Last week’s market sell-off was a frightful reminder of the risks that come with investing, but also of the extraordinary backdrop in which we find ourselves at present.

Investors have been living through an extended cycle of burgeoning returns that must be followed by a drawdown, according to James Harries, manager of the £657m Trojan Global Income fund.

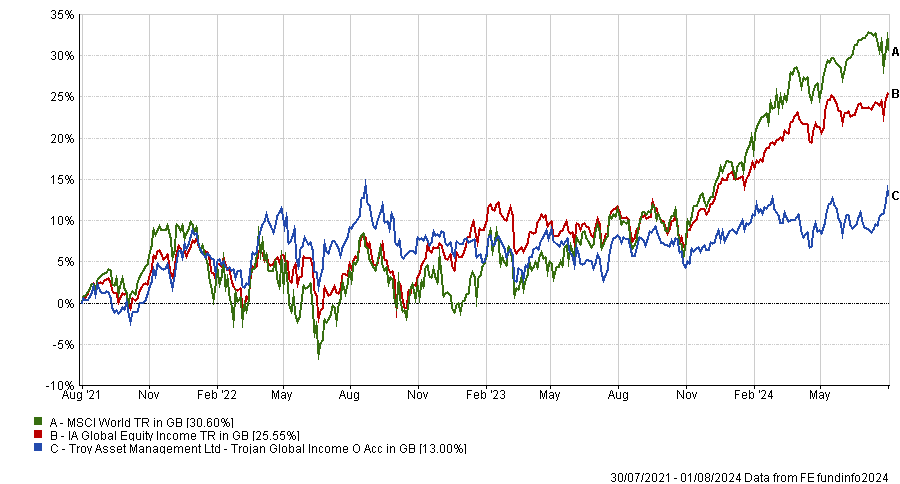

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Drawdowns, in fact, are one of the two main risks investors are facing today.

“Since the great financial crisis of 2008, investors have enjoyed remarkable returns from equity markets delivered over a very long period of time in the context of an extremely extended economic cycle. At some point, they are going to suffer a severe drawdown,” he said.

We are at “a very interesting juncture” at the moment, with “the most material and fastest-rising cost of capital and interest rates in 40 years”, paired with a US market that is still “as expensive as it's ever been”.

Harries sees today’s market as “a world extremes” – extreme concentration, investor exuberance, valuations and, when comparing US earnings yield to bond yields, extremely low equity-risk premiums, “the lowest we've had for a very long time”.

“That is a time for caution”, he proclaimed. But the oddities don’t end there.

The fact that we now have a cost of capital is “great news and should be celebrated by investors”, who can get “decent” income on their money for the first time.

But there are risks attached to that as well, in fact the second biggest risk investors face today is reinvestment risk, or the possibility that the returns from an investment might yield less when allocated to a new investment.

This is because it is likely interest rates will come down at some point – although they may not go back down to where they were. As such, people will need to reinvest capital and face reinvestment risk, Harries explained.

He also lamented that we haven not had “an orthodox economic cycle” for years, whereby excessive inflation leads to rising interest rates, which in turn lead to an economic slowdown and finally to a new economic cycle that starts again.

“This hasn’t happened in at least 25 years, so it may have become unfamiliar to people,” he said. “But I don't think it's a given that interest rates coming down is necessarily going to be taken positively by investors. It may be because it's in the context of a slowing economy.”

If rate cuts don’t spur a bull run, the slowing-economy scenario would play directly into the manager’s hands, as the Trojan Global Income fund is designed defensively to provide below-average volatility.

And in his view, this is exactly what has been unfolding even beyond this week’s sell-off, as we've seen the US bond yield come down from about 4.4% to about 4%, the moves in the yen, oil and copper being particularly weak and the gold spot price strengthening.

We've also seen a rotation in equity markets away from some of the previous leaders (including US tech, a sector that is “fully valued”, as Harries recently told Trustnet) and towards some of the areas that he favours.

This, according to the manager “may be a glimpse of things to come”.