The traditional approach to investing in the 10 years or so before retirement – encapsulated by lifestyle pension funds – is to shift from equities into bonds and cash to de-risk. That may still be appropriate for those who want to buy an annuity or take a cash lump sum, but many people would prefer to keep growing their pension pots, according to RBC Brewin Dolphin.

Therefore, it makes sense to have a high equity allocation during your 60s and 70s to grow capital, beat inflation and fund later-life spending, said senior investment manager Rob Burgeman.

“When you get to 60, you’re far too young to take no risk because actuarially you’re going to live longer,” he observed.

Below, Burgeman suggests a pension portfolio for someone in their 60s.

Asset allocation

In the years leading up to retirement, he recommends taking the equity allocation down from 90-100% to 70-75% over a couple of years.

Retirement is not the cliff-edge it once was, given that many people opt for a phased retirement – leaving full-time work earlier, perhaps, but continuing to work part-time during their 60s.

They may need to draw down from their pension fund to supplement their income until the state pension kicks in at the age of 67, which might necessitate a move into fixed income during one’s early 60s to boost yield.

But once people can use their state pension to meet many of their everyday spending needs, they may rely less on income from their personal pension savings and decide to switch back into equities for long-term growth.

The appropriate pension strategy for someone in their 60s will also hinge upon whether they intend to take 25% of the pot as a tax-free lump sum. De-risking ahead of this “crystallisation event” would make sense because otherwise, if equity markets fall sharply and decimate the pension pot’s value in a short time, that 25% will suddenly be worth a lot less.

“Pulling up at the edge of the cliff with the wheels smoking isn’t really a great basis for an investment strategy. You don’t want to find that Russian tanks have rolled into Ukraine or that Covid has struck the week before you’re about to take your tax-free cash,” he noted.

After someone retires, their capacity for loss will be diminished, so “you do need to turn the gas down a bit”. Burgeman suggested allocating 60-75% to equities and the remainder to bonds and alternatives. Equities “do the heavy lifting” and allow the pot to at least keep pace with inflation, he explained.

Historically, a balanced portfolio has grown by 4% a year in real terms, meaning that the beneficiary could take an income worth 4% a year and leave enough in the pot for the capital to continue growing.

Burgeman proposed holding one or two years’ worth of spending requirements in cash so if a financial crisis occurs, the person can stop drawing down from their pension to allow their investments time to recover.

Equity funds

RBC Brewin Dolphin uses a mix of passive and active strategies in clients’ portfolios. “Active costs more so I think you have a right to expect some excess performance,” he said.

In the US, it is hard for active equity managers to beat the S&P 500 index so a cheap tracker could be a better option. Some enhanced index strategies such as JPMorgan US Research Enhanced Index Equity have added value over time with minimal benchmark drift, he said.

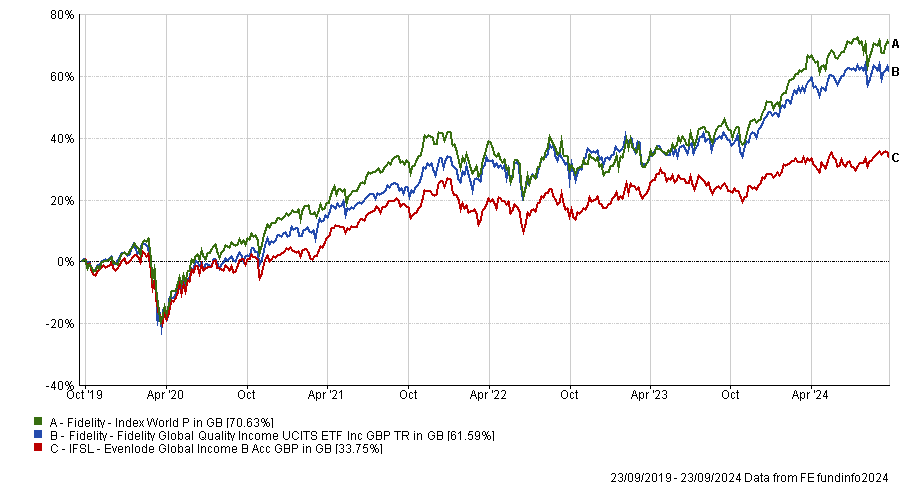

A global tracker such as Fidelity Index World is “not rocket science but it will do a job for you without costing an arm and a leg”.

For lower volatility and an income tilt, Fidelity International’s Quality Income series of exchange-traded funds are closely aligned to global indices but have more muted peaks and troughs.

He also suggested pairing a tracker with a fund such as Evenlode Global Income to boost yield. It has struggled in relative terms during the past 12-18 months because global indices have been propelled upwards by their large weightings to tech stocks, which are not Evenlode’s hunting ground (apart from Microsoft, which is one of its top 10 holdings). Evenlode also owns Unilever, L’Oreal and Procter & Gamble; “it’s a nice list of blue chip names”, Burgeman said.

Performance of funds over 5yrs

Source: FE Analytics

Bonds

With yields at their current elevated levels, Burgeman thinks bonds will return to their traditional role of providing “ballast” to portfolios.

Investing in individual gilts directly has its merits because investors can achieve a fixed return between now and whatever year they choose.

For a strategic bond fund that can allocate across government, inflation-linked and corporate bonds, he chose Robeco Global Credits, which only holds investment-grade bonds. The majority of the fund’s assets are corporate bonds, which have a higher return than government bonds.

Another option is Jupiter Strategic Bond, with the experienced Ariel Bezalel, an FE fundinfo Alpha Manager, at the helm.

Alternative investments, commodities and diversifiers

Burgeman suggested a 3-5% allocation to gold as an insurance policy.

“Gold’s not going to give you an income in retirement and last time I checked, they don’t take it down at Tesco’s, but it does have a role to play in portfolios because when the really nasty stuff happens, gold tends to do rather well. It did very well over Covid [and] over the Ukraine period when everything else didn’t,” he said.

Multi-asset strategies can also provide diversification against equities and bonds.

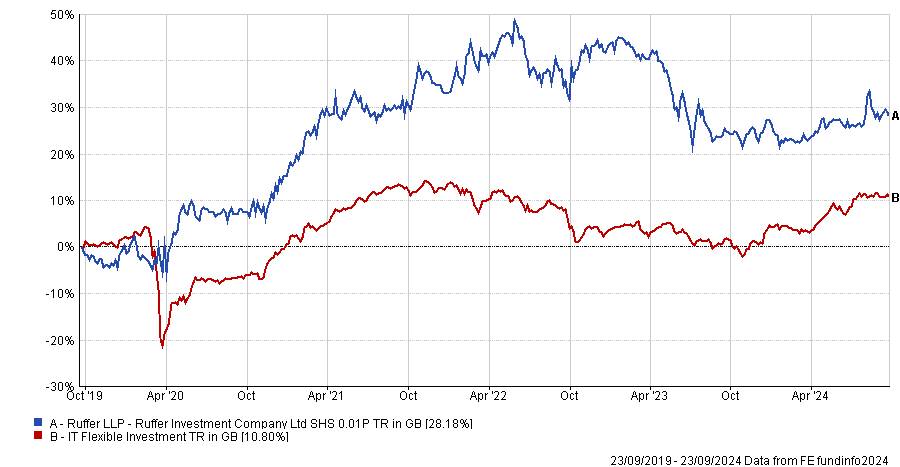

“Do you go for disaster insurance with someone like Ruffer? The trouble with Ruffer is, you do give up quite a lot in terms of upside potential, but it’s certainly one which has a role to play in preserving value and perhaps that’s what’s important in this field.”

Performance of trust vs sector over 5yrs

Source: FE Analytics

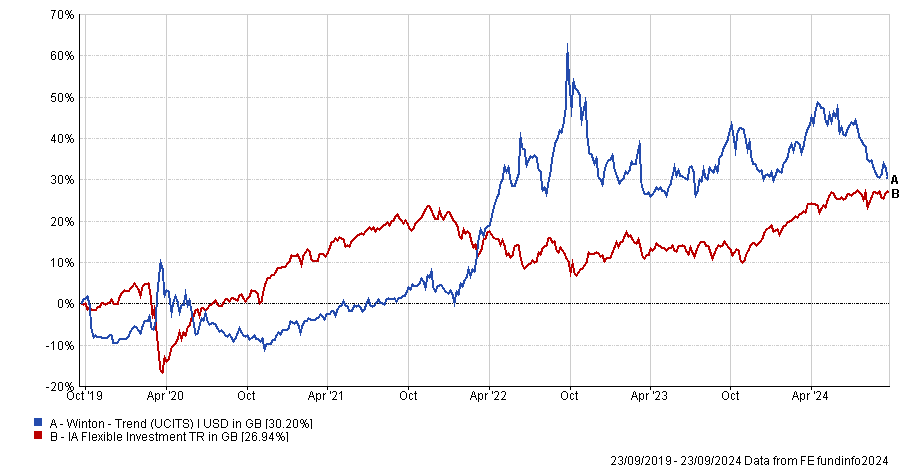

Another suggestion is Winton Trend, an algorithmic trading strategy following medium-term price trends across commodities, currencies, equity indices and fixed income. It delivers “steady, cautious growth”, although it can get caught out by a sudden shift in sentiment and can follow markets downwards, he warned.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Property funds such as Schroder Global Cities Real Estate can deliver a decent yield with inflation protection, he added.