Savers have a multitude of options at present for their cash, with savings rates relatively high (and beating inflation), markets coming off a small de-rating and mortgage rates remaining higher than the past decade despite being likely to fall in the coming months as interest rates are cut.

To this end, analysts at interactive investor looked at the potential benefits of two of the most common options people use when they have additional savings to put away – paying off their mortgage early or investing in their pension.

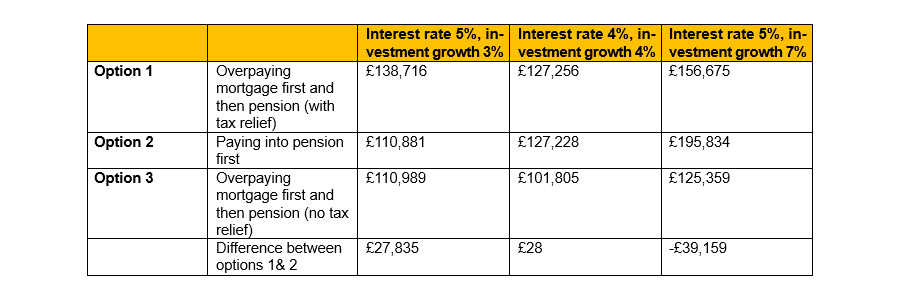

Much comes down to the expected level of return in the coming years, the data showed. To work out the differences, ii researchers looked at someone with a £200,000 mortgage with a 25-year term paying between 4% and 5% in interest each year.

They then calculated overpaying an additional £200 per month, which would result in the mortgage ending six years early. For the example, interest rates are assumed to be static. This is ‘Option 1’ in the below table.

This is pitted against investing the additional £200 per month into a pension, shown as ‘Option 2’. Both are assumed to benefit from pension tax relief.

‘Option 3’ is the same methodology as Option 1, but assumes that the pension tax relief has been removed.

Table of returns under different scenarios

Source: interactive investor

In the first scenario, with interest rates at around 5% and investment returns of around 3% savers would be better off with Option 1 – overpaying their mortgage – to the tune of almost £28,000.

If rates are assumed at 4%, with returns of around 4%, there is little to choose between Option 1 and 2. However, if markets boom over the period, making 7% per year on average (above the long-run average for stock markets) pension investing is the best choice, making almost £40,000 more than overpaying the mortgage.

Craig Rickman, personal finance and pensions expert at ii, said: “As you may expect, the gap between interest rates and expected investment growth result in different outcomes. Put simply, if the interest rate is higher than the anticipated investment growth, overpaying your mortgage first and then adding to your pension is the preferable option.”

However, he noted that, when choosing between the two options, the rate of tax you pay could be a “crucial factor” as those in the higher-rate and additional-rate tax bands can gain 40% or 45% upfront relief, respectively, on pension payments.

“Paying into a pension can not only trim your tax bill but may also help you to swerve or reduce the high-income child benefit charge or keep your personal income tax allowance. It’s vital to factor this into any decision you ultimately make,” he said.

This discussion is particularly pertinent at present, with the recent fall in mortgage rates potentially shifting the conversation.

People’s decision will also come down to circumstance. For example, investing in a pension is a risk, while overpaying the mortgage is a guaranteed benefit that would leave individuals debt free much quicker, something he described as “the holy grail of financial freedom”.

But that is not the only choice, as the numbers above show. He said the arguments for using spare cash to boost your pension are “equally strong”, but do require savers to understand investment risk.

“There's no one-size-fits-all answer here – both options can improve your long-term financial security. The right path for you will depend on your individual circumstances, including your financial goals, current mortgage terms, tax position, and risk tolerance,” said Rickman.

“For those torn between the two, the good news is the decision isn’t binary. You can choose to split any surplus savings or income between reducing your mortgage and boosting your pension.”