It is hard to be upbeat at present, with the US election upcoming, geopolitical tensions on the rise, war in different parts of the world and numerous concerns in markets around the world. Throw in inflation (which is still yet to come down to central banks’ forecasts) and it is easy to be downbeat.

But analysis by Robeco shows that investors and savers alike have a nice problem to solve. For the first time in a long time, everything is forecast to make money and beat inflation. This means portfolio construction comes down to how to get those returns and how much risk someone is willing to take. It’s a question of picking your poison, but for once it is not actually poison investors are taking.

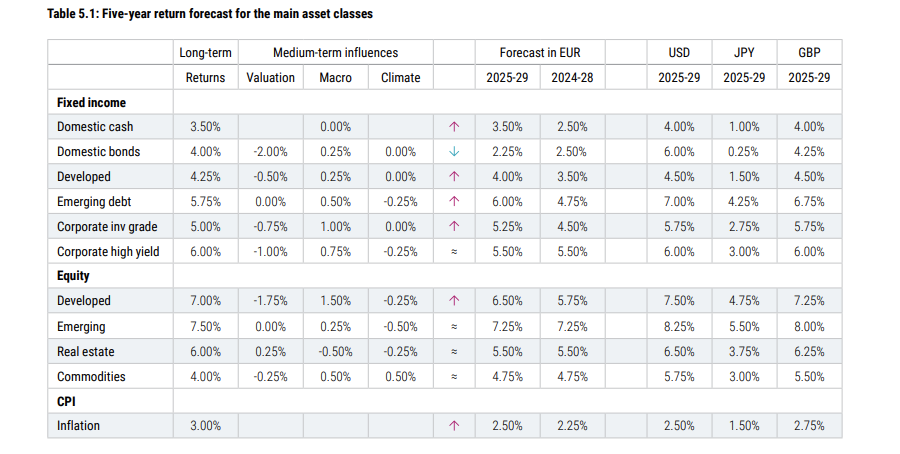

Let me explain. Please bear with me as the chart below is a little confusing, but I will do my best to simplify it. In the left-hand column are the long-term expected returns for different asset classes on average, each year. Next comes three factors that may impact those returns in the medium term.

Then, for UK investors, we can skip all the way to the right-hand side of the chart, where it shows the expected returns for the next five years of each asset class in sterling terms.

Source: Robeco

Okay, perhaps it wasn’t that complicated. However, the more important question is what investors can take away from the results.

The first thing to consider is the bottom row, which suggests UK inflation will hover around 2.75%, so all of the numbers above need to beat this to make a real return.

Luckily for savers and investors alike, all of the asset classes included here are expected to beat inflation, with emerging market equities forecast to be the best-performing asset class over the next five years – with 8% annual returns forecasted in sterling.

This comes at a time when few are likely to be loading up on emerging market stocks, which have perennially disappointed and recently suffered another major setback when the Chinese market tanked late last year.

Is that return worth the risk? The answer, of course, is it depends but, if these predictions are correct, investors may be able to just stick with developed market equities. Here, the return potential is 7.25%. This seems like a strong set of returns for investors, with much less risk than in emerging markets.

Over the past 10 years, the MSCI Emerging Markets index has a volatility of 14.3%, while the developed market index (MSCI World) is at 11.7%. Maximum drawdowns (the most an investor could have lost if buying and selling at the worst time) and the maximum loss (the biggest continuous drop) are also far shallower in developed markets.

Both are high when compared to cash or bonds but for 75 basis points of additional returns, is the extra risk of an emerging markets allocation justified?

Of course, there is also risk in developed markets at present, particularly for those invested in global and US trackers, with many highlighting concerns around the valuations of the ‘Magnificent Seven’, upon which these investors will be highly dependent.

So this begs the question…

Why invest in equities at all? Some investors may decide to eschew the stock market. After all, they can get 4% from cash over the next five years, according to Robeco, and it is fair to argue that there is a lot more than double the risk involved with buying something like emerging market stocks than keeping your savings in a bank account.

Or they could look to bonds. Here the asset class with the most risk attached (emerging market debt) is expected to make 6.75% per year, just 50 basis points behind developed equities.

Don’t be fooled though. These are also quite risky, as are corporate high-yield bonds, which are forecast to make around 6%.

Investment grade bonds might be the best risk-adjusted returns of the lot, paying out 5.75% per year – more than double inflation. This is also more than commodities and just behind property – suggesting that these alternatives may not have the appeal they once did.

I am not suggesting that investors sell out of everything and buy investment-grade bonds in their entirety (sorry to the fund managers that run these strategies).

But as the above table shows, that diversification is much easier to achieve at present than it has been in the past and investors now have a wealth of choices to make money.

In reality, investors may want a bit of all sorts to make up their portfolios. However they choose to do that, these predictions show that the next five years could be prosperous ones.