A handful of funds made top-quartile returns during both the recent market downturn and two weeks of recovery that followed it – with the lion’s share of these investing in UK equities, analysis by Trustnet shows.

Worries about the health of the US economy and the lofty valuations in some parts of the market caused stock markets to drift downwards from mid-July, only for a full-blown rout to take place on Monday 5 August when investors unwound the Japanese carry trade.

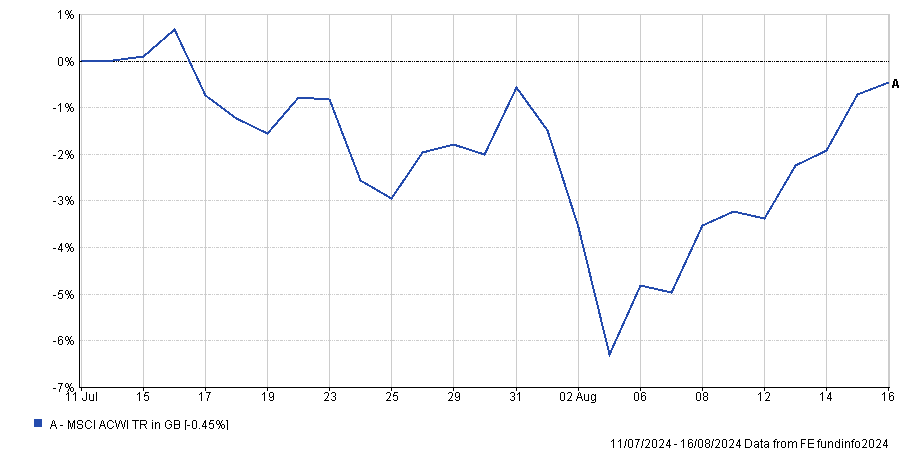

However, equities have been rallying since then, as the chart below shows, with the MSCI AC World index gaining 6.2% (in sterling terms). Some of this recovery was down to new economic data suggesting the US economy could avoid recession.

Performance of MSCI AC World since 11 Jul 2024

Source: FE Analytics. Total return in sterling between 11 Jul and 16 Aug 2024

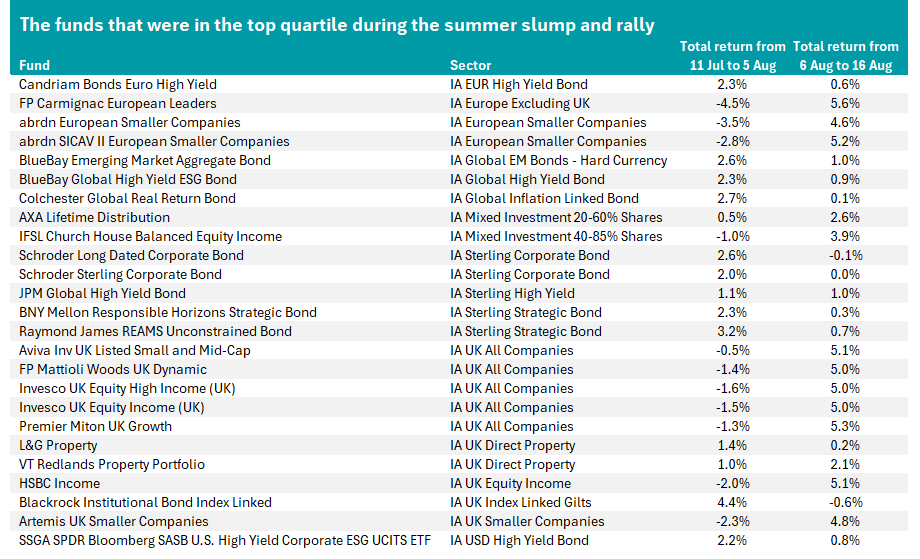

In this article, Trustnet looked for the funds that were able to maintain a top-quartile ranking in their Investment Association peer group during both periods – the summer slump and the fortnight-long recovery that followed.

Of the 3,676 funds with a sufficient track record and inclusion in a sector where quartile rankings are appropriate, just 25 – or 0.7% - achieved this. All of them can be seen in the table at the bottom of the article.

UK equity funds are the most common entrants on the list, with seven making the cut: five from the IA UK All Companies sector and one each from IA UK Equity Income and IA UK Smaller Companies (Artemis UK Smaller Companies, Aviva Inv UK Listed Small and Mid-Cap, FP Mattioli Woods UK Dynamic, HSBC Income, Invesco UK Equity High Income, Invesco UK Equity Income and Premier Miton UK Growth)

The UK held up better than areas such as the US and Japan when markets crashed, thanks to it representing better value than many of its peers and being the source of renewed investor confidence following stronger economic data and the change in government.

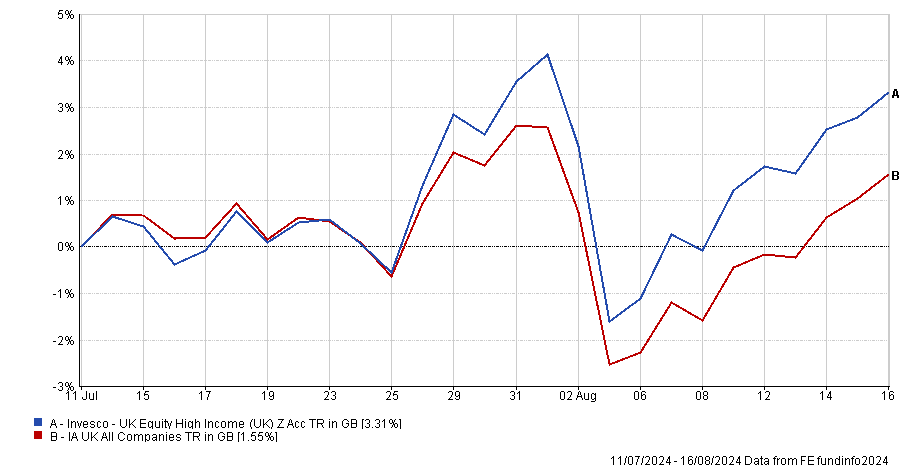

The largest fund on the shortlist is the £2.4bn Invesco UK Equity High Income fund, which limited losses to 1.6% in the market dip and has made 5% in the past fortnight. It is managed by Ciaran Mallon and James Goldstone; they also run the £1.1bn Invesco UK Equity Income fund, which is another to make top-quartile returns in both periods.

Invesco says both funds do not have an inbuilt style bias but Mallon and Goldstone look for good quality yet unvalued companies with strong cashflow generation. This has led to the likes of Barclays, Next, BP, RELX and Shell being among the top holdings.

In their latest update, published before the 5 August sell-off, the managers said: “We are particularly optimistic at the medium to long-term outlook for UK equities. In our discussions with clients over recent months we also sense a greater level of interest across a broad range of UK equity funds than we have seen for many years.

“At the heart of the interest is a growing appreciation that the UK offers exposure to many high-quality cash-generative companies that in many cases trade at valuations below global peers, even after taking account of differences in return on capital.”

Performance of Invesco UK Equity High Income vs sector since 11 Jul 2024

Source: FE Analytics. Total return in sterling between 11 Jul and 16 Aug 2024

Some UK funds on the shortlist – Invesco UK Equity High Income, Invesco UK Equity Income and HSBC Income – build their portfolios around large-cap stocks, especially those with a value tilt. This has helped as investors have returned to value stocks after a lengthy period of underperformance.

However, another recent trend is shown through the appearance of Aviva Inv UK Listed Small and Mid-Cap, Artemis UK Smaller Companies and Premier Miton UK Growth. These funds focus on opportunities further down the market capitalisation spectrum and UK smaller companies have been one of the strongest parts of the market in 2024.

FP Mattioli Woods UK Dynamic tends to invest around 10% of its portfolio in smaller companies.

David Stormont, a manager in Federated Hermes’ small- and mid-cap team, recently highlighted stronger economic data, improving consumer confidence and falling interest rates as strengthening the outlook for the UK.

“We believe this improving outlook will provide a strong tailwind for UK small-cap stocks. These companies earn a greater proportion of their earnings from the domestic economy than their large-cap peers, and have higher weightings to cyclical sectors such as industrials and consumer discretionary,” he explained.

“In previous cycles we have seen robust outperformance of UK small-cap companies over large-cap in periods of recovery and economic expansion.”

The full list of the 25 funds that were in the top quartile during both the summer slump and the recent recovery can be found in the table below.

Source: FE Analytics. Total return in sterling between 11 Jul and 16 Aug 2024