Following a long period of underperformance, the UK market has been rallying in recent months and investors might be considering adding to their domestic exposure.

That said, the discount on UK equities remains significant. The MSCI UK index is trading on a forward price-to-earnings (P/E) ratio of 11.7x, compared with 14.1x for the MSCI Europe ex UK and 21x for the MSCI North America.

Tom Stevenson, investment director at Fidelity International, said: “The UK stock market is no longer trading in absolute bargain territory - but it is pretty close to it. Valuations in the US – even after the hiatus in markets mid-summer – remain close to their recent peaks.

“Moreover, the UK is now underpinned by several factors including more growth and the actual onset of falling interest rates. That could fuel a further unwinding of the discount that’s been applied to UK shares ever since the Brexit referendum in 2016.”

Below, the Fidelity investment director highlights five funds investors considering buying UK equities might want to look at.

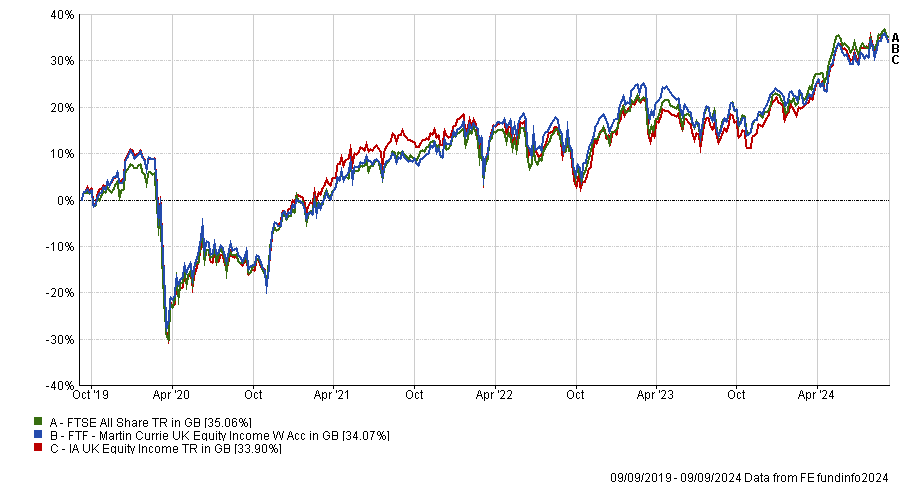

FTF Martin Currie UK Equity Income

Starting with active picks, Stevenson pointed to the £857m FTF Martin Currie UK Equity Income fund. Managed by Ben Russon, Will Bradwell and Joanne Rands, the fund aims to deliver an income higher than the FTSE All Share, doing so with a portfolio that tends to have the majority of assets in large-caps.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“We like this fund as it invests primarily in companies listed in the UK, although the investment manager has the freedom to invest up to 10% outside the FTSE All Share index,” Stevenson said. “The manager is also committed to UK equity investing – which can be a rarity, as most investment firms tend to focus on global investing.”

Fidelity’s analysts said FTF Martin Currie UK Equity Income might be a good option for investors seeking dividend income from companies primarily listed in the UK.

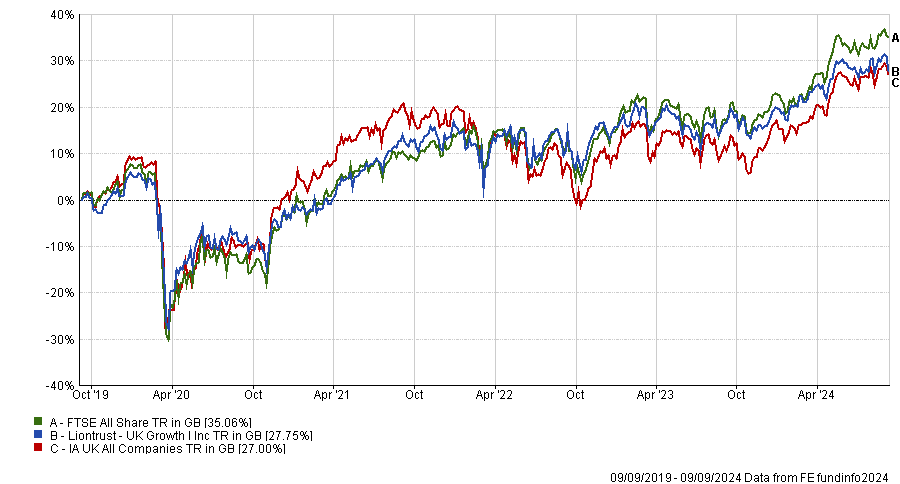

Liontrust UK Growth

Next up is Liontrust UK Growth, which is managed by Anthony Cross, Julian Fosh, Matthew Tonge and Victoria Stevens. The £993m fund looks for UK companies with ‘economic advantages’, or intangible assets such as intellectual property, recurring business and distribution networks that are hard to replicate and provide long-term protection from competition.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“It’s worth noting that this fund’s approach has a ‘quality’ bias, meaning it will buy companies that tend to be more expensive than others,” Stevenson said. “Due to this, the manager takes a very long-term view when investing.”

Because of this long-term approach, Liontrust UK Growth could be a holding for investors looking to invest for 10 years or more.

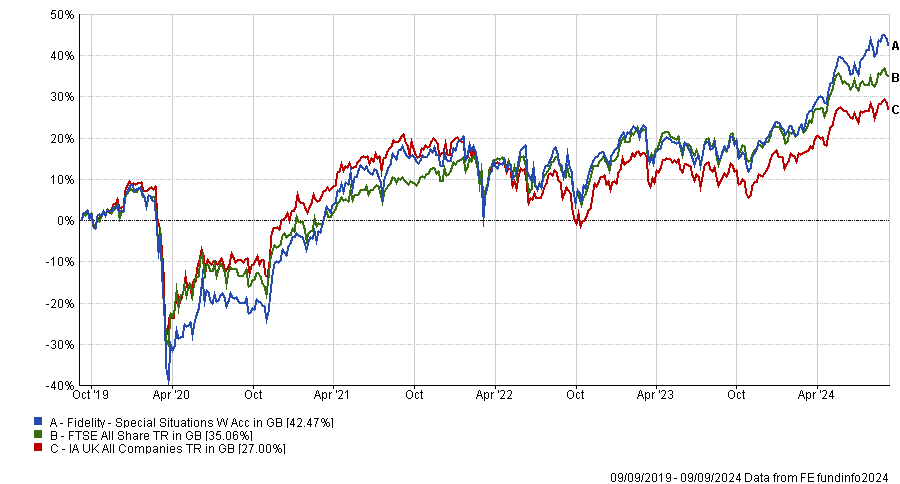

Fidelity Special Situations

The third active pick is the £2.9bn Fidelity Special Situations fund. It is managed by Alex Wright, with Jonathan Winton as co-manager, and has a strong long-term track record – currently in the top quartile over one, three, five and 10 years.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“There’s a focus on companies that the manager believes are undervalued. Our experts like this fund because the manager is a ‘seasoned UK investor’,” Stevenson said. “There’s also a willingness to invest in smaller companies, an area in which Fidelity brings expertise.”

Wright’s contrarian approach means Fidelity Special Situations is a value fund and should perform better when the value style is leading the market, although it has also done well in growth-led markets. Analysts at Rayner Spencer Mills Research said the fund is suitable to hold over a full market cycle, but added it might be more suited to being a satellite rather than core holding.

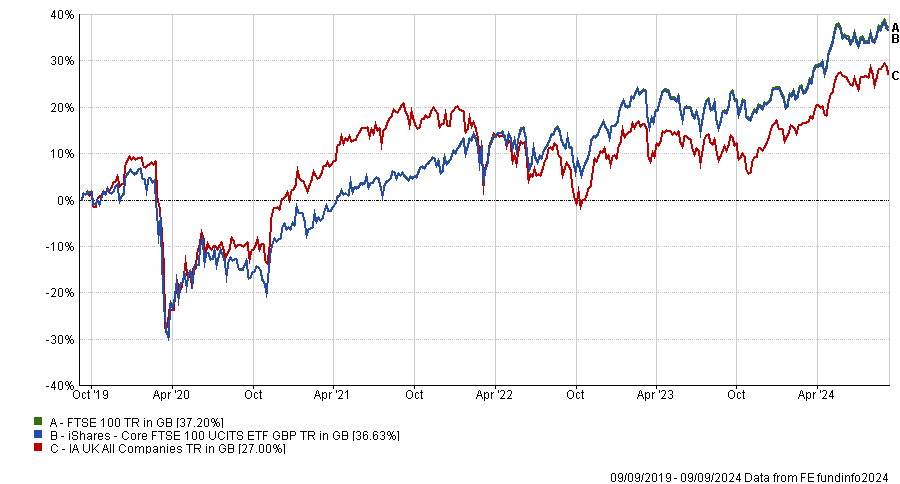

iShares Core FTSE 100 ETF

Turning to passive options, Stevenson picked the iShares Core FTSE 100 ETF. As its name suggests, the ETF tracks the FTSE 100 index, meaning it provides exposure to the largest companies in the domestic market.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“Our experts like this fund as BlackRock is a seasoned investor in passive funds and the fund’s costs are low,” he said.

The iShares Core FTSE 100 ETF may be suitable for investors who looking for exposure to large UK equities, have a long-term horizon and are cost-conscious, Fidelity said.

Vanguard FTSE 250 ETF

The final pick is Vanguard FTSE 250 ETF, which is intended to sit alongside a FTSE 100 tracker and offer exposure to UK mid-caps.

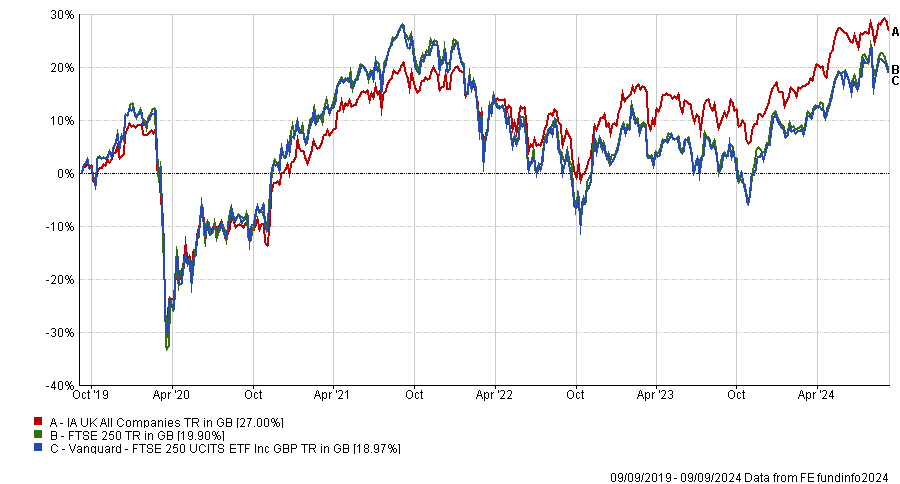

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

The FTSE 250 tends to be more geared to the fortunes of the domestic economy, as its members are more likely to have significant business with UK customers, unlike the FTSE 100 where the bulk of revenues are derived from overseas.

“Given that the fund invests in medium-sized companies, there may be more volatility and risk arising compared to larger sized companies,” Stevenson added.