The investment world has traditionally adhered to a 60/40 split between equities and bonds, providing a stable framework for investors seeking balanced returns.

However, as the financial landscape has evolved, the interplay between equities and bonds is no longer as uncorrelated as it once was. Put another way, this shift in behaviour has prompted reassessment of what a diversified portfolio should look like.

Today, wealth managers and fund selectors are increasingly seeking to manage uncertainties and market volatility through non-traditional means. In some cases, they are doing it by adding uncorrelated constituents, such as liquid alternatives – i.e. commodities, forex, or systematic strategies – to portfolios.

This makes sense. The integration of alternatives with traditional portfolio models can address the inherent limitations of the 60/40 split. For instance, employing systematic absolute return strategies can enhance diversification and manage risks more effectively.

But the popularity of these funds and others has meant they have become victims of their own success – and that means fund selectors may not always be getting the outcome they want.

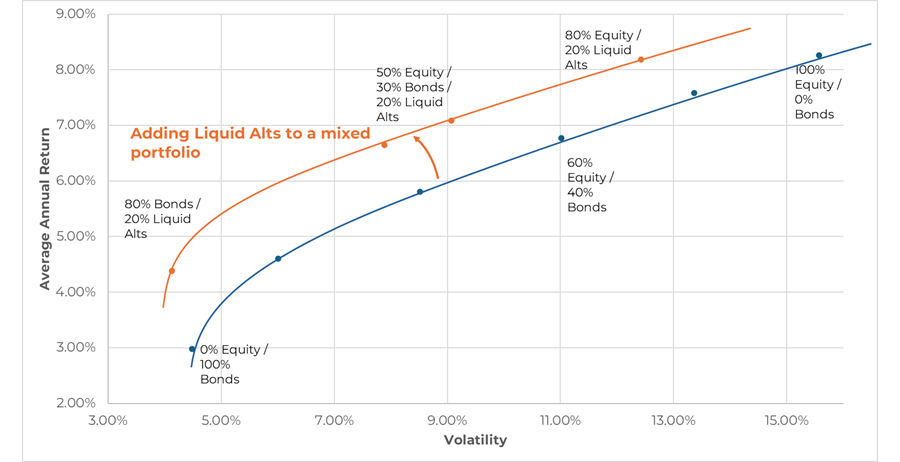

In the chart below, portfolios with a 20% allocation to alternatives are consistently positioned above and to the left of those containing only equities and bonds.

This indicates that portfolios including alternatives either provide the same return with reduced volatility, a higher return with the same volatility, or a combination of both higher returns and lower volatility.

How a 60/40 portfolio compares with adding alternatives

Source: Data sourced from C8 Technologies. Data from 2013 through 2024. Equities refers to MSCI ACWI Net Total Return USD Index. Bonds: iShares Core U.S. Aggregate Bond ETF. Alts: S&P Systematic Global Macro

Crowding

For the most part, fund managers rely on the same information (company news, financial statements, research reports, price and volume) and similar well-known strategies, which they use in similar ways – i.e. smart beta and off-the-shelf quantitative investment strategies (QIS).

Experienced investors in the wealth management sector have begun asking if the huge amount of capital running in similar QIS is starting to inhibit returns and risking a change in how uncorrelated they really are.

This, of course, is the opposite of what investors are seeking. Yet there remains broad enthusiasm for the concept of supplementing a portfolio of discretionary active funds with funds that are quantitative and systematic.

In our view, the best way for them to do this is use funds that combine strategies that come from as wide a source of quantitative research as possible. This is the basis behind the new breed of absolute returns funds – the ‘multi-strategy’ – which first gained prominence in the hedge fund world.

Adoption yet to take off

With so much data and technology available today – most of which was unavailable just a few years ago – it can be difficult for investors to determine how best to select and to combine strategies in a useful way, let alone find an investment edge.

It is partly why traditional absolute return fund portfolios are still dominated by classic strategies such as value, momentum and mean reversion.

Multi-strategy funds seek to solve this ‘blending’ problem for wealth managers by combining the multitude sources of alpha in an optimal way.

The key here is to be able to formulate at least a general hypothesis as to why value could be found in a quant strategy – whether that value comes from predicting stock prices, volatility, fundamentals, or something else.

The good news is that there is an abundance of potential alpha and genuine sources of uncorrelated returns. The key is to be able to vet and rigorously test these, which is where differences can emerge.

Asking the right questions

A big problem facing wealth managers is that the market is saturated with off-the-shelf QIS from wholesale providers such as banks. These often take existing systematic trades and repackage them into other products, giving investors easy exposure. But this means that strategies are often very similar to one another, with the provider adding little value.

When considering the large amount of capital that is running in these strategies, their efficacy is naturally limited due to crowding, rendering their backtests, which often look optically appealing, somewhat less compelling on a forward-looking basis.

Wealth managers seeking genuine multi-strategy funds should ask a few key questions. Does the provider do its own specialist research and development? What is its track record in building its own strategies and successfully combining them, using its own intellectual property? How does its track record compare to others?

Adding quant systematic strategies is a good complement to traditional discretionary funds. But it is important wealth managers really understand what they are buying.

Going forward, we expect more wealth managers to be attracted by the promise of improved overall portfolio risk and returns. But just as they seek to avoid active funds that are little more than closet trackers, they should choose carefully when selecting multi-strategy funds.

True multi-strategy funds have been successful in the hedge fund industry for good reason. And there are many reasons to think that, as more data about the physical and online world is collected, researchers will find ever more value in combining uncorrelated strategies to unlock returns.

Jonathan Dagg, portfolio manager at European and Global Advisers. The views expressed above should not be taken as investment advice.