UK inflation has ticked up again for the first time this year, as the consumer prices index (CPI) rose to 2.2% in the 12 months to July 2024 from 2.0% in June, Office for National Statistics figures show.

The increase was largely expected and the main culprit was energy prices, which have not dropped to the same extent that they did last year, AJ Bell director of personal finance Laura Suter explained.

“The price of energy actually fell in the month, but due to the way inflation is calculated energy prices didn’t fall by as much as they did in July last year, which translated to an increase in the figures,” she said.

“It’s a common story across a number of areas, where prices fell in the month but were higher than a year ago – having the effect of pushing up headline inflation. We saw a similar story in petrol and diesel prices and in second-hand cars.”

The headline CPI figure of 2.2% doesn’t tell the whole story, however. Core inflation (which excludes more volatile elements like energy, food, alcohol and tobacco) fell to 3.3% in July from 3.5% in June, its lowest level since September 2021.

Services inflation, which is a particularly sticky component, also dropped from 5.7% to 5.2% – but this was still elevated according to Richard Carter, head of fixed interest research at Quilter Cheviot.

“The problem the Bank of England [BoE] has is that services inflation remains elevated at 5.2% and, with wage growth remaining well above the headline rate of inflation, there are many risks out there should the BoE move too quickly in cutting rates,” he said.

“Indeed, with core CPI at 3.3%, we would expect November to be the earliest date for the next rate cut, unless we see a significant deterioration of the economy in the meantime. Any further, unexpected rises, will start to ring alarm bells just as consumers and businesses crave further rate cuts.”

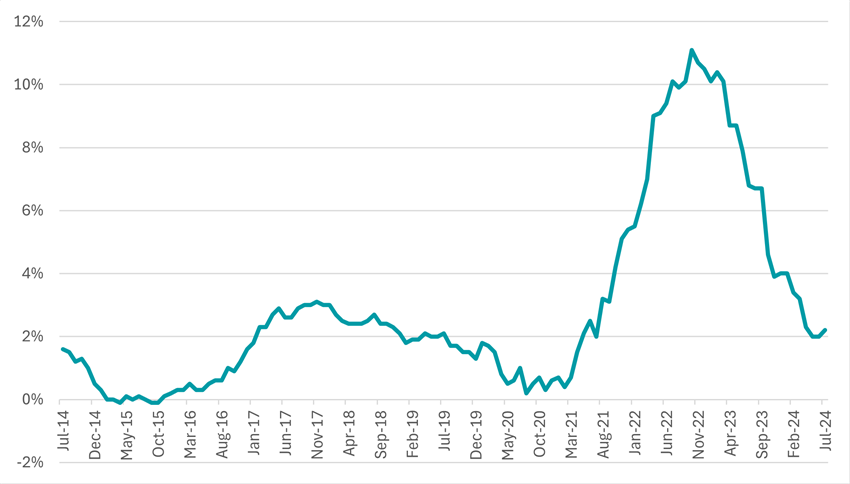

Annual CPI inflation rates

Source: Office for National Statistics

Indeed, markets are now expecting rates to dip below 4% towards the end of next year, as noted by Ed Monk, associate director for personal investing at Fidelity International, who predicted one more cut in 2024.

While lower rates have tended to be positive news for stock markets, investors should always be aware of the wider picture – that rates are coming down because there is less momentum in the economy.

“The Bank of England has begun to ease monetary policy and will be watching growth data closely for signs of a more sudden slowdown that could accelerate the timetable for rate cuts,” he said.

“As rates fall cash will become less attractive. Many investors have sought the safety of cash deposits this year as rates have stuck above the rate of inflation, but they may be forced to reassess as interest rates falls. Bonds, which have disappointed for some time, may become more attractive if cuts come through more quickly.”

Craig Rickman, personal finance and pensions expert at interactive investor, also invited investors to remain alert. Despite the significant drop from the dizzying double-digit heights that battered finances two years ago, “the threat to long-term wealth creation hasn’t disappeared completely”, and savers and investors “would be wise to bear this in mind when making decisions with their money”.

“If left unchecked, price rises can have a punishing impact on your financial future, silently eroding the ‘real value’ of your portfolio and reducing its future buying power. That’s why it’s essential to make sure your savings and investments aim to beat inflation,” he said.

“Hunting for the best cash savings rates, making the most of your tax wrappers such as SIPPs and ISAs, and keeping your portfolio costs low are three savvy ways to mitigate the impact of price rises on your wealth.”