The US is overtaking the UK and the rest of the world in the list of favourite geographies for many income managers, offering opportunities where other markets fall short.

One fan of the region is Stuart Rhodes, who, together with John Weavers and Kathryn Leonard, manages the fifth-largest fund in the IA Global Equity Income sector – M&G Global Dividend. More than 50% of the £2bn of assets under management is currently invested in US dividend-paying companies.

While the manager keeps an overweight position to the UK and Europe, where he sees “some exceptional high yield opportunities, especially in financials”, it is only in the “fruitful hunting ground” of the US that dividend investors can find opportunities for long-term dividend growth “across a variety of sectors”.

Rhodes currently spreads his US exposure across many areas, including technology, healthcare and consumer discretionary and this variety is the first reason why income investors like the market.

“The US stands out for its depth and breadth, as well as the dominance of its new economy exposure, in contrast to the rest of the world where the investment options available for income seekers are more limited, especially in the tech sector,” Rhodes said.

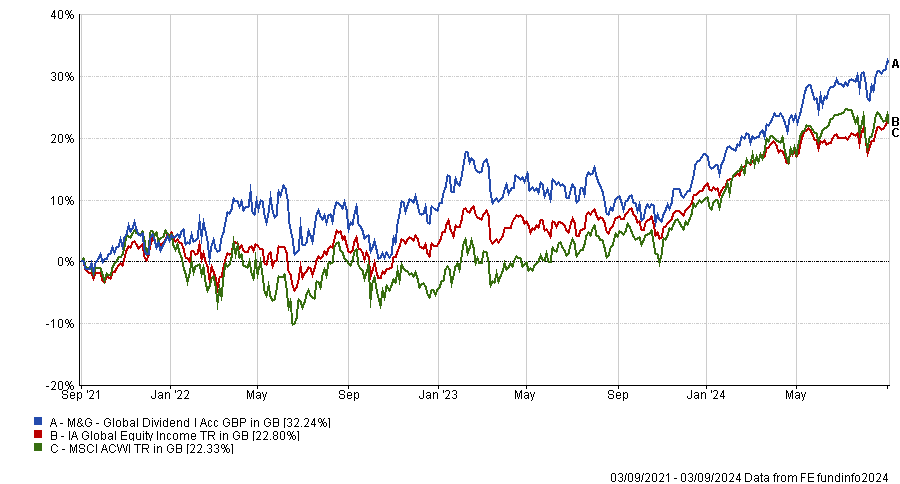

Performance of fund against sector and index over 3yrs Source: FE Analytics

Source: FE Analytics

Opportunities span across market capitalisations as well, as Simon Adler, co-manager of the Schroder Global Equity Income and Global Recovery funds, noted.

His allocation to the US has doubled since the Covid era, going from 15% to 30%, as the opportunity set has got “a lot better” in both the very large-cap part of the market and in some of the smaller parts.

A quick-fire look at the Schroders portfolios exemplifies this. It has recently been adding to US businesses trading on “very attractive multiples”, which have gone through difficult periods but are “ultimately going to be successful”.

Examples include Verizon, Pfizer, Kraft Heinz, Mohawk Group and Black & Decker, “world-leading businesses in their sectors” that are going to have a tough 18 months ahead of them, but that the manager has bought “on a temporary discount” because he is “willing to be patient”.

Among smaller companies are the publisher John Wiley and home furniture company La-Z-Boy, which have “great products, great brand positions, decent balance sheets, and can see through a tough patch and come out the other end really strong”.

Some of these names have already started to work out in the manager’s favour, with Mohawk up more than 50% over the past 12 months, La-Z-Boy 37% and Wiley adding 33%.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Another reason why the market is so loved is dividends. The US is home to the longest dividend track records in the world, exemplified by the ‘Dividend Achievers’, companies that have increased their dividends every year for 25 years or more, as Rhodes noted.

These established long-term dividend growers include Microsoft, which makes up 3.4% of the M&G Global Dividend fund.

But it’s not just that: There’s newcomers joining the fray of dividend payers year after year, including Alphabet, which has announced its maiden dividends this year and has become a potential investment candidate for income strategies.

Dividends are also less likely to be cut in the US, according to Rhodes, who noted that these companies can be under more scrutiny to keep their payments and therefore are more wary when starting a dividend.

“US companies understand the importance of cash returns to shareholders and take pride in consistent dividend growth across economic cycles – in contrast to other parts of the world where dividend cuts are more prevalent especially during the tough times,” he said.

Michael Clarfeld, manager of the FTF ClearBridge US Equity Income fund, also thinks US dividends are less likely to be cut, but admittedly that’s because “payout ratios are much lower than in Europe”, to the tune of 70% to 40% on average.

“There’s gives and takes with that,” he said. “The lower payout ratio leaves more money to invest organically in the business and grow it as well as giving more discretionary capital for the management to grow that stream over time.”

This is not always the case, however, as US companies in the Schroder income portfolios are giving Adler a larger average dividend than UK companies – 4.5% versus 3.7%.

In any case, Clarfeld said investors shouldn’t be put off by lower yields on average, because the reason to buy US equity income is not the current yields, but the power of compounding.

“Our average company has compounded about a 9% or 10% rate historically. If you think about that, that’s doubling your income every seven years.”

Finally, Clarfeld saw a final, conjunctural reason why US income makes sense now – the market concentration in the United States, as the top 10 stocks in the S&P 500 make up almost 40% of the index.

“A lot of people might benefit from a broader and more conservative allocation to the market to complement their Magnificent Seven exposure”, he said.

The ‘Magnificent Seven’ are “phenomenal companies, wildly profitable and still growing nicely”, so the manager said it is not a question whether one should have exposure there. The question is how much and how much is the price tag.

“There are opportunities outside of those handful of concentrated names that are very reasonably valued,” he concluded.