Investors are “not good” at timing markets, but there is one area that is a “screaming buy”, according to James Calder, chief investment officer at City Asset Management.

He is coming off “the worst two years” of his career, after rising interest rates hammered his portfolio in 2022 and 2023, but is back on the upswing so far in 2024.

“Even during the global financial crisis, it was frightening but central banks did their best to prevent total collapse. They were your friends,” he said.

“In the past couple of years central banks did their best to stamp out inflation but that meant raising interest rates and skirting with recession, which hurt certain areas of the market.”

Yet, with the Bank of England and European Central Bank already embarking on their own interest rate-cutting cycles and the Federal Reserve likely to follow suit this week, things could be turning around for the better.

In particular this could help out unloved areas in the investment trust space that he described as “long-duration hard assets” such as infrastructure and renewable energy.

These trusts are “still on substantial discounts” but should provide investors with “reasonable upside and a decent yield” from here, Calder said. “These all just look incredibly cheap. There is latent value there. They are a screaming buy at this point.”

However, he noted that investors who wish to take advantage should “have a seven-year time horizon” at least, as they will “never call the top or the bottom”.

The selections below offer investors “reasonable upside and a decent yield” based on their current prices.

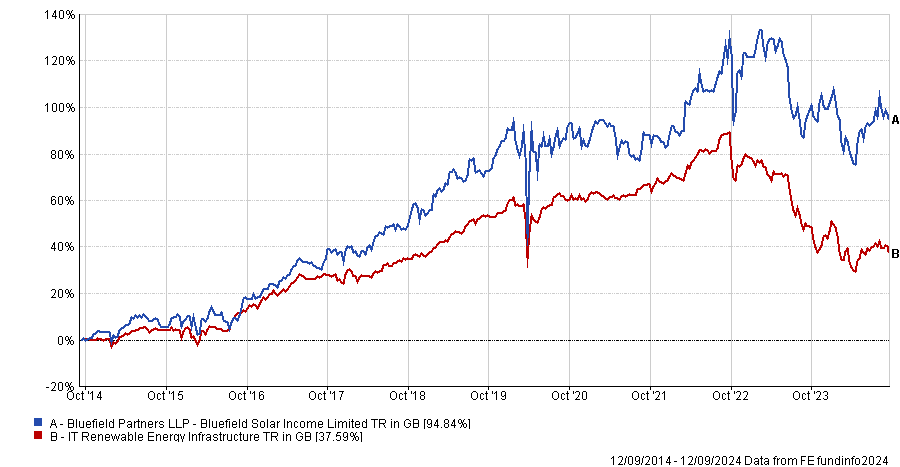

His first choice is in the environmental space, where he likes Bluefield Solar Income. The trust has a market capitalisation of £626m and has been the second-best performer in the 21-strong IT Renewable Energy sector over the past decade. There are only six trusts with a track record that spans that far, however.

It is also second versus 11 peers over five years and is fourth out of 19 in the sector over three years – all top-quartile efforts. It currently yields 8.5% and is on a discount of around 18.6%.

“It doesn’t have a lot of debt and the dividend is covered. Yield is going to provide a big chunk of your returns but the discount should come in as interest rates come down,” said Calder.

Performance of trust vs sector over 10yrs

Source: FE Analytics

Another option could be The Renewables Infrastructure Group, he added. The £2.6bn trust is on a 22.7% discount and yields 7%. It has had a strong year, making 4.4% at a time when the IT Renewable Infrastructure peer group has averaged a 7.5% loss, and has consistently been an above-average performer in the sector over three, five and 10 years.

The trust has had an active period, according to Andrew Rees, an associate at Deutsche Numis, who said following the investment company’s interim results last month, it has “made strong progress” on disposing assets with almost £190m of sales at an average 10% premium to book value. It also announced a £50m share buyback programme.

“This remains an attractive entry point for a portfolio that is diversified by both geography and technology managed by an experienced team,” he said.

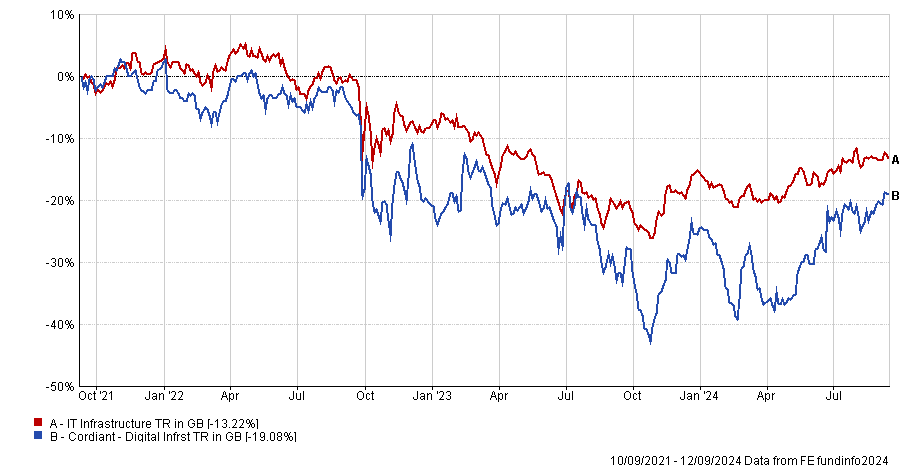

It was one of three infrastructure trusts Calder recommended. Another was Cordiant Digital Infrastructure, a selection he said “might raise some eyebrows”.

The trust invests in mobile towers, data centres and network cables – all things required in the new artificial intelligence (AI) and technology era, but Cordiant Digital Infrastructure has struggled despite this.

It has been the worst performer in the IT Infrastructure sector over three years and second-worst over 12 months, beating only the Digital 9 Infrastructure trust.

These are the only two trusts of their kind in the sector, with the majority of their peers investing in more traditional infrastructure projects, and Calder said Cordiant had been “dragged down” by its main rival.

Performance of trust vs sector over 3yrs

Source: FE Analytics

“It has been tarred with the same brush as the other one in the sector,” he said, despite having much stronger potential for both net-asset value (NAV) and share price gains.

“The trust’s manager is buying shares which is always a very good sign. He has the courage of his own convictions, which gives us confidence,” said Calder.

The third infrastructure pick was HICL Infrastructure, which has been a middling performer in the IT Infrastructure sector over one, three, five and 10 years, failing to beat the average return in the sector over any time period. However, the fund has a market capitalisation of £2.6bn and its size was a draw for the fund selector.

In its interim update in July, the trust was in line with expectations, according to Rees, and provided an update on the regulator Ofwat’s dealings with portfolio holding Affinity Water. It is the largest position in the trust and is in negotiations over its business plan. Rees noted that a positive outcome should allow Affinity Water to make payouts to its investors by December, which “should continue to improve HICL's dividend cover from 1.05x”.