Utilities are getting a new lease on life thanks to the advance of artificial intelligence (AI), according to Michael Clarfeld, manager of the FTF ClearBridge US Equity Income fund.

As someone who runs a dividend fund, Clarfed understands saying utilities are a good investment may lead investors to roll their eyes at the cliché. But he is convinced that, while the old arguments for incorporating utility companies in income portfolios still hold (namely that they are “low-risk businesses that throw off nice dividends”), today the investment case is even more compelling.

That’s mainly for two reasons, he explained. The first one – and admittedly “the more powerful over the long term” – is the growth opportunities.

These companies aren’t known for their growth capacity and haven’t grown much in the past 20 years. However, that is bound to change as they should benefit from “really nice growth in the years ahead”.

“That’s a big change from the norm,” said Clarfeld, brought about by a combination of factors: electrification and the energy transition; AI’s needs for data centres; and climate change, which is generating the need to harden the grid, especially in the US where it has to cope with Californian wildfires, hurricanes in Texas and other extreme events.

All these phenomena are “huge consumers of capital”, which is a good thing for utilities in terms of their growth profile.

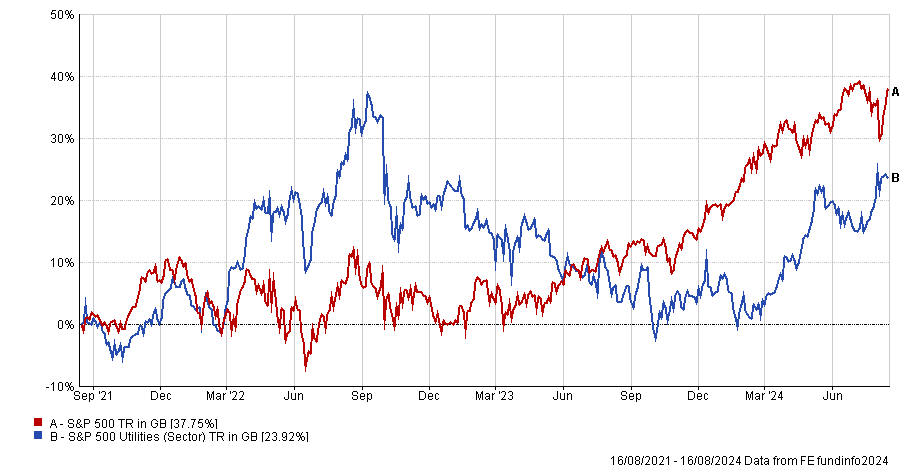

Performance of indices over 3yrs

Source: FE Analytics

The second incentive comes from their recent underperformance, as illustrated in the chart above. Utilities have had a positive move in the past couple of months, but underperformed “pretty significantly” in 2023, when interest rates worldwide were rising and investors were swapping them out, “thinking them as bond proxies”, said Clarfeld.

The fact that they are coming from this “depressed level” might give them an additional boost from here on.

“Combine this with a low-risk business model and the fact that they’re trading at attractive valuations given the sell-off over the past couple of years, and we see high single-digit growth from utilities for a long time,” he said.

One stock in this sector that has done particularly well in the FTF ClearBridge US Equity Income portfolio is Williams, a natural gas pipeline company.

It is a type of utility, which owns the gas pipeline that moves natural gas from the production field to the end market.

It plays on two themes, Clarfeld explained – US energy, where there has been “tremendous growth” in energy production following the war in Ukraine, as people were looking for natural gas supplies outside Russia; and the AI data centres story, as “people try to figure out how are we going to power data centres”.

Additionally, as the world increases renewable energies, “you need backup sources for the days that the sun doesn't shine and the wind doesn't blow, and natural gas is a good play there”, the manager said.

Natural gas still yields north of 4% with “a net solid dividend growth”.

Clarfeld isn’t the only manager with eyes on this sector, however, with Sam Witherow, manager of the JPM Global Equity Income fund, maintaining his largest active overweight to utilities, as he recently told Trustnet.