In the shifting economic landscape, investors should start to consider buying income-generating assets, as they should benefit the most from the Bank of England’s loosening monetary policy, according to Tom Stevenson, investment director at Fidelity International.

One more base-rate cut is priced in for later in the year, but it is the nature of the cut that will determine the direction of the market, not the cut itself.

“If central banks are expected to cut rates simply because inflation has been brought under control, it generally benefits the stock market. Lower rates make dividend-paying stocks more attractive and reduce borrowing costs for companies,” Stevenson said.

“But things are different if rates are being cut to deal with a recession. Investors must weigh the potential benefits against the negative impact on corporate profits and may be inclined to sell shares if they believe a recession is imminent.”

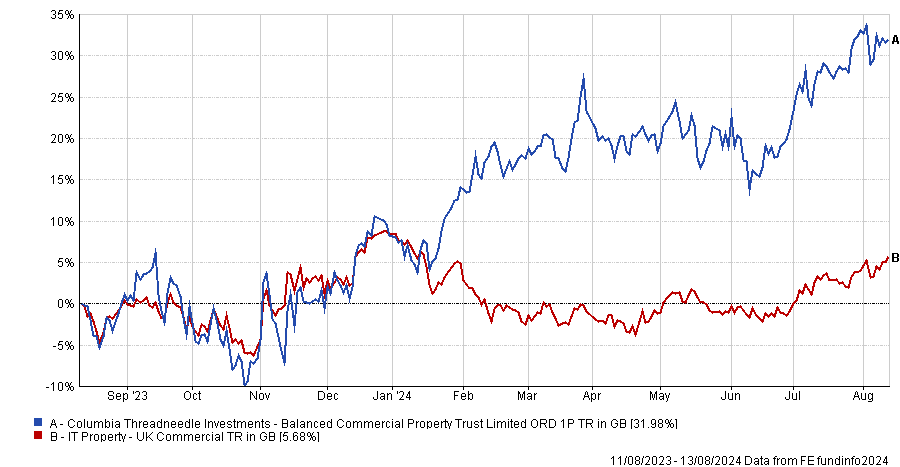

While bonds might be the first asset class that comes to mind as a beneficiary from a falling rates environment, Stevenson selected four funds from Fidelity’s Select 50 list that belong to two less talked-about sectors to “allow investors to balance potential gains with the risks associated with an uncertain economic outlook”.

For those looking to reposition their portfolios, the first fund to consider according to the investment director is First Sentier Global Listed Infrastructure.

Performance of fund against sector over 1yr

Source: FE Analytics

It currently yields 3.3% and invests in infrastructure companies, which Stevenson said stand to benefit from lower rates.

“The fund is open-ended but avoids liquidity problems by investing in the shares of listed infrastructure companies (one holding is Britain’s National Grid) rather than in infrastructure assets themselves,” he said.

For fans of investment companies, another “solid choice” in this area is the £2.4bn International Public Partnerships trust.

Performance of trust against sector and indices over 1yr

Source: FE Analytics

The strategy provides exposure to “essential assets” such as hospitals and railways and currently yields 5.6% while trading at a 17% discount.

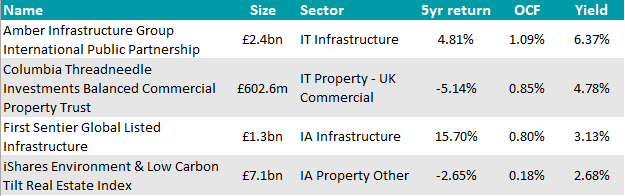

On the property side, Stevenson highlighted the Balanced Commercial Property trust.

“Yielding 5% and trading at a 18.45% discount, it offers potential upside as borrowing costs decrease,” he said.

It is one of the largest physical UK property trusts available investing in prime UK commercial property which has had the same manager, Richard Kirby, since launch.

The trust is also recommended RSMR analysts, who said it was a “core holding”, noting the “consistent monthly income” makes it “attractive for investors as an alternative source of yield from fixed income and equity”.

In the past year, it soared above its peer group, as the chart below shows.

Performance of trust against sector over 1yr

Source: FE Analytics

“Property and infrastructure investment trusts can benefit in another way from interest rate cuts: they tend to have borrowed money, so falling rates should cut their interest bills,” Stevenson explained.

The final pick was the iShares Environment & Low Carbon Tilt Real Estate index fund, a passive strategy that tracks the performance of the FTSE EPRA/NAREIT Developed index. A “sustainable investment option” in the real estate sector, the fund is currently yielding 5%.