Interest rate cuts don’t come about that frequently – at least not to the extent the market is expecting today. The heightened volatility of the past week also contributes to leaving investors with unanswered asset allocation and fund selection questions.

To help with the uncertainty, experts at interactive investor (ii) share below their favourite stocks, bonds and funds that might benefit from a rate-cutting cycle.

Funds and trusts

The fund research team at ii had “plenty of suggestions to shout about”, but analyst Tom Bigley settled on the Artemis Income fund.

This £4.8bn strategy, led by FE fundinfo Alpha Manager Adrian Frost, is a “flexible, high conviction portfolio” of UK large-cap stocks selected for providing a steady and growing income along with capital growth over five years.

Its “highly experienced team” has consistently applied a “sensible, tried-and-tested approach” that made it “one of the most highly regarded in the sector”, according to Bigley, who particularly admired the clear mantra of “cash flow first and dividends second”.

“In short, they prefer to hold companies that can consistently generate strong cashflows, which is key to fuelling the dividend that shareholders receive,” he explained.

“The fund is unlikely to significantly underperform or outperform over shorter-term periods, however, the consistency of approach has delivered strong returns over the long term.”

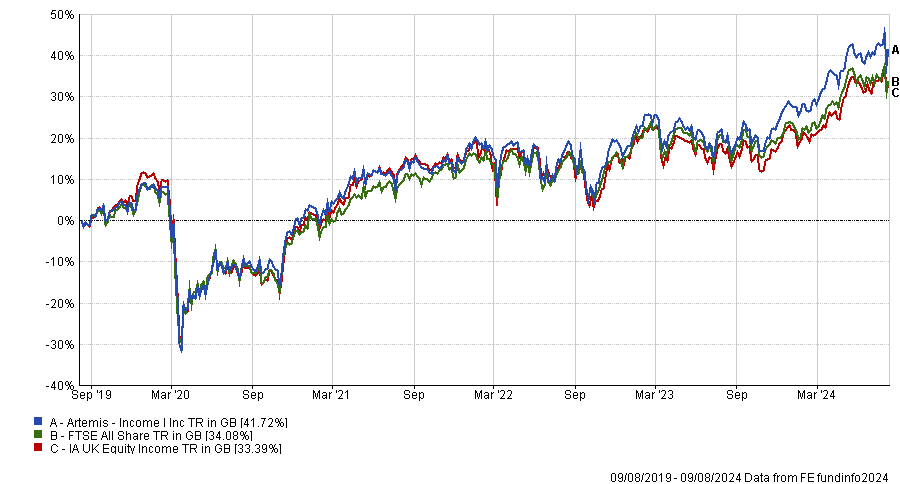

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Analyst Alex Watts suggested more interest-rate-sensitive sectors can be expected to perform well in the context of cuts to central bank rates, so he went for the TR Property Trust.

This £1bn Columbia Threadneedle investment company is “well suited to access the yields from real estate”. It is led by Marcus Phayre-Mudge, who takes a hybrid approach to pan-European property securities and can allocate 15% to physical property (7% currently).

It yields 4.6%, far surpassing its benchmark, and has an “impressive” record of growing the distributions year-on-year. Because it is “prudently managed” it has a “healthy” reserve to deal with potential earnings shortfalls and continue to pay income in down years too.

“Given property sector stress in 2022, the trust has a negative return over three years. However, the long-term track record is stellar, returning just under and just over 3% in excess of its benchmark over 10 and 15 years respectively,” Watts said.

“With REITs having been under a lot of pressure recently, an active and risk-managed approach is a good way to tap into the yield and potential upside for the sector.”

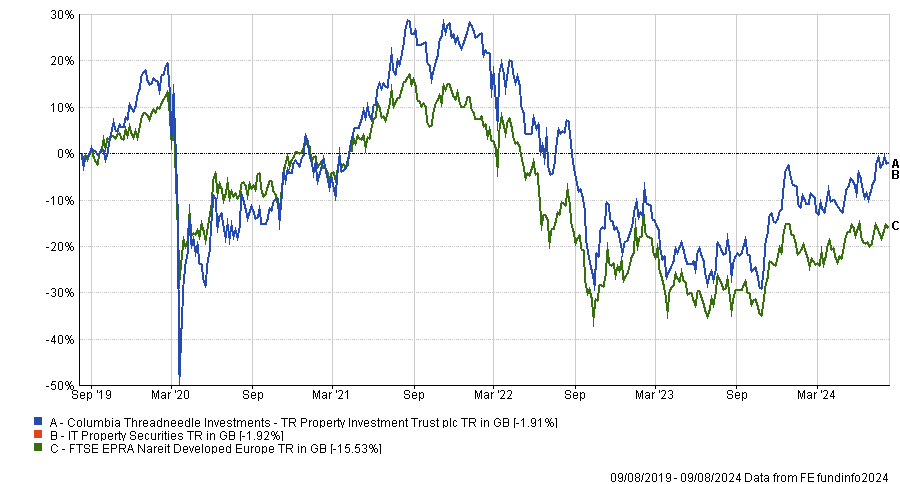

Performance of trust against index over 5yrs

Source: FE Analytics

Stocks and bonds

Within the FTSE indices, only two stocks overcame the hurdles of a high yield, adequate cover, an acceptable share price performance and a positive market consensus on prospects, set by Richard Hunter, ii head of markets. These were British American Tobacco and HSBC.

While there are other companies that have better dividend yields, the headline figure isn’t the be-all and end-all in this context.

For instance, Vodafone's dividend yield stands at 11.1%, yet its shares have dipped 6% over the past year and 43% across the past two years, he noted.

In addition, punchy and attractive dividend yields should always be looked at in the context of the company’s dividend cover.

“This is important because, all things being equal, if a share price falls the dividend yield will rise. A seemingly healthy dividend yield could, therefore, be the result of a falling share price – and a company which is potentially in trouble,” Hunter said.

Finally, Dzmitry Lipski, head of funds research, was sold on short-dated high-quality government and corporate bonds, given their yields, and suggested accessing them through the Jupiter Strategic Bond.

The fund is managed by “highly experienced managers” Ariel Bezalel and Harry Richards, supported by the wider, “well-resourced” fixed income team at Jupiter.

Approximately 60% of the portfolio is allocated in corporate bonds, and more than 20% in government bonds. – for a total yield north of 4%.

“The fund has shown strong performance and resilience over the long term and provides an attractive yield,” said Lipski.

“Given the fund’s flexibility and focus on downside protection, this makes it a strong core option for investors within a well-diversified portfolio.”

Performance of fund against index over 5yrs

Source: FE Analytics