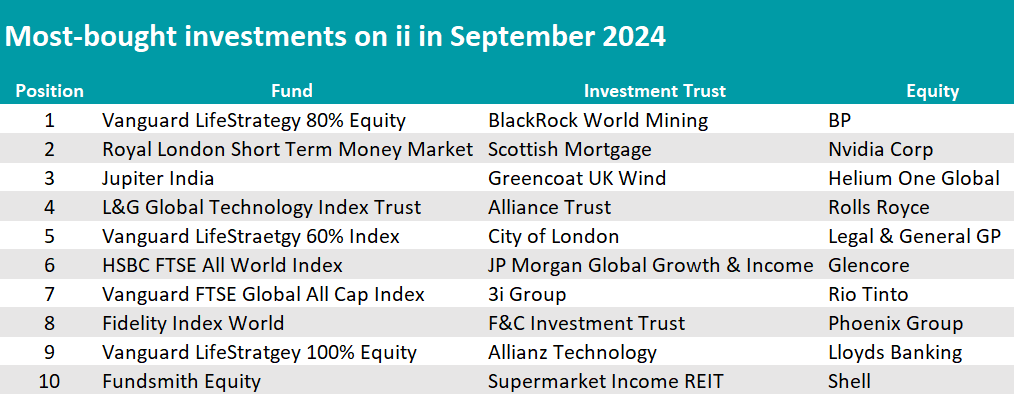

Scottish Mortgage has dropped from its podium as interactive investor (ii)’s most-bought trust this September, a place it held for an entire year. In its stead, BlackRock World Mining, which invests in mining and metal companies globally, climbed the ranks gaining eight positions since August.

This was the result of a diminished enthusiasm in technology and renewed interest for commodities, according to ii’s Kyle Caldwell.

The trend was also evident with the Allianz Technology trust losing one position and Polar Capital Technology exiting the top 10 entirely.

There were also signs in the open-ended space. Here, the L&G Global Technology index, once the most-bought fund, moved down to fourth place in favour of Vanguard LifeStrategy 80% Equity.

“Whenever there’s a strong short-term period for a sector or theme [such as technology], it’s prudent to reexamine whether your overall exposure needs trimming back to keep a lid on risk,” he said.

Another notable mover, Fundsmith Equity made a comeback after taking a break from the spotlight last month, when it slipped off the list for the first time since tracking began in 2018.

Source: interactive investor

Within the equities ranking, technology was ousted, with Amazon exiting, while oil took centre stage. BP became the new most-bought stock among ii clients and Shell also joined the cast, after both fell more than 9% over the month on the back of a weaker oil price, as ii’s head of markets Richard Hunter noted.

The “generous” dividend yields of 5.7% and 4.2% respectively were the cherry on top of the cake and were enough to lure investors back in.

Other “perennial” income-generating stocks were on the list, including financial wealth providers and insurers Phoenix Group and Legal & General, which were joined by Lloyds Banking and Rio Tinto. More usual suspects included Rolls Royce and Nvidia, whose popularity continued in September after some scathing in the previous month.

“Having suffered something of a summer lull, Nvidia shares have more recently returned to market darling status and continue to feature highly in the ii most bought list. The shares added a further 12% in the month taking the year-to-date gain to a stellar 152%,” said Hunter.

“Rolls-Royce remains well regarded by investors with the share price adding another 14% in the month to now register a gain of 78% so far this year.”