Bear markets such as the recent sell-off are when many active managers prove their mettle by avoiding risks and protecting investors’ capital. Indeed, this is often the reason people choose active managers in the first place – to have an experienced hand at the tiller when markets look their scariest. After all, when skies are sunny and stock markets are heading higher, a passive tracker can capture all the upside.

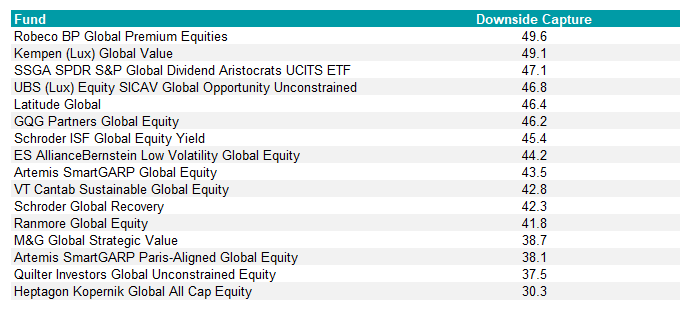

To that end, Trustnet looked at the downside capture ratios of funds in the IA Global Equity sector to discover which ones fell by half as much – or less – as the MSCI All Country World Index when it dipped during the past three years. A score of 100 means the downside was equal to that of the MSCI ACWI, so we have filtered for funds with a score of below 50.

This period captures the bear market of 2022, and the July sell-off. The data does not include this month’s volatility.

Global equity funds offering downside protection

Source: FE Analytics; the downside capture ratios span the three-year period to 31 Jul 2024

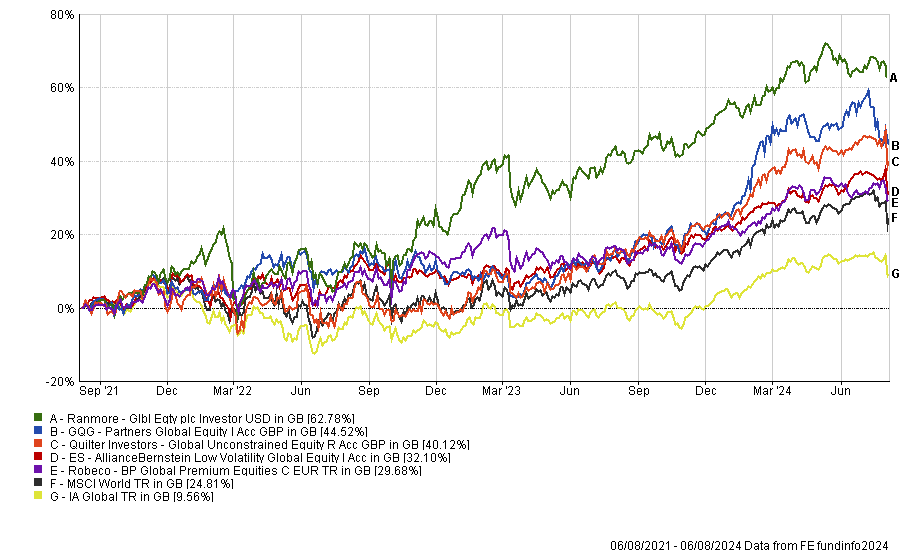

However, the holy grail for fund selectors is arguably to find a manager who can shield investors from the vagaries of stock market volatility yet still participate in most of the gains when momentum takes hold.

By looking at funds’ upside capture ratios, Trustnet found five strategies offering downside protection that also managed to capture at least 70% of the benchmark’s upside when it rose. As well as the dips mentioned above, the three-year period also includes positive times such as the recovery in 2023 and the strong gains during the first half of 2024.

Funds’ annualised upside and downside capture ratios over 3yrs

Source: FE Analytics, data to 31 Jul 2024

Ranmore Global Equity, the strongest performer of the group, was the only fund that added alpha in both up and down markets, with an upside capture ratio of 112.8.

Nonetheless, all five funds beat their sector average by a wide margin and also outperformed both the MSCI World and MSCI All Country World indices.

Performance of funds vs sector and MSCI World over 3yrs

Source: FE Analytics, data to 31 Jul 2024 in sterling terms

Below, Trustnet looks at the five funds in detail.

Sean Peche’s $307m Ranmore Global Equity fund protects against downside risk through diversification and by focusing on valuations. It is also a strong performer, clocking up the third-best returns in the IA Global sector for the three years to 7 August 2024 (61.5% versus 10.4% for the sector in sterling terms).

Simon Evan-Cook, a fund manager at Downing, described Peche as a contrarian investor who is “happy to invest in stocks and industries that are hated by other investors”.

Peche is not afraid to recycle cash into opportunities with a greater upside and therefore his holding period is shorter than most managers, which suggests he is getting the timing right for when companies’ share prices will correct, Evan-Cook said.

The next-best performer on the list was the £2.6bn GQG Partners Global Equity fund. It is the seventh best performer in the IA Global sector over three years and second over one year to 6 August 2024. It has not experienced losses in any calendar year since its launch in 2019.

FE fundinfo Alpha Managers Rajiv Jain, Brian Kersmanc and Sudarshan Murthy endeavour to outperform by minimising losses. One way they do that is by working with GQG’s non-financial analysts whose backgrounds span journalism, accounting and private equity, and who are adept at spotting risks.

Kersmanc said the fund’s investment philosophy has three pillars: a long-term focus, quality bias and capital preservation.

An important element of GQG Partners’ culture, he continued, is prohibiting fund managers from having personal trading accounts. They are only permitted to invest in GQG strategies or broad-based indices, so their interests are aligned with clients. “Half of my own personal savings are invested alongside our clients,” Kersmanc said.

The AllianceBernstein Low Volatility Global Equity fund is also helmed by an Alpha Manager, Kent Hargis. This strategy aims for lower volatility than the MSCI World and to reduce losses when global equity markets decline.

Yet, despite the defensive nature of the strategy, Hargis has achieved top-quartile performance over one and three years. He selects stocks that are attractive based on quality, stability and price and the fund’s top 10 holdings include Microsoft, Broadcom, Apple, Shell and Novo Nordisk.

Next, Robeco BP Global Premium Equities is managed by Christopher Hart, Joshua Jones and Soyoun Song at Boston Partners. The €4.5bn all-cap value fund focuses on companies with attractive valuations, solid business fundamentals and identifiable catalysts.

Its largest holdings are Samsung Electronics, JPMorgan Chase and Siemens, which account for about 2% of the portfolio apiece. Amgen and United Overseas Bank joined its top 10 holdings in June 2024, replacing Airbus and Rheinmetall.

Performance in recent years has diverged considerably from the MSCI World. The fund lagged significantly during the first half of this year – a strong bull market – and last year, but it played defence with aplomb in 2022, returning 2.4% versus the benchmark’s losses of -12.8%. It matched the market’s strong returns in 2021 but lost money in 2020 when the benchmark was in positive territory.

Quilter Investors Global Unconstrained Equity also made the grade, although this is a white-labelled fund run by Royal London Asset Management’s (RLAM) global equity team. Several members of that group left recently to establish their own boutique so the fund has passed to Mike Fox, RLAM’s head of sustainable investments. Quilter is reviewing the fund but does not plan to make an immediate switch.