Janus Henderson Investors’ Jonathan Coleman has been appointed to run the £183m Omnis US Smaller Companies fund from November onwards.

The manager, who is part of the US small- and mid-cap growth team at Janus Henderson, will replace T. Rowe Price’s Curt Organt and Matt Mahon, who have run the fund since 2019 and 2023, respectively.

The move follows “a change in personnel at T. Rowe Price”, which triggered “a strategic review of the incumbent manager”, Omnis Investments announced.

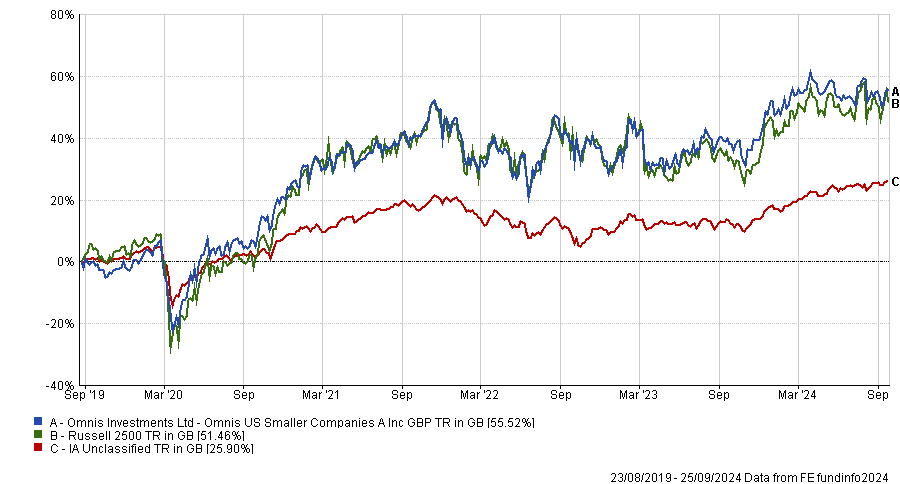

During Organt’s tenure, the fund has beaten its benchmark, the Russell 2500, by four percentage points, as shown in the chart below.

Performance of fund against sector and index since August 2019

Source: FE Analytics

Coleman, who has more than three decades of investment experience, said his team has a “strong track record in identifying high-quality, smaller US companies with strong growth potential”.

Omnis reassured investors that there will be no alternations to the fund’s strategy, investment objectives or philosophy. It will continue to focus on US early-stage companies with competitive advantages, a high return on capital and robust cash flow generation. The new team will “carefully consider” the price paid for stocks, relative to intrinsic value, Omnis stated.

Andrew Summers, Omnis’ chief investment officer, said he was “impressed” with the new team’s “disciplined investment process, which combines a focus on fundamental research with a strong emphasis on valuations”.