Passive funds have scooped up investors’ money and “put a dent in active managers’ fortunes”, according ISS MI EMEA research leader Benjamin Reed-Hurwitz, editor of the latest Pridham report.

Investors poured money into funds in the second quarter of 2024 with big fund groups benefiting, although investors’ preference went to passive solutions over active funds.

The Pridham report monitors sales trends in the UK fund market using data supplied by the fund groups themselves. It covers more than £1trn in assets under management, with Vanguard included for the first time in the latest report.

From April to June this year, some 60% of the UK’s largest asset managers increase their net sales, while 43% registered positive retail net flows during the quarter, compared to 38% in the previous quarter and 21% in the final three months of 2023.

The positive sentiment, paired with a slowdown in outflows, has fuelled a sense of “guarded optimism” among the fund groups, but whether that trend continues into the third quarter “remains to be seen”, according to Reed-Hurwitz, especially considering the severe market volatility we have witnessed in recent weeks.

“On the positive side, investors in the past have been drawn to equities when interest rates are falling, as they have begun to in Europe and, perhaps, soon in the US, too,” he said. “That may well provide the conditions needed to carry that momentum through to the end of the year.”

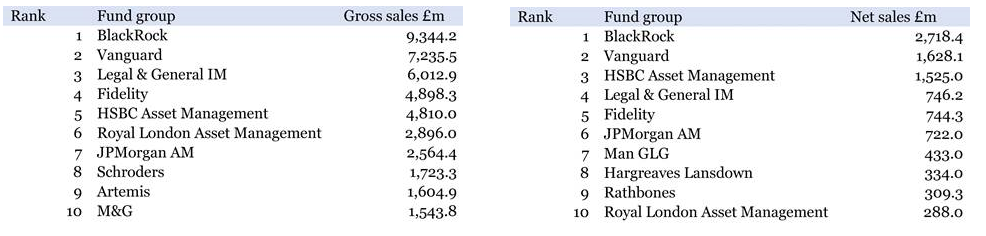

However, it was passive equity funds that led the way with more than £5bn in net sales, with the five best-selling fund groups in the second quarter all big names in tracker funds – BlackRock, Vanguard, Legal and General, Fidelity and HSBC Asset Management topped the charts, as the tables below show.

Source: The Pridham Report

Vanguard led the way in mixed-asset fund sales, with its LifeStrategy range (in particular the 80% equity option) propelling the firm’s success among retail investors.

But while the success of passive funds “has put a recent dent in many active managers’ fortunes”, Reed-Hurwitz is convinced that there is a sense that “investment opportunities will continue to broaden in the coming quarters”, particularly in the equity space.

In fact, the report showed that many active managers managed to carve out pockets of success in certain areas.

JP Morgan was the prime example of this, rising up the ranking thanks to the launch of a UK-domiciled version of its Global Focus fund, which became the best-selling fund by net sales for the quarter and reached £1bn of assets under management.

Global and North American funds remained crowd favourites, but there were successes elsewhere too. Managers such as Artemis managed to attract interest in less loved equity sectors, with Artemis UK Select a top performer in the UK. It helped the asset manager achieve ninth place in the retail gross sales ranking.

When it comes to bonds, sterling corporate bond funds took centre stage as investors’ top choice in eight out of the top 10 bond fund houses by gross sales. BlackRock, LGIM and Royal London were all beneficiaries of their popularity.