Investing in financial markets means playing the long game, and for fund managers like James Harries, who runs the £657m Trojan Global Income fund, this often means waiting for the right moment to add to new stocks or sectors to maximise the chances of a positive outcome.

Industrials, consumer products and financials are the three industries where he is exercising his patience at the moment and where he would like to have “considerably more capital allocated” if it weren’t for valuations – luckily for some, the manager thinks they are about to come down.

“If we can increase the quality of the portfolio, and by that I mean the underlying return on capital, or importantly the growth, without diminishing the income, then that would inform how we allocate capital,” he said.

With this in mind, he outlined the reasoning behind each of the three areas below.

First, industrial businesses. The investible universe for Trojan Global Income (which is a sub-set of the MSCI World index, as the manager explained to Trustnet at the start of the month) has some industrial businesses which are “very high quality”.

“We know them well, but we think they are much too expensive,” he said, anticipating that at some point, he could have a “very dramatic greater allocation” to the area, despite it having a degree of economic cyclicality attached.

The second area is consumer businesses, which he favoured despite the cost-of-living crisis and other intrinsic problems – which might turn into opportunities.

Some of “the more typical consumer businesses” such as Starbucks and Nike have been suffering from consumer weakness. Luxury behemoths as large as LVMH haven’t been exempt and are also “appearing to begin to suffer from somewhat inconsistent demand”, notably from consumers in China. On top of that, some of these companies “may also have syncretic problems with their businesses” at the moment.

“Without sounding like a heartless fund manager, if that gave us an opportunity to invest in some consumer businesses at better valuations, then we will take that opportunity,” Harries said.

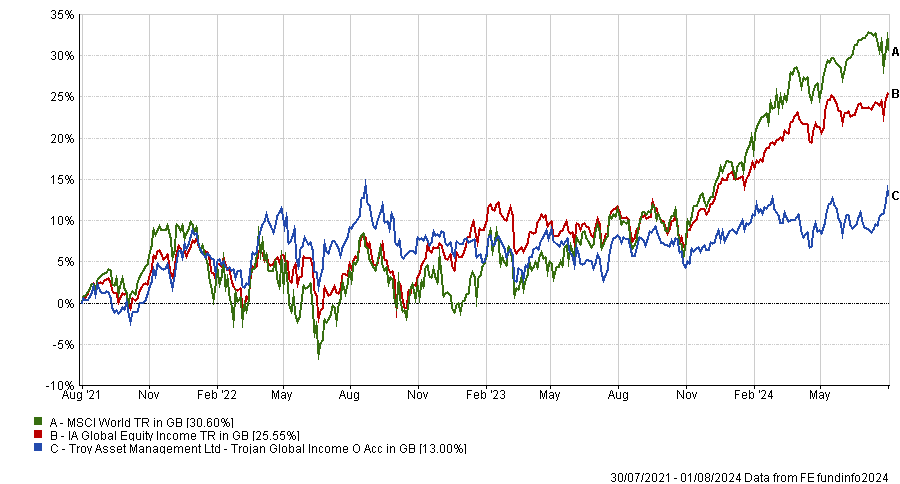

Performance of fund against sector and index over 1yr

Source: FE Analytics

The third area was non-bank financials, a sector where “many high-quality businesses are geared into the level of activity in capital markets”.

“Given that we think equity markets are pretty fully valued, we need to be patient about allocations to those areas,” he admitted.

“Ideally, you want the fastest-growing, highest-quality yielding portfolio you can possibly get at the lowest valuations – you'll never achieve that of course. But if we do get a more difficult period and valuations become a little bit more sensible, than that will give us an opportunity to reallocate capital within the portfolio.”

Other areas the manager likes are healthcare companies, which “tend to be high quality and are relatively inexpensive” and tobacco, which he compared to consumer companies.

“I suspect they won't be called tobacco companies at some point, but nicotine consumer products companies,” he said.

They are now offering people a range of different products in the form of heat-not-burn, and vapes, which “makes for a much more sustainable business”, because the product is “much less harmful”.

“So although people are smoking less, you could argue that consumption of nicotine is increasing,” he said.

At 5.1% British American Tobacco is the third-largest holding in the portfolio. The area, the manager said, is offering “very attractive prospects” through a combination of “the greater sustainability of the businesses” and “the incredible value that you're being offered”, particularly at a time when “the market itself is very fully valued and we might be moving into a slowdown”.