The UK continues to be a happy hunting ground for mergers and acquisitions, with a record 19 deals on the table for companies in the FTSE 350, according to data from Peel Hunt.

Charles Hall, head of research at the firm, said low valuations and willing sellers are two of the main reasons why UK companies are being bought up in their droves.

Bids worth £47bn are live, but this figure rockets to £97bn when factoring in bids announced last year and completing this year, as well as de-listings.

Of the 40 transactions announced year to date, 19 were for companies in the FTSE 350, five in the FTSE SmallCap and 14 on AIM.

Comparatively, there were 39 transactions announced in the entirety of last year, with just two from the FTSE 350, 14 in the FTSE SmallCap and 19 on AIM.

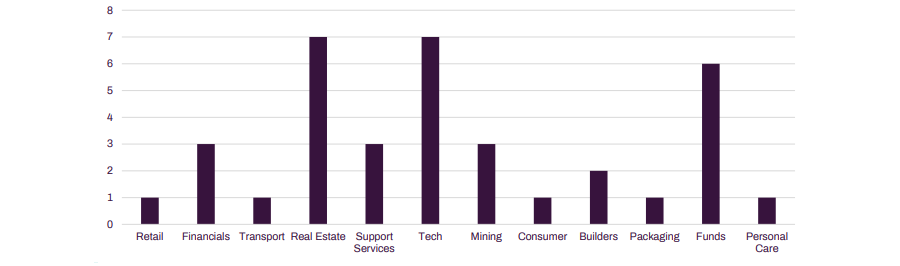

In terms of sectors, the biggest areas to be affected are tech (£10bn) and real estate (£4.5bn), as the below chart shows.

Bid activity by sector

Source: Peel Hunt

Companies representing 10% of the total value of the FTSE 250 are potentially leaving the market in the span of just nine months, including the UK’s largest fund supermarket Hargreaves Lansdown, which is included in the study as it wasn't promoted to the FTSE 100 until after its bid.

However, the effects could be even more directly felt in the FTSE SmallCap space, where stocks will be promoted to the FTSE 250 to replace their larger peers being bought up.

There was a drop in activity during the third quarter of the year, which Hall suggested was due to the normal summer lull, but he said more deals are likely in the latter half of this year.

“Given the improving economic environment and a more accommodating lending market, it feels highly likely that the elevated rate of M&A will continue,” he said.

Earlier this year Hall called on the Labour government to get to grips with rampant M&A activity, warning that the UK market will continue to shrink if nothing is done.

This time around he noted it was of particular importance for smaller companies. Typically this is solved by initial public offerings (IPOs) and although this area is “starting to emerge from hibernation”, there remain “structural issues in the UK that need to be addressed to retain a healthy UK equity market”.

“We believe we need to address the demand side, if the UK is to retain its growth companies and to ensure that the equity market is able to provide long-term growth capital. In our view this can be delivered through pension reform, ISA reform and a national wealth fund,” he said.

However, it is not all bad news. Investors in bid-for stocks have profited mightily. The average premium of these offers is 40%, with some materially higher. The report highlighted Wincanton (104% above the share price on the day of the bid), Spirent (86%), International Distributions Services (73%) and Keywords Studios (69%).

Most of the money is coming from corporate buyers (68% of the bids have come from rival firms) as the rate environment and economic outlook have become clearer, said Hall.

“It has been particularly noticeable that corporates have been the main acquirers. This suggests greater confidence in the economic outlook and the interest rate environment. It also shows the attractiveness of UK companies and the potential for synergies in a low-growth environment,” he said.

By contrast, it has been “surprising” to see relatively low activity from private equity, where an estimated $4trn remains on the sidelines.

“We expect this to change as financing conditions improve, which means that private equity is likely to be a more active acquirer going forwards,” said Hall.