After more than a decade of domination, US growth funds are starting to cede places at the top of the rankings to their value counterparts.

It has been a tumultuous three years for investors in growth names such as the behemoth US tech and healthcare stocks. Higher interest rates that started climbing towards the end of 2021 and beginning of 2022 threatened to derail their performance before the rise of artificial intelligence (AI) caused names such as the ‘Magnificent Seven’ to flourish.

But this short-term volatility has allowed other, formerly maligned strategies, to leap up the rankings, including value funds, which have spent much of the past decade in the shadow of their growth peers.

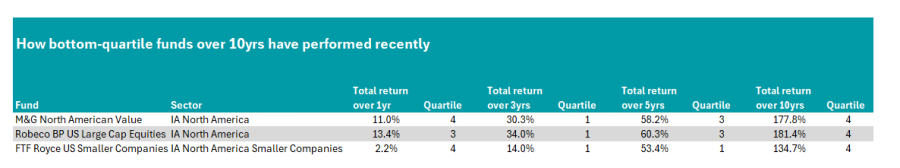

Below, Trustnet highlights three US equity funds in the IA North American and IA North American Smaller Companies sectors that have rebounded from a bottom-quartile performance over 10 years to the top 25% of their sector over the past three years.

Across both sectors, three funds fit our criteria, all of which invest with a value tilt. They were: M&G North American Value, Robeco BP US Large Cap Equities and FTF Royce US Smaller Companies.

How bottom quartile funds over 10yrs have performed recently

Source: FE Analytics.

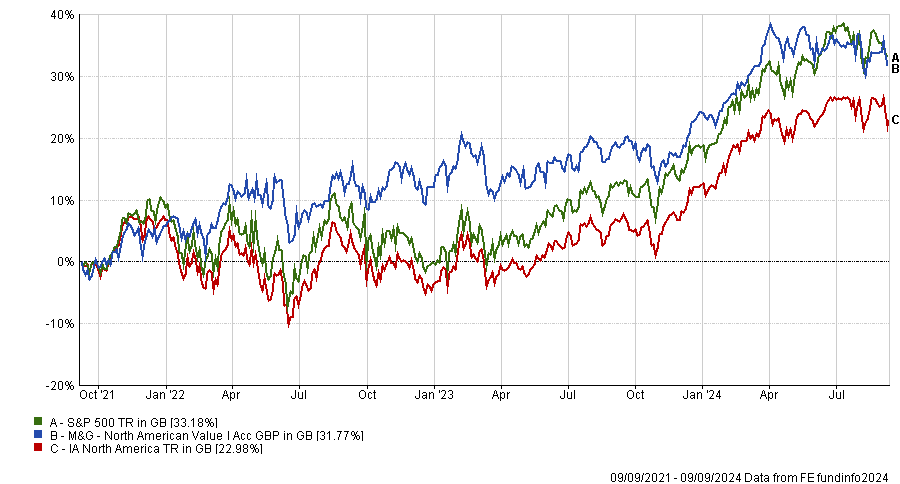

First up is the £280m M&G North American Value fund, co-managed by Daniel White and Richard Halle, which has an FE Fundinfo Crown Rating of four.

It rallied from a bottom 20 performer over 10 years in the 129-strong IA North America sector, but made a first-quartile return of 30.3% over the past three years, enjoying a particularly strong 2022.

It managed to make 5.9% that year during a challenging one for US stocks, which had to contend with high global interest rates causing many of the formerly surging growth stocks to struggle.

Performance of fund vs the sector and benchmark over 3yrs

Source: FE Analytics

Nevertheless, its track record has not been perfect, with 2022’s strong performance followed by a fall to the third and bottom quartile in 2023 and 2024 respectively.

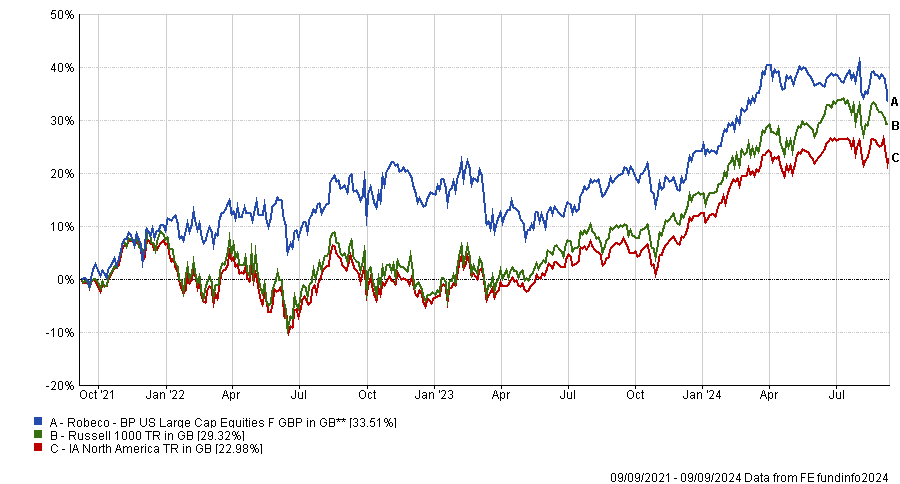

Also from the IA North America peer group is the £1.1bn Robeco BP US Large Cap Equities fund. It is led by a four-strong team, the longest-tenured of which are David Pyle and Mark Donovan, who have been named managers on the fund since 2010.

Over the past three years, it has become one of the top 20 performers in the peer group, up 10.4%, owing to a two-year streak from 2021 to 2022 in which it ranked within the first quartile of its sector with returns for these years of 29.7% and 6.5% respectively.

Performance of fund vs the sector and benchmark over 3yrs

Source: FE Analytics

Once again, however, performance has not been smooth sailing throughout this period and the fund dipped to the bottom quartile in 2023, and in 2024 it sits in the third quartile.

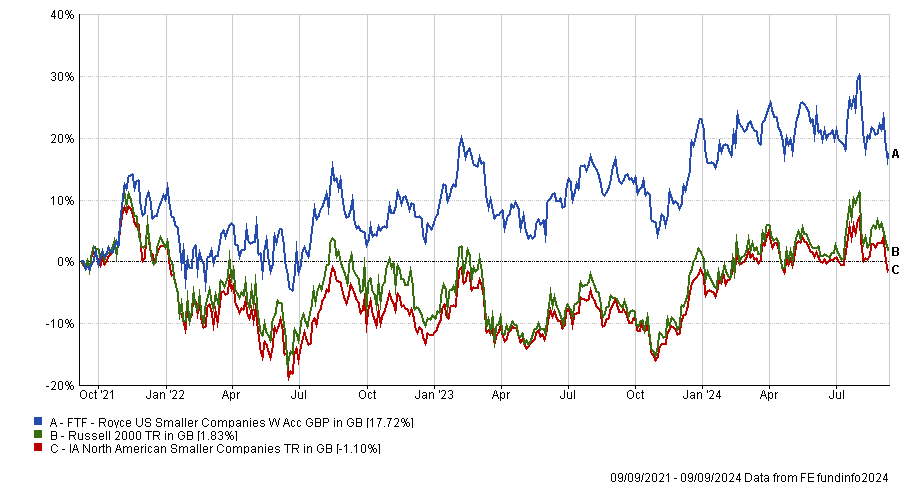

In the IA North American Smaller Companies sector, only one fund matched this criteria of bottom quartile over 10 years to top 25% over three; the £263.7m FTF Royce US Smaller Companies fund, headed up by Lauren Romeo.

Thanks to consistent first-quartile performances in each year between 2021 and 2023, the portfolio has not only been a top performer over three years, but it has also been one of the top performers over the past five years.

Performance of fund vs the sector and benchmark over 3yrs

Source: FE Analytics

Its record in 2022 is particularly notable because, despite making a loss of 3.72%, the fund was the second-best portfolio in the peer group, in a challenging year for smaller companies across the globe.

High global interest rates and geopolitical conflicts meant investors feared a US recession, and these concerns hit smaller company equity funds particularly hard.

With some funds in the wider North American Smaller Companies’ peer group falling in value by as much as 30% that year, the FTF Royce US Smaller Companies portfolio’s performance was among the best in the sector.

It was flanked by two years of strong gains in 2021 (up 26%) and 2023 (16.12%). However, 2024 has proven particularly challenging for the fund, as it fell to be one of the worst-performing portfolios in the sector, down 4.4% year-to-date.

Previously in this series, we have looked at the Europe Excluding UK, UK Smaller Companies, UK Equity Income, emerging markets, IA Global and Global Equity Income, and the UK All Companies sectors.