacific Leaders Sustainability.

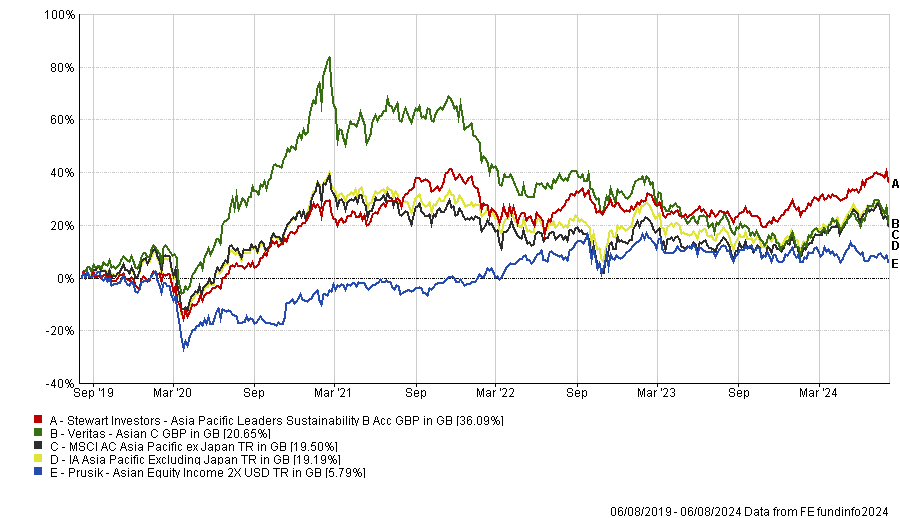

Performance of funds over 5yrs vs sector and benchmark

Source: FE Analytics

Ezra Sun, who runs the $2.4bn Veritas Asian fund, focuses on long-term themes and gravitates towards higher growth stocks.

Wood said: “Whilst historically the fund has held a significant amount in China, more recently it has shifted towards South Korea, in part following the recent focus on corporate governance and the ‘value up’ programme.

“The manager has struggled somewhat of late, but we believe now is a reasonable time to invest in a manager with a strong long-term track record.”

For Knacke, Veritas Asset Management’s experienced management team and analysts are its key competitive advantage, which he believes is sustainable because their interests are aligned.

Shard Capital counterbalances Veritas Asian with Prusik Asian Equity Income, which has a value tilt. It invests in companies paying dividends of 5-10% with the cashflow to support dividend growth of 5-10%.

“You can get these compounders that grow, mainly because of demographics, through the cycle, even with this more defensive bias,” said Knacke.

The decade from 2010 to 2020 was a bull market and Prusik delivered “extraordinary returns”, he said, “but when it really came through was when there was market volatility and big drawdowns.”

The MSCI Asian Pacific ex-Japan index fell 8.2% in sterling terms from 11 July to 5 August. Prusik was more or less flat whereas Veritas, as expected, was down 7.7%. Prusik also preserved capital during the growth sell-off of 2022, as the chart below shows.

Prusik has a downside capture ratio of just 39.2 for the three years to 31 July 2024, meaning that if the MSCI Asia Pacific ex-Japan index fell by, say 5%, Prusik’s fund would slide about 2%.

Performance of funds over 3yrs vs sector and benchmark

Source: FE Analytics

Quilter Cheviot’s defensive fund pick, the £6.5bn Stewart Investors Asia Pacific Leaders Sustainability fund, is managed by David Gait and the Sydney-based sustainability team at Stewart Investors.

The portfolio typically has 50 to 60 holdings in high-quality, medium-to-large companies across the Asia Pacific region that are positioned to contribute to and benefit from sustainable development.

“The fund is biased towards the highest quality companies and has significant positions within Healthcare and Consumer Staples, whilst the team has focused much more on India than on China. The fund is a naturally more defensive proposition, albeit it has been able to take advantage of the strong run in India of late,” Wood explained.