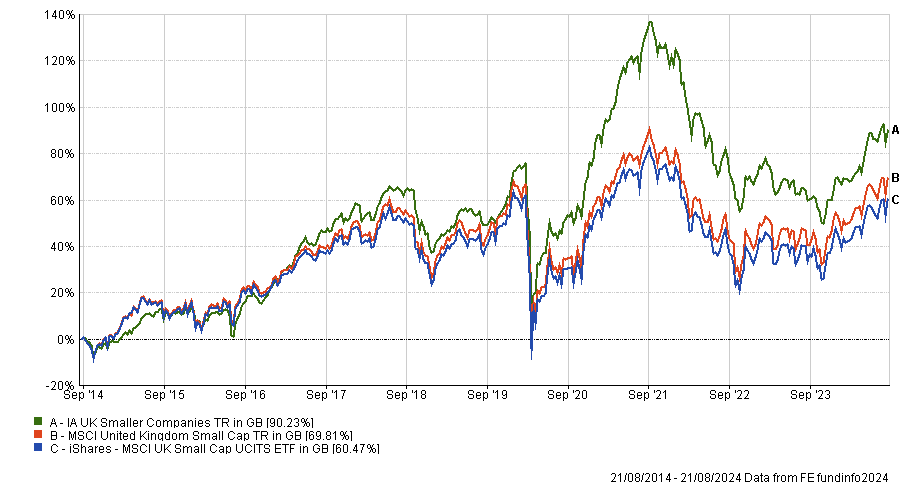

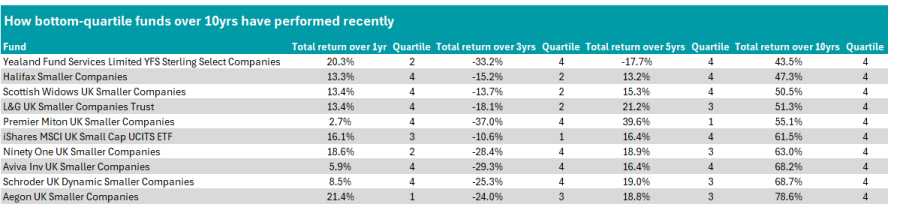

Only the iShares MSCI UK Small Cap UCITS ETF has managed to go from the bottom quartile of the IA UK Smaller Companies sector over 10 years to the first quartile in the past three years, based on data from FE Analytics.

The iShares ETF is a passively managed fund, currently holding £182m in assets under management (AUM). It has achieved first-quartile performance over the past three years, with a notable performance last year when it was the second-best performing portfolio in the whole sector, up nearly 9%.

However, this alone was not enough to make up for some of the fund's more disappointing performances over the past decade, most notably in 2022, where it fell by 22.8%.

Performance of the fund vs the sector and the benchmark over 10yrs

Source: FE Analytics

As such, over three years it has made a 10.6% loss, but this was still good enough for it to rise to the top quartile over the period. It has been a challenging time for UK small-caps over the past three years, with just five funds in the IA UK Smaller Companies sector making a positive return.

This was a consequence of rising interest rates in the UK and the disastrous mini-Budget, which tanked the pound, hitting domestic stocks hard. The rise of the US large-caps and the chunky yields on offer from bonds have also meant investors have felt less inclined to take on the added risk that comes from small-caps.

As part of an ongoing series, Trustnet looked at funds in the IA UK Smaller Companies sector that have risen from the bottom quartile in the long term to the top 25% of the peer group in the past three years.

While iShares MSCI UK Small Cap UCITS ETF is the only fund to match the criteria, by widening the search to include portfolios that rose to the second quartile over three years or to the top quartile over different timeframes, five more funds entered the results.

How the bottom-quartile UK Small Companies funds over 10yrs have performed recently

Source: FE Analytics

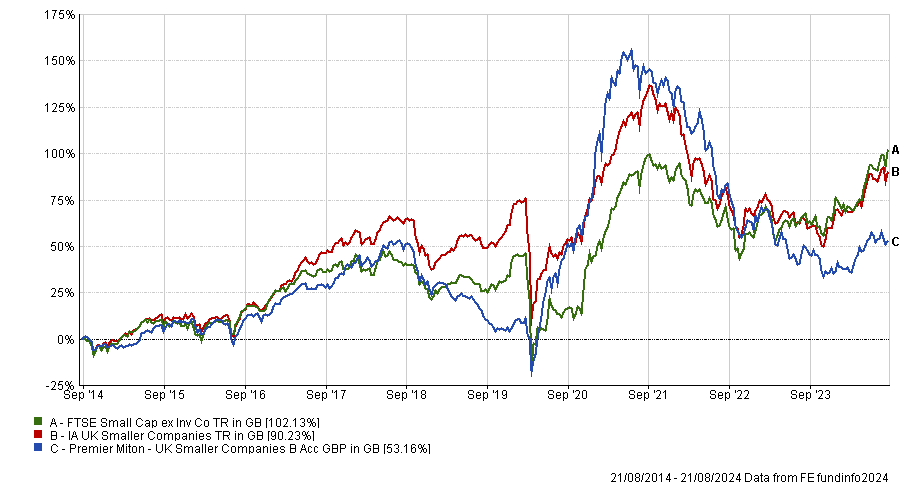

One such fund is Premier Miton UK Smaller Companies, co-managed by Gervais Williams and Martin Turner since 2012. Despite poor performance over the past three years, including a stint as the worst-performing portfolio in the sector last year, the £53m fund was in the top quartile over five years, indicating an impressive performance pre-2021.

Indeed, it had an extremely positive 2020, ranking as the top performer of the sector, up 77.3%, despite a rough start to the year due to the pandemic. While 2020 was a strong year for UK small-caps generally, this was more than double the performance of the second-best fund that year.

Williams said: “The fund’s share price also fell again when the global pandemic started in March 2020. But thereafter, although the mainstream stock market recovered to some degree, generally the global recession held back the upsides of most mainstream stocks.”

“In contrast, whilst the prospects for many quoted small-caps were also affected by the global recession, there were others where the change in customer behaviour greatly improved their prospects.”

While it has not been smooth sailing, Williams remained optimistic about the fund’s long-term goals and said he believed UK small- and micro-caps will continue to have the greatest potential.

“Turner and I have sought to be a little braver than most others in our peer group, in anticipation that the fund’s returns will have the potential to be much stronger over the longer term,” he added.

Performance of fund vs sector and benchmark over 10 years

Source – FE Analytics

Turning to those in the first quartile over one year, this more flexible criteria included the £187m Aegon UK Smaller Companies fund, managed by Elaine Morgan. The portfolio rose to the third quartile over the past three years.

The fund made 21.4% last year, nearly 5 percentage points more than the Deutsche Smaller Companies Ex-Investment Trust benchmark.

In a statement on the funds’ performance, Morgan said: “The strongest theme driving the strong market return has been the moderation in inflation, which has enabled interest rate expectations to come down, ‘unwinding’ some of the stressors of 2022.

“The depressed valuations within the market enabled the fund to take advantage of opportunities at the larger cap end of the spectrum.”

Lastly, several funds never managed to achieve first-quartile returns but did rise from the bottom 25% of the sector to the second quartile over three years.

These included the £42m Scottish Widows UK Smaller Companies fund, the £184m L&G Smaller Companies fund, and the £113m Halifax Smaller Companies fund.

Previously in this series, we have looked at the UK Equity Income, emerging markets, IA Global and Global Equity Income, and the UK All Companies sectors.