News on Tuesday 27 August took the music industry by storm: Oasis is doing a reunion tour.

I’m happy (if not a little bit nervous in social circles) to admit, I am not the most avid of Oasis fans. Sure, everybody loves ‘Wonderwall’ and ‘Don’t Look Back in Anger’ and ‘Champagne Supernova’ and... you see, that’s all I can come up with. But even though it’s not my favourite band, I still found myself completely caught up in the excitement with the rest of the Oasis fan base. This includes checking when tickets were put on sale, entering pre-ticket ballots by Googling the name of the original Oasis drummer (come on, who didn’t?), trying and, for the record, failing to get tickets, and finally, reading up on the band’s journey to the success it commands today.

Whilst flitting through various online biographies, it occurred to me that the band has an uncanny ability to time its most notable chapters with periods of extreme volatility in financial markets. Whether it was forming in 1990/91 during the early 1990s recession; releasing the infamous ‘Definitely Maybe’ album in 1994, the year of the ‘great bond massacre’; or breaking up in August 2009, just after the global financial crisis. It makes you ponder, is the Oasis reunion a warning sign of what’s to come?

The forming of the Rock ‘N’ Roll Star(s)

When Liam Gallagher, Paul Arthurs, Paul McGuigan, and of course, Tony McCarroll formed a band and invited Noel Gallagher to join as its lead guitarist, Oasis was formed.

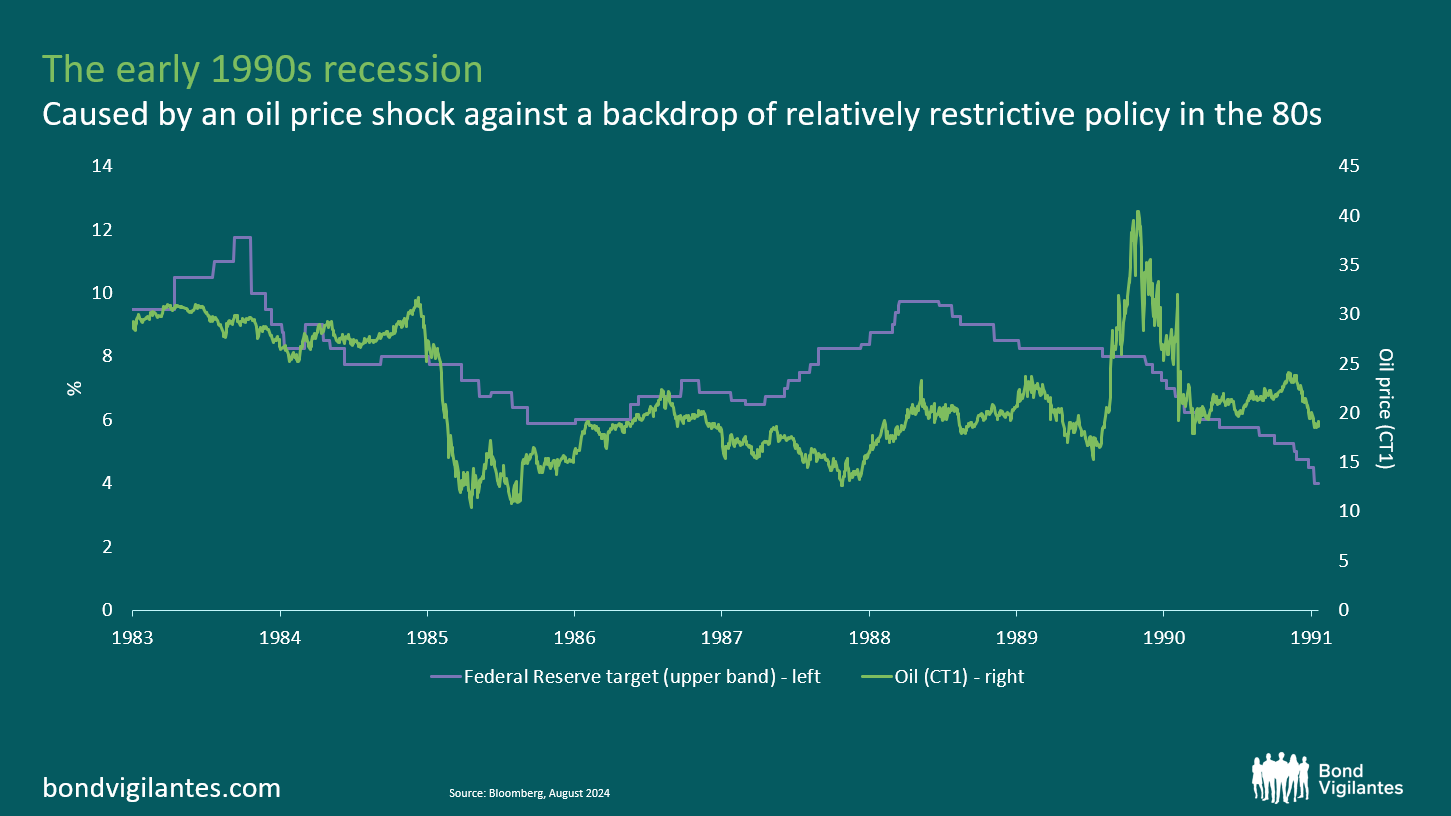

It’s difficult to know whether their focus at the time was on producing future world-changing music or whether an overspill of inflation and monetary policy effects from the 1980s, combined with an oil price shock caused by Iraq’s invasion of Kuwait and growing consumer pessimism, would tip the economy into a recession. Perhaps it was both but, whatever the case, the one thing we can say for sure is… both happened.

The release of ‘Definitely Maybe’ and the great bond massacre

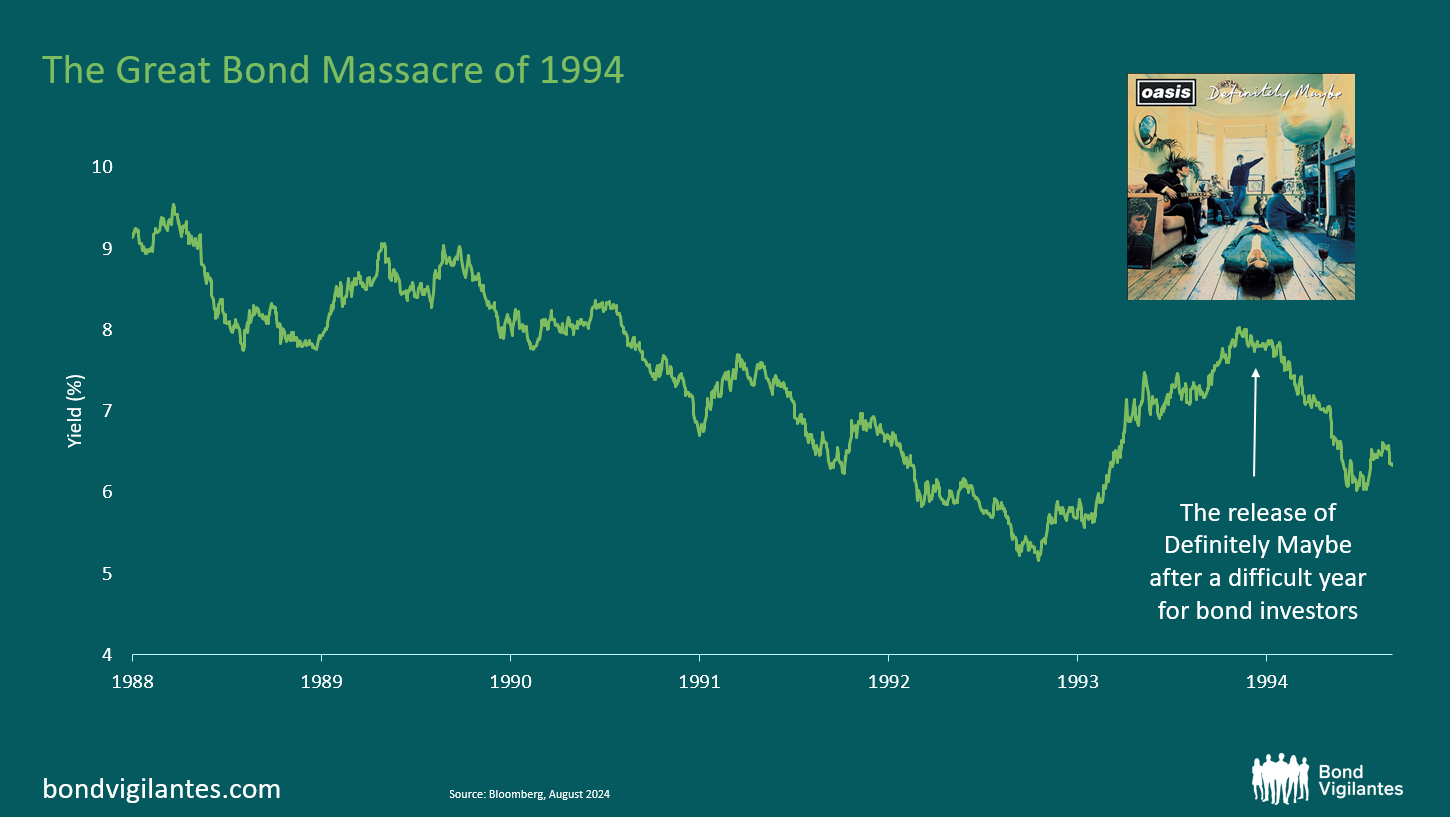

‘Definitely Maybe’, released on 29 August 1994 (a time of the year I’ll be referring back to later), was the fastest selling debut album of all time in the UK when released. Whilst the first two singles, ‘Supersonic’ and ‘Shakermaker’, missed the Top 10, a stint of 22 consecutive Top 10 singles commenced with the release of the iconic ‘Live Forever’.

I’ll be honest, I’m not sure on the exact timing of the recording of this song, but with lyrics including ‘did you ever feel the pain’, I can’t help but wonder(wall) if Oasis was loosely alluding to the brutal sell-off in bond markets which would latterly be coined the ‘great bond massacre’.

Indeed, fixed income investors had enjoyed a period of gradually declining interest rates from the heights of early 1988 (albeit with a few healthy doses of volatility). Through 1994, a rise in interest rates and the spread of volatility across international markets half the world away resulted in a very challenging period for market participants, who perhaps should have known that yields can’t just continuously move lower little by little without some inflationary backlash.

The band’s breakup in 2009, a year after the global financial crisis

With Arthurs and McGuigan leaving the band in 1999, some might say that the timing of important band events coinciding with volatility in financial markets could be attributed to them, especially given the band was relatively quiet around the tech bubble in the early 2000s.

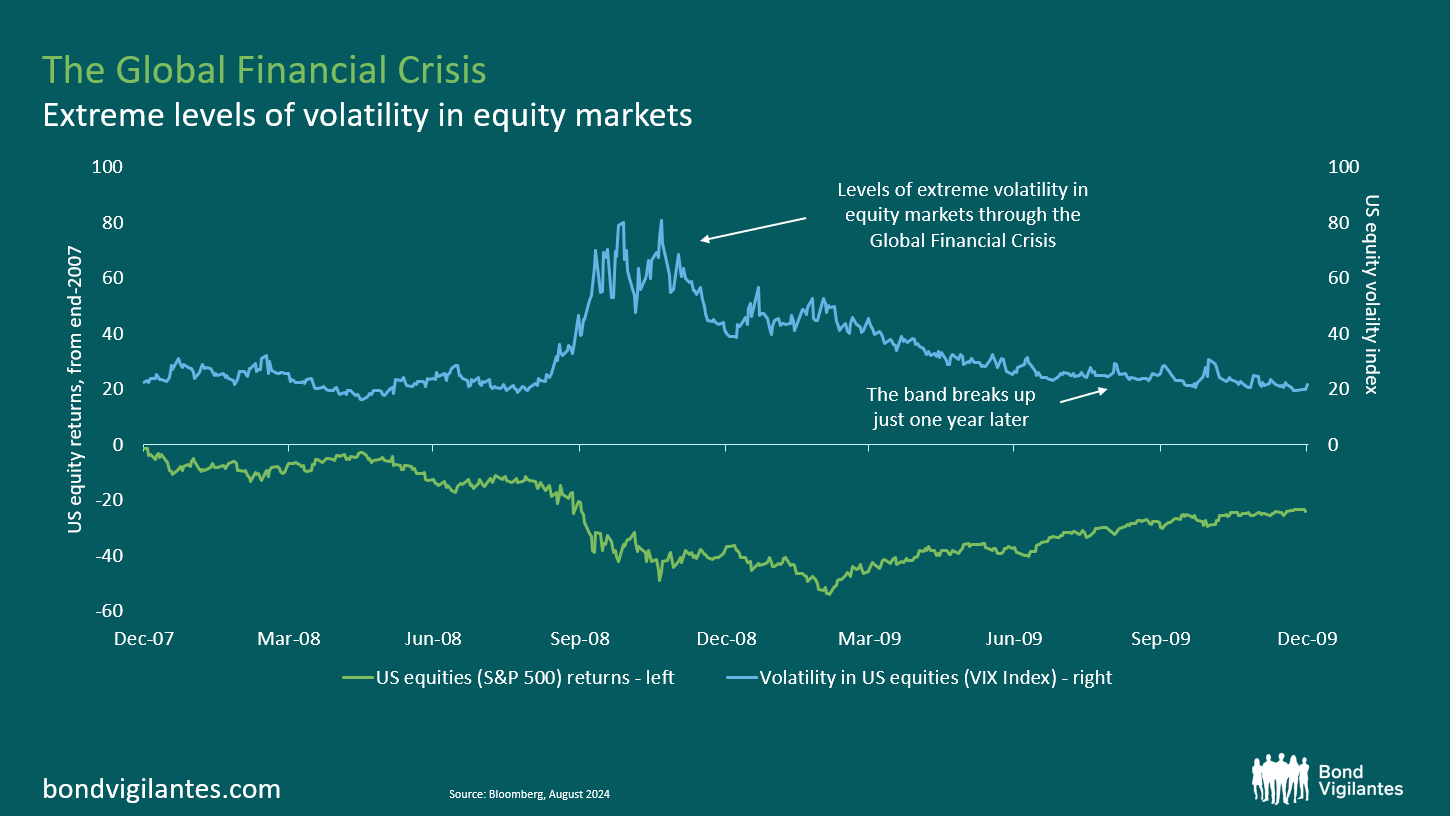

But putting a stop to that theory, the Gallaghers patiently waited for the next globally significant market event – the global financial crisis – before calling an end to Oasis.

It was rumoured that the brothers’ relationship involved some difficulties, with the odd jibe in interviews and the travelling separately to gigs, but the breaking point came the night the band was due to perform at the Rock en Seine festival in Paris, on 28 August 2009 (that time of year again). Fans had no choice but to roll with it and accept the changed musical landscape with acquiescence.

By the time the band broke up, the economy had started to recover. If the breakup had happened around a year earlier, I really would be considering an Oasis Recessionary Indicator. Much has been written about the global financial crisis over the years, so I don’t wish to rehash that here – this section serves only to highlight that once again, a pertinent point in the Oasis story has coincided with a period of extreme volatility in financial markets.

The reunion is here: Is Oasis trying to warn us?

Hopefully the band’s ‘do as I say and not as I do’ attitude hasn’t escaped many. Since February 1996 the world has been told over a billion times don’t look back in anger – it took you 15 long years, fellas. But now, the wait is over.

On 27 August, almost exactly 30 years after ‘Definitely Maybe’ was released, and almost exactly 15 years after the band decided not to talk tonight in the break-up concert in Paris, Oasis announced its reunion tour. I offer my congratulations to those who were lucky enough to get tickets over the weekend, my partner tried desperately hard for around eight hours before being removed from the website on accusations of being non-human.

To close, I don’t wish to jump to conclusions as to why Oasis decided to reunite, but I can’t help myself believing that it can only be as a warning of imminent volatility in financial markets. The economic cycle is at an inflection point and it could be argued that interest rates have been too high for too long, causing irreparable damage to the economy in its current cycle.

Perhaps Noel and Liam share similar concerns about the Federal Reserve achieving a soft landing? Or perhaps the timing around the band forming, the release of the ‘Definitely Maybe’ album and the band’s breakup all coinciding with periods of volatility in financial markets has just been completely and utterly coincidental. I’ll leave that with you to decide.

Joe Sullivan-Bissett is a fixed income investment director at M&G Investments. The views expressed above should not be taken as investment advice.