With the Federal Reserve widely expected to make its first interest rate cut in the current cycle this week, research by J. Safra Sarasin has highlighted the assets that performed best in past cutting cycles.

Wolf von Rotberg, an equity strategist at J. Safra Sarasin Sustainable Asset Management, found that rate cuts have historically produced widely varying results across asset classes and sectors, depending on whether the economy heads into a recession or avoids one.

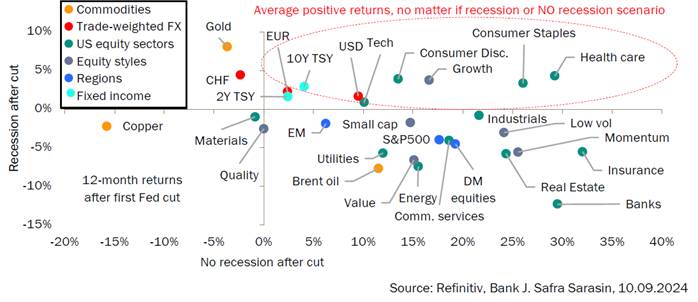

“Unsurprisingly, in cases when the first rate cut was followed by a recession, performance looks very different compared to cycles when no recession occurred,” von Rotberg said. “US equities dropped on average by 4% in the 12 months after the first cut if a recession hit, but rose by 18% if no recession occurred.”

This means that on a broad asset allocation level, the macro scenario following the first cut becomes more important than the cut itself.

In a recession following a rate cut, fixed-income assets such as US Treasuries tend to outperform equities. Von Rotberg pointed out that “in a recession scenario, Treasuries always outperformed equities, no matter if the investment horizon is three, six or 12 months after the cut”.

This makes government bonds an appealing option for investors looking to protect their portfolios in case of a downturn. On the other hand, if the economy avoids a recession, equities typically outperform bonds by a wide margin.

“If no recession occurs, equities typically outperform Treasuries by a remarkable 15% over the following 12 months," von Rotberg adds, highlighting the potential upside for risk assets in a more favourable macroeconomic environment.

One of the most consistent performers across all cutting cycles has been growth stocks (including tech stocks), which typically add 9% over the 12 months following the first Fed rate cut. They have made positive returns in both recessionary and non-recessionary environments.

The assets that made positive returns, on average, in both recession and non-recession periods after a rate cut can be seen in the top right quadrant of the chart below.

Top right shows assets which performed in recession and no recession episodes

Defensive sectors like healthcare and consumer staples, along with safe-haven assets such as US Treasuries, are likely to continue delivering steady returns regardless of the macro outlook.

“Healthcare has not only gained 14% following the first cut, on average, but has also seen average positive 12-month returns if a recession hit,” von Rotberg said.

Consumer staples, another defensive sector, also produced steady returns across both recessionary and non-recessionary periods, making these stocks an attractive choice for cautious investors.

Consumer discretionary stocks, while typically cyclical, have fared relatively well across most cutting cycles, except for the 2007–2008 financial crisis. “Consumer discretionary returned 8% on average across all cycles and even delivered average positive returns if a recession followed the cut,” the strategist said.

Additionally, certain safe-haven assets, such as US Treasuries and the US dollar, have demonstrated resilience across various economic conditions.

In contrast, some assets have struggled regardless of whether the economy entered a recession. Commodities, particularly copper, have been consistent underperformers in both recessionary and non-recessionary environments.

This underperformance is tied to copper’s close correlation with industrial production and global growth, both of which tend to weaken after rate cuts as the economy adjusts to shifting monetary conditions.

Energy and materials stocks also tend to struggle when the Fed begins cutting rates, especially in the event of a recession. “Materials and energy followed their key drivers, namely the copper price and oil,” von Rotberg explained. “Copper prices in particular appear to be a lost cause after the Fed starts cutting rates.”

The analysis, which spans six Fed rate-cutting cycles dating back to 1982, reveals that only two of these cycles were not followed by a recession – those beginning in 1984 and 1995. The other cycles (those in 1989, 2001, 2007 and 2019) were followed by recessions, making these periods particularly difficult for cyclical sectors like banks and energy.

“Banks stand out as they have by far been the weakest sector during periods in which the first cut was followed by a recession, dropping by 12% on average,” von Rotberg noted.

On the other hand, banks have performed well in environments where no recession followed, rising an average of 30% over 12 months. This cyclical sensitivity makes banks a high-risk sector when recession fears rise.

Gold, another safe-haven asset, performs particularly well in recessionary periods. “Gold acts as a safe-haven during recessions, but tends to lag when the economy strengthens,” von Rotberg said.

Investors should, therefore, focus on positioning their portfolios based on where they believe the broader economy is headed rather than reacting to the rate cut itself.

“A cut itself says little about the performance afterwards,” von Rotberg finished.

“Yet importantly, there are asset classes and sectors which have produced more consistent returns than others. Healthcare, staples, Treasuries, as well as growth stocks and the US dollar stand out as they have fairly consistently gained in the 12 months after the Fed first started to cut rates.”