The three-day working week. Bags of rubbish piled high in Leicester Square. Gravediggers refusing to bury the dead. If you believe certain elements of the right-wing press, the new government’s immediate capitulation on public-sector pay rises risks taking us back to the 1970s, when trade unions had the power to make such dystopian scenes a reality.

However, if anyone wants to see what sort of impact the recent pay rises handed out to train drivers, nurses and junior doctors has had in the past, we would point them to a decade that was not only more recent, but a lot less dramatic – the 2000s.

Get used to it

Let’s take the recent 14.9% pay rise handed to train drivers, spread out over three years when cumulative inflation is expected to be about 11%.

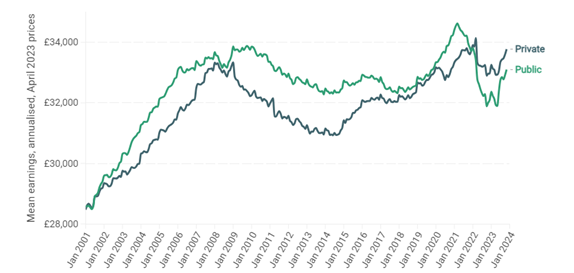

After more than a decade of austerity, and the past few years when the previous government was trying to keep a lid on inflation, this seems generous. But when you compare it to the period between 2001 and 2010, the difference is imperceptible: during this period, inflation rose at an average pace of 2.2% a year but public sector workers saw wage increases – in real terms – of about 2% a year. Pay rises in the private sector weren’t too far behind.

Real average (mean) annual earnings per employee in the public and private sectors, 2001-2023

Source: Office for National Statistics

I am not here to offer political opinions or discuss the rights and wrongs of government policy. I am far more interested in what happens next. With public-sector wages still below 2010 levels in real terms and the Labour party in power, we believe further above-inflation increases are likely in the years ahead.

This sends a powerful signal to employees in the private sector – and most companies we meet with are discussing pay rises of about 3% to 5% next year.

Pricing power

So what does this mean for investors? In such an environment, it is important to invest in companies that have the pricing power to cover off this future cost pressure.

This is one of the reasons why we tend to like market leaders in specialist niches – in our experience, these tend to be better able to push through price increases than smaller competitors.

But it is important not to overpay for such businesses.

Another impact of cost-push inflation is that it has made a return to the era of ultra-low interest rates unlikely. It would therefore be dangerous to bet that growth stocks will recover the (exceptionally high) ratings achieved in the latter years of quantitative easing.

The extent of value’s outperformance

Over much of the past 10 to 15 years, it has often felt that valuation – what you pay for a share – has not mattered. Lessons from the previous 50 years would suggest the exact opposite. Small-cap investing is often associated with growth investing but it is actually value that wins, and handsomely, over the long run – since the 1950s, it comes out at 3.7% per annum outperformance.

This doesn’t mean the companies we favour aren’t growing. It’s just they are doing so at a rate of about 9% – not enough to get traditional growth investors excited. This is reflected in the valuation you can buy them at: an average of 12.5x earnings or an 8% free cashflow yield.

We suggest investors also refuse to compromise on balance sheet strength – our median holding is forecast to have almost no net debt by 2025. This is important in an environment where the cost of borrowing, although beginning to fall, is likely to remain high.

Strong balance sheets give companies time and the optionality to invest in their future. This is why we argue it is better to invest in boring businesses that have demonstrated the ability to stand resolute in a crisis than in the racy start-ups tipped to disrupt them. These more exciting stocks often disappoint – and fail to turn a profit in the interim.

No return to the ’70s

The era of trade union dominance in the UK was brought to an end by the Conservative government of Margaret Thatcher, who was once misquoted as saying: “The problem with socialism is that you eventually run out of other people's money.”

By refusing to base your strategy on the anomalous era of 2010 to 2020, we think you lower the risk of owning businesses contending with a similar fate.

William Tamworth is co-manager of the Artemis UK Smaller Companies fund. The views expressed above should not be taken as investment advice.