Market wobbles can represent a good time for investors to get into the market – particularly those who have never done so before and have a long time horizon for their money.

The recommendation from most professionals is to get in when stocks are cheap and sell when they are expensive. Although there is no guarantee that stocks are now good value, they are at least lower in value than they were before the summer started, due to a slide downwards over the past few months that culminated in last week’s brief sell-off

As such, Trustnet asked Quilter Cheviot head of fund research Nick Wood to come up with a perfect portfolio for a young person starting their investment journey.

“With it potentially not being touched for 20, 30 or even 40 years (if for retirement), there is a real opportunity to take a risk knowing that equities deliver the greatest growth potential over the long term,” he said.

His portfolio includes both public companies as well as private equity and is largely made up of investment trusts, which he said look good value as “plenty are on meaningful discounts – where the share price is lower than the net asset value (NAV) of the holdings”.

“Investment trusts are inherently more volatile than open-ended funds, but again the long time horizon means this is less of an issue as time is very much on the investor's side,” said Wood.

His highest conviction is in JPMorgan Global Growth & Income, where he allocated 30% of the portfolio, despite it being one of the rare strategies trading on a slight premium of 0.8%.

The trust has been the best performer in the IT Global Equity Income sector over three, five and 10 years, although it was one of the worst-affected by the most recent drop in equity markets over the past few months.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“This trust provides investors with broad global equity exposure and draws on JP Morgan’s investment process, resulting in a portfolio of only the firm’s highest conviction (top 50-90) companies being selected on the basis of quality earnings that are growing faster than the market,” said Wood.

“It pays a dividend of 4% of net asset value every year and has the ability to borrow to invest (gearing), meaning shareholders should benefit over the long term.”

To go alongside this, he put 20% of the pot in Scottish Mortgage, the high-growth portfolio from Edinburgh-based asset manager Baillie Gifford.

The trust has been choppy, down 38.1% over the past three years, but despite this remains the best performer in the IT Global sector over the past decade. Its shares can be snapped up at an 9.5% discount to NAV.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“Perhaps one of the UK’s best-known investment vehicles, the team at Scottish Mortgage run an investment philosophy that is truly long term, seeking the next generation of market leaders,” said Wood.

He highlighted the trust’s “significant outperformance” relative to its peers during the initial stages of the Covid pandemic in 2020, as well as its dominance during the low-growth, low interest rate-environment of the past decade.

Much of its success came from unlisted companies, such as the current largest private equity position in the trust: Elon Musk’s unquoted SpaceX.

“Up to 30% of the portfolio can be invested in unlisted investments, capturing the opportunity before any initial public offering (IPO),” said Wood.

“As such, the trust is very much set up in the growth space, and with inflation coming under control and rate cuts due to be implemented in the US, conditions are positive for the portfolio in the short term, while also remaining bright in the long term thanks to its focus on transformational trends.”

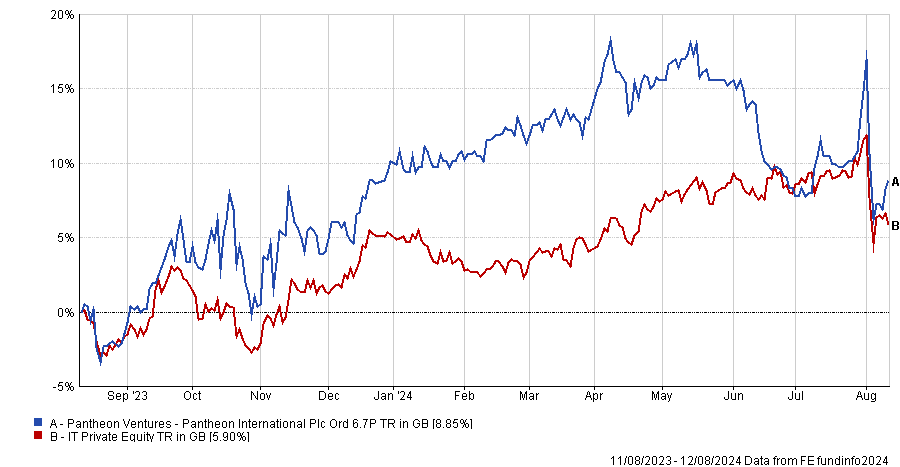

To enhance the private equity offering even further, Pantheon International was also added and given a 15% weighting. Because private companies are riskier than their public counterparts, its shares sit on a wide discount of more than 37%, but could be good value if the trust soars.

The trust has been a third-quartile performer in the IT Private Equity sector over the past three, five and 10 years, but has risen over the past 12 months to the second quartile, slipping back in recent days, as the below chart shows.

Performance of fund vs sector over 1yr

Source: FE Analytics

“With a long-term time horizon, private equity has proven capable of providing excellent returns to patient investors. The underlying portfolio is made up of over 500 companies and spans buy-outs, growth capital and venture capital, whilst being diversified geographically and by sector,” said Wood.

“This trust pays a dividend, which over the years will compound for investors, while also providing opportunities for growth via exits.”

He also allocated 15% to Bill Ackerman’s Pershing Square Holdings, a fund with a “significant activist approach”. It looks for poorly run companies that can be turned around with corporate action – something that has worked out well over the past five years with the trust up 164.3%, the best return in the IT North America sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Wood said the trust is a combination of “high-quality stocks” (currently 12), providing “differentiated exposure to the US alongside that held by Scottish Mortgage and JPM Global Growth and Income.”

The share price discount of 28.5% is exceptionally wide as this strategy is perceived as riskier than a traditional portfolio. However, the Quilter Cheviot head of fund research noted that this makes now “a good time to invest”.

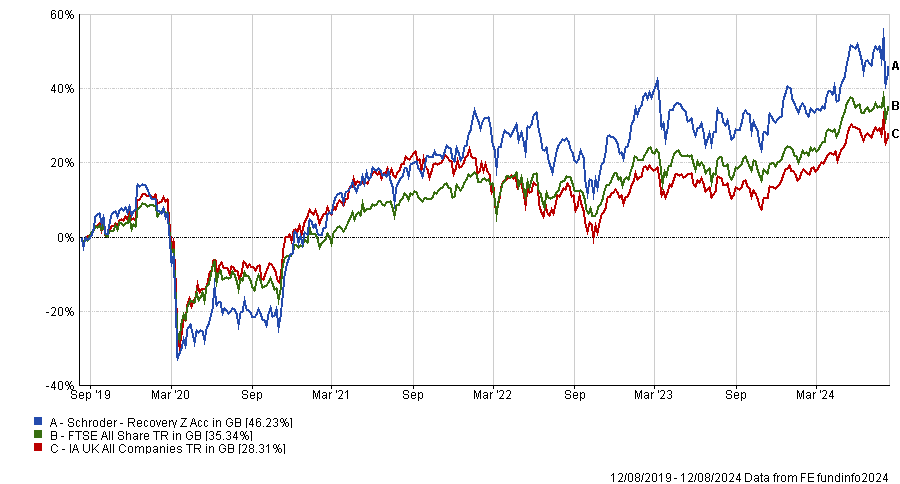

Lastly, he selected something closer to home with a 20% weighting to Schroder Recovery, the UK fund run by the firm’s value team. It has consistently outperformed expectations, beating the market over the longer term even when the style of buying out-of-favour companies was itself unloved.

“With the UK still out of favour, there is potentially a double discount, with the team selecting the cheapest companies within the UK that have suffered short-term setbacks,” he said.

“Due to the contrarian nature of the fund, returns can diverge from its benchmark index (FTSE All-Share) but this should mean plenty of opportunities for above-average returns over the long term.”

The only non-investment trust pick on the list, the fund has been a top-quartile performer over the past three and five years, although it has been below-average more recently.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

This may be due to the team’s current bias towards small and mid-sized companies, which has worked well in pockets when expected rate cuts have boosted investor sentiment, but has struggled in the very short term after the recent market wobbles.