The ugly duckling is the perfect metaphor for contrarian investments – underappreciated and undervalued, different from the flock, but with the potential to turn into swans.

Joe Bauernfreund, chief investment officer of Asset Value Investors (AVI), said: “The ugly ducklings are the ones that get left behind that nobody cares about, nobody bothers about, but very often they're the ones where there is a much more compelling valuation argument.”

Below, managers outlined their favourite areas that are currently unloved, including Chinese equities, property and commodities.

China

Ruffer fund manager Duncan MacInnes believes China to be “probably the ugliest duckling of all” as “everyone's default reaction” is that China is “uninvestable” due to the geopolitical risk. But he finds that attitude “closed-minded”.

“I think there's no such thing as bad investments. There are just bad prices. And Chinese equities are pricing in a lot of bad news,” he said.

Investors and fund managers are concerned about tariffs imposed by the US, especially if Donald Trump wins the presidency, as well as the risk of a Taiwan invasion, so they have put China in the “too hard pile”.

“You can see how under-owned China is because it didn't sell off in that early August wobble. China was just flat and that's because there were no Western investors involved anymore to panic sell it,” he observed.

For fund managers, there is an element of career risk if China invades Taiwan, which would “basically be the start of World War III”. In this scenario, investors could lose 100% of their money, as those that invested in Russia found out following its invasion of Ukraine.

“Nobody wants to own any, in case that happens, because they'll have to tell their clients and it will, of course, seem like it was entirely foreseeable,” said MacInnes.

However, it is impossible to avoid exposure to China as it accounts for 20% of global GDP and impacts a wide range of companies from luxury conglomerate LVMH to tech stocks such as Nvidia and Tesla.

“So everyone is long China anyway, they're just long it at a much higher valuation via global growth companies than they are if they're long it via Chinese equities directly,” the Ruffer manager said.

He has direct exposure to the country via tech behemoth Alibaba and a Chinese equity ETF.

Family-controlled companies

Family-controlled companies often hold private assets that the market finds hard to value, such as Dow Jones, which is 100% owned by Rupert Murdoch's News Corp.

Bauernfreund said markets can be “quite inefficient in pricing” companies that require a lot of analysis and suggested that, in his view, Dow Jones can be compared with the New York Times, which is listed.

“It trades at 19x EBITDA [earnings before interest, taxes, depreciation, and amortization] and the implied valuation on Dow Jones is around 5x or 6x, so there's a very substantial discount there,” he said. “Yet we would argue that Dow Jones is a better business than the New York Times.”

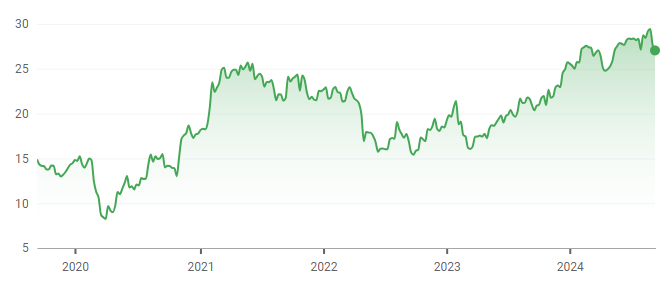

News Corp share price over 5yrs in dollars

Source: Google Finance

D’Ieteren Group is another under-appreciated, family-controlled company. Wilfrid Craigie, senior investment analyst at AVI, said the Belgian family made its money distributing Volkswagen cars but “the value really lies in a 50% stake they hold in Belron”, the vehicle glass repair and replacement business.

Windscreen repair is becoming much more technical with the move towards driverless cars that have cameras fitted to their windscreens and Belron is the market leader.

“Due to the increased complexity, we've seen margins go from about 5% in 2018 to over 20% today,” Craigie said. “Markets are really mispricing the inherent value in this unlisted business.”

D’Ieteren Group’s share price over 5yrs in euros

Source: Google Finance

UK commercial property

The Covid-induced transition to working from home and shopping online led to the demise of the office sector and the UK high street, and to the ousting of commercial property from many a portfolio, said David Lewis, lead investment manager on the Jupiter Merlin multi-manager team.

In particular, open-ended property funds have been under fire, promising investors daily dealing in an asset class that is tough to sell, which forced many to close when they could not raise enough cash to meet redemptions. As a result, “many [investors] rid themselves of their exposure when they could”, he said.

The Jupiter Merlin team introduced the Mayfair Capital Commercial Property fund to its Merlin Portfolios in 2014 and has stuck with this allocation.

“We were always aware of the danger of being in widely held open-ended funds, unprotected from the vagaries of performance-chasing investors, making the underlying fund managers forced buyers in the good times and forced sellers in the bad. We instead created our own fund managed by Swiss Life Asset Managers, formerly Mayfair Capital Investment Management,” Lewis explained.

“We see this well-selected suite of properties, with reliable tenants with baked in rental uplifts, and yields of around 5%, as an attractive opportunity.”

Commodities

From a strategic perspective, Ruffer believes investors should allocate to commodities alongside equities and bonds because commodities tend to perform well in inflationary environments and times of geopolitical disruption.

Yet because these are cyclical assets that wax and wane with the economy, MacInnes said investors need to be tactical. “Just because you think they're going to be good over a five to 10 year view, that doesn't mean they can't hurt you quite a lot in the in the interim,” he said.

“Commodities are now very ugly. Copper and oil are down 20% since April and May. That's the battle we're fighting here. You want to hold these for multiple years but you also want to sidestep the 20% drops if you can. You don't really want to own copper into a recession.”