Every regional equity market has its quirks and the way to outperform is far from uniform. In the UK, funds excelled by outpacing rising markets whereas in the US, the best track records were obtained by preserving capital during downturns, research by Trustnet suggests.

In Europe ex-UK and Japan, several managers were able to beat their benchmarks in both rising and falling markets, achieving the best of both worlds to stay ahead of the pack.

To find the best funds in every region, Trustnet looked at their upside and downside capture ratios for the three years to 31 August 2024 against a commonly-used benchmark. We also measured funds’ overall capture ratios (upside capture divided by downside) – a measure used to level the playing field between aggressive and cautious investment styles. An overall capture ratio higher than one indicates that the fund outperformed.

Playing defence in the US

The S&P 500 has been one of the hardest indices to beat of late, with three-year returns of 35.1% in sterling terms proving a tough hurdle for the majority of funds in the IA North America sector.

The benchmark’s top 10 performers by weight (including Apple, Microsoft, Nvidia, Amazon, Meta Platforms, Alphabet, Berkshire Hathaway, Eli Lilly and Broadcom) have excelled, so one way to beat the bogie during bull market periods would have been to go overweight these stocks.

Active managers, however, are often reluctant to pile into their benchmark’s largest positions, lest they be accused of acting like closet trackers. Instead, US equity specialists found a different way to outperform – by falling less than the benchmark when it dipped, smoothing the ride for their investors.

Quilter Investors US Equity Income and BNY Mellon US Equity Income in particular stand out for their low downside capture ratios of 8% and 29.6%, respectively. Even though equity income strategies are usually more defensive in nature – tending to own large companies with the cash flows and strong balance sheets that enable them to pay dividends – these downside capture ratios are extremely low in comparison to other funds.

In every region apart from North America, the funds with the best overall capture ratios outperformed most if not all of their peers. But in the US the two lists diverged, as the tables below reveal, and the same held true for global equity funds.

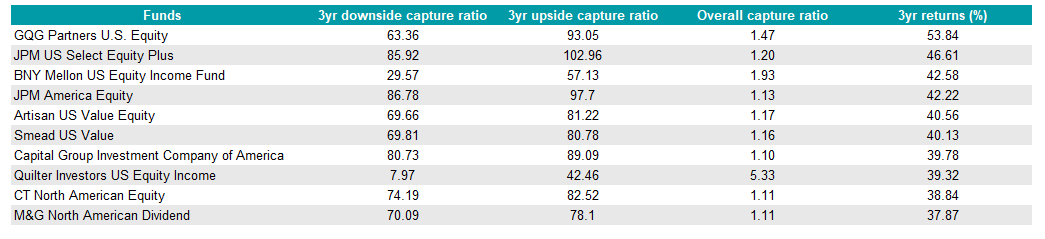

Best performing actively managed US equity funds over 3yrs

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the S&P 500

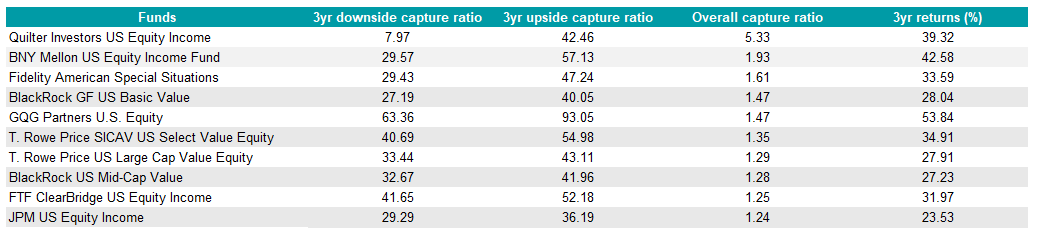

Funds with the best overall capture ratios in the IA North America sector

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the S&P 500

Global managers mirror US funds

Managers of global equity funds might logically be expected to mirror the behaviour of active US equity managers given that US stocks comprise the majority of global benchmarks, and that is exactly what they did over the past three years.

Funds with the best overall capture ratios got there largely by having low downside capture ratios, preserving capital in falling markets.

As in the US, the funds that delivered the best returns in the past three years did not all have sector-leading overall capture ratios (unlike in all the other regions where the lists converge).

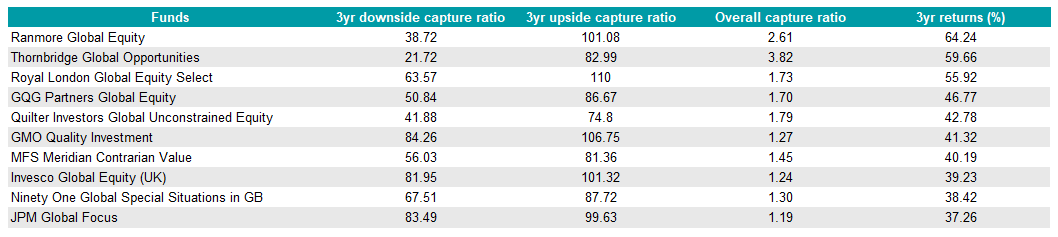

Best performing global equity funds over 3yrs

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the MSCI World index

Schroder ISF Global Energy returned a sector-leading 94.8% over three years but was left out of the above table because its focus on the energy sector means it isn't directly comparable to the other funds. Passive and enhanced index funds were also excluded from this research.

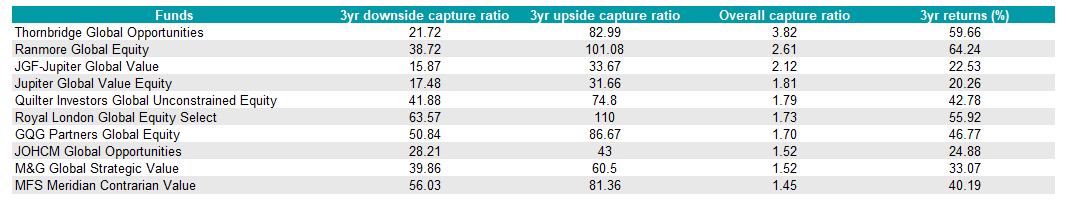

Funds with the best overall capture ratios in the IA Global sector

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the MSCI World index

Going gangbusters in the UK

The UK stock market is in many ways the opposite of the US. It has a higher weighting to financial services, energy and healthcare but far less exposure to the high-growth technology sector.

Returns have been lower as a result, so active managers tried to eke out what gains they could and the best of them raced ahead of their benchmark.

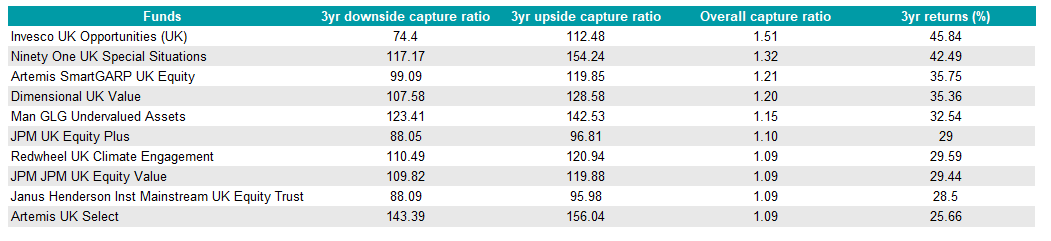

The UK stands out as the region in which managers had the highest upside capture ratios. All but one of the 10 best performing funds and all but two of the 10 funds with the best overall capture ratios (for the three years ending 31 August 2024) outperformed the FTSE All Share in rising markets.

Even the two outliers – JPM UK Equity Plus and Janus Henderson Institutional Mainstream UK Equity Trust – captured more than 95% of the index’s upside in rising markets.

On the flipside, most of these funds fell in lockstep with or further than the index when it tumbled. The only exceptions were Invesco UK Opportunities and the aforementioned JPM UK Equity Plus and Janus Henderson Institutional Mainstream UK Equity Trust, which afforded their investors an element of downside protection.

Funds with the best overall capture ratios in the IA UK All Companies sector

Source: FE Analytics, data to 31 Aug 2024; capture ratios are versus the FTSE All Share

Jupiter UK Special Situations and JOHCM UK Dynamic also deserve a mention for being amongst their sector’s top 10 performers over three years, whilst their overall capture ratios placed then 12th and 13th, respectively, among their peers.

Asia Pacific and emerging markets field a mixed team

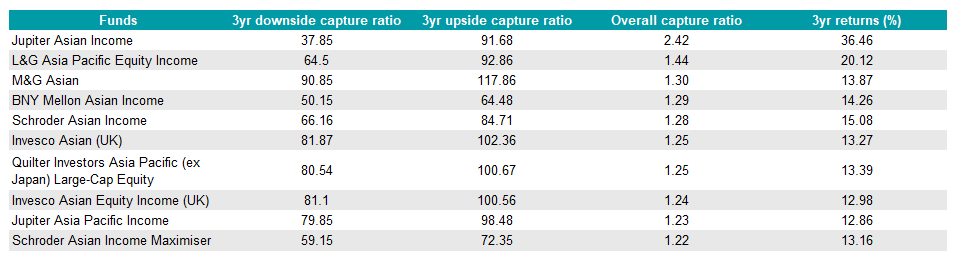

The top performers in the IA Asia Pacific and IA Global Emerging Markets sectors were a mix of cautious and aggressive strategies. Yet for several funds, the emphasis was on downside protection in these sometimes-volatile regions, where drawdowns can be large.

Jupiter Asian Income led the Asia Pacific peer group, achieving a return of 36.5% for the three years to 31 August 2024 in sterling terms, and did so with a low downside capture ratio of 37.9. Next in line was L&G Asia Pacific Equity Income, another defensive player with a 64.5 downside capture ratio. Both funds participated in more than 90% of the index’s gains when it rose.

In third and fourth place were two more defensive equity income strategies, as the table below shows: Schroder Asian Income and BNY Mellon Asian Income.

They were followed by a range of funds who beat their peers by outpacing the benchmark in rising markets.

Funds with the best overall capture ratios in the IA Asia Pacific Sector

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the FTSE Asia Pacific ex Japan index

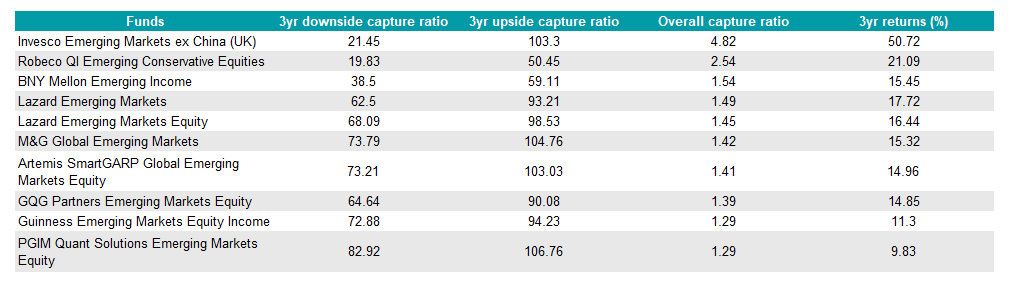

The emerging markets funds with the best overall capture ratios and highest three-year returns achieved this with very low downside capture ratios of 21.5 for Invesco Emerging Markets ex China and 19.8 for Robeco QI Emerging Conservative Equities, although the former evaded much of the sector's pains by excluding China.

Funds with the best overall capture ratios in the IA Global Emerging Markets sector

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the MSCI Emerging Markets index

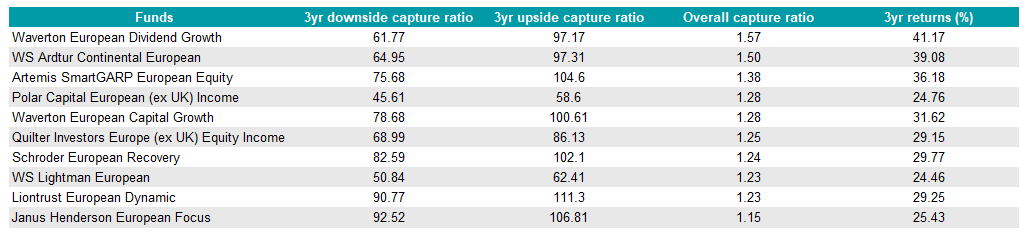

Best of both worlds in Europe and Japan

The story in Europe was arguably what investors might expect from the best active managers: most of the funds delivering the highest returns managed to outperform in falling markets and capture most of the upside during good times.

Funds with the best overall capture ratios in the IA Europe Excluding UK sector

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the MSCI Europe ex UK index

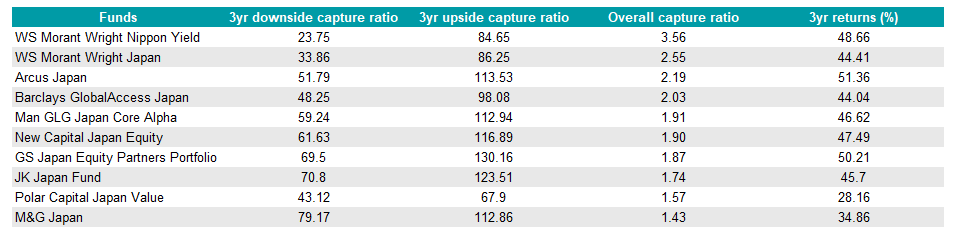

In Japan, the sector's top funds did an even better job of avoiding pitfalls and capitalising upon gains. Two Morant Wright funds led the pack by protecting on the downside, even though they lagged the TOPIX when it rose. Other funds such as Arcus Japan and GS Japan Equity Partners Portfolio stormed ahead of the benchmark in rising markets but still managed to preserve capital during downturns.

Funds with the best overall capture ratios in the IA Japan sector

Source: FE Analytics, data to 31 Aug 2024, in sterling terms; capture ratios are versus the TOPIX