The ‘Magnificent Seven’ have been dominant in markets over the past 18 months as the artificial intelligence (AI) theme has boomed. But not all are convinced of its staying power.

In fact, Dmitry Solomakhin, lead manager of Fidelity FAST Global, is actively shorting some of the biggest US tech names.

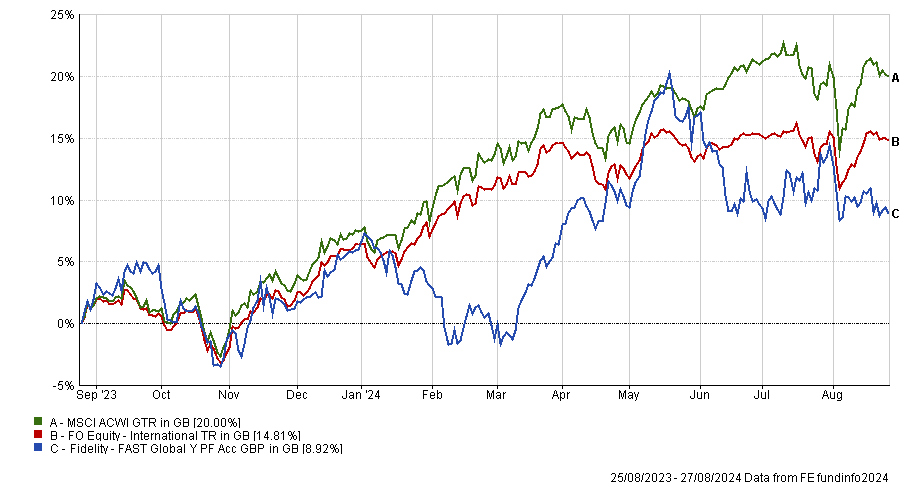

These positions will undoubtedly have been painful for the fund, as Solomakhin told Trustnet earlier this month. Despite a top-quartile record over three, five and 10 years, the fund has dropped to the bottom 25% of its sector over one year – something he puts down to short positions in AI winners.

Performance of fund vs sector and benchmark over 1yr

Source: FE Analytics

So why short these AI winners in the first place? Solomakhin said if investors take a step back, they may realise there is a gap between market expectations and reality, which makes the sector a “rich hunting ground” for short positions.

“Hyperscalers are spending a lot of money. It started with Open AI and Microsoft and then Google joined the race because it felt threatened. Then others followed,” he said.

“If you listen to conference calls from the likes of Amazon and Microsoft now, they will tell you they don’t know exactly how all of this tech is going to be used but they would rather overspend now than regret [not doing so] later,” said the Fidelity FAST Global manager.

Solomakhin understands the tech sector well, having been a technology fund manager between 2008 and 2013, so he has “seen a number of these cycles in the past”.

The cycle of spending money early to develop technology, without worrying about its future monetisation, is “the tech mould”, he said.

“Nothing against AI at all. It is real, it is tangible and it is there. It is going to grow, but the reality versus market expectations: there is a gap.”

He was concerned that some of the customers for the new technologies being created within the world of AI “don’t have real businesses”.

Instead, they “raised money from venture capital” in the same way that crypto-mining businesses did a few years ago. He said some of these start-ups will “run out of cash” because there is “no business model”.

Additionally, while there are some “obvious use cases” for the technology being produced at present, there is “nothing fundamentally new” about the products.

“A lot of this stuff has been with us for 20 years. Yes this might be a better product but it is not a new concept,” said Solomakhin.

As such, “at some point there will be a digestion period where people realise they have spent all this money but won’t know how to make money out of it. There will be a bit of trouble,” he noted.

He likened it to the rise of renewable energy, solar, wind and electric vehicles, which rocketed in the late 2010s and early 2020s on the back of an environmental, social and governance (ESG) wave but have come back down to earth since.

“These themes are absolutely real but if you look at the number of casualties, so to speak, in terms of the equity being destroyed as the theme is being developed, it is unbelievable,” the manager said.

Although Fidelity International does not publicly disclose its short positions, the fund’s factsheet lists two short positions in stocks worth 4.4% and 3.9% of the MSCI All Country World Index benchmark.

It also shows that the fund has nothing in Microsoft. Looking at the latest MSCI ACWI factsheet, this implies the portfolio has a 2.7% short position

However, investors should not expect shorting tech to be an ongoing theme. Should valuations return to more “normal” levels, the fund will look very different.

Indeed, Solomakhin noted that three years ago he was mainly shorting special purpose acquisition companies (SPACS) and ESG-related names.

“We didn’t have a negative view on ESG but a lot of the companies were not real businesses,” he said.