Buying things when they are at the top is rarely a good strategy when it comes to investing, but experts believe there is an exception to this rule at present.

UK gold investors have made a 21% return so far this year, as the price of the safe-haven asset reached new highs last week, peaking above £1,990 per ounce on Wednesday, the 25th new record in 2024 to date.

The increase was driven by multiple factors, including speculative trading, sterling depreciation and supply-and-demand dynamics, which experts believe might continue to support prices into 2025.

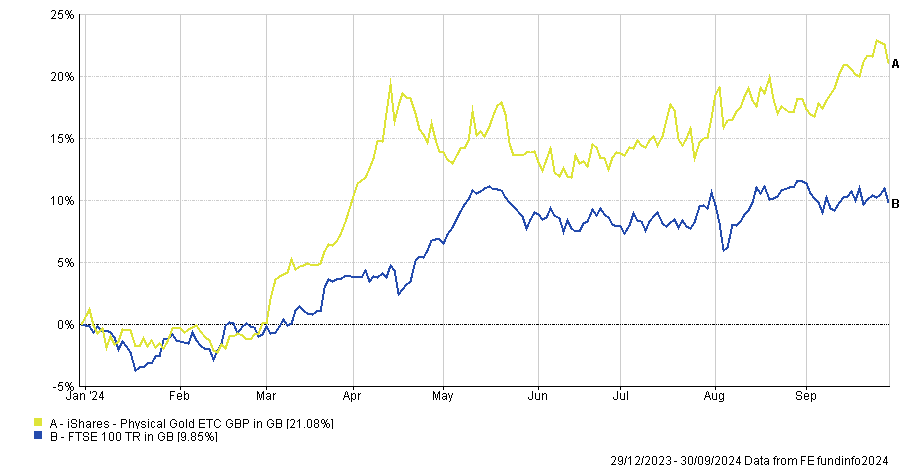

Performance of FTSE 100 index and gold in 2024

Source: FE Analytics

BullionVault director of research Adrian Ash noted how 2024's run of record gold price record highs marks the highest total since 2011 when riots in England coincided with the downgrading of US government debt and the peak of the Eurozone debt crisis.

It also matches the full-year total of 2008, when the global credit crunch became an all-out financial crisis with the collapse of Lehman Brothers.

This year, in contrast, Western stock markets also set new all-time highs, despite the wars in the Middle East and Ukraine.

"The latest gold bull market contrasts with the precious metal's jumps during both the Covid pandemic and financial crisis because Western investors haven't joined in to date,” Ash said. "The latest run was driven by speculative trading in futures and options contracts rather than by demand for physical bullion.”

For Rebekah McMillan, associate portfolio manager on the multi-asset team at Neuberger Berman, it is clear that gold prices are only going to head upwards as the precious metal should also benefit from a dovish Federal Reserve, a potentially softer dollar and declining real interest rates.

This prospect, alongside robust demand from China and India combined with the record pace of purchases from central banks, suggests “a sturdy price floor for gold”, according to McMillan.

“With the Fed beginning its policy easing, major sell-side analysts are now revising up their price estimates suggesting price risks skewed to the upside as sentiment is likely to spillover from analysts to investors,” she said.

“Furthermore, we anticipate heightened market volatility in the lead up to the US election, the potential implications for US-China relations, as well as ongoing uncertainty surrounding conflict in the Middle East, as well as between Russia and Ukraine. We believe this makes gold an attractive asset for those seeking stability in the face of geopolitical and recessionary risks.”

From an allocation perspective, Neuberger Berman has exposure to gold through an actively managed commodities strategy and maintains a long commodity position in gold within a “carefully risk-managed portfolio of tactical positions”.

As for how long this outperformance can continue, Isabel Albarran, investment officer at Close Brothers Asset Management, expects gold’s record-breaking rally to extend towards 2025.

“Expectations of interest rate cuts from prominent central banks could also support the gold price, but elsewhere, the rally could also continue not least because of a notable revival of large inflows into gold exchange-traded funds (ETFs).”

But not everyone was convinced about allocating significantly to the asset. Alastair Laing, manager of the Capital Gearing trust, was concerned about volatility.

While still seeing gold’s attractiveness at a portfolio level, which derives from its low correlation to equities and bonds, the precious metal has had such strong performance that he is “nervous about having a large amount in a portfolio”.

Instead, he prefers the “more reliable” returns of government bonds. Capital Gearing only has 1% in gold – a relatively low allocation for a defensively positioned trust.

“We wouldn't think of gold as a classic defensive asset like bonds are. If a bond price moves by 3%-4% in capital terms, that's a big movement – gold could move that much in a week,” he said.

“That's a volatility similar to an equity, so you’d want to have a sizing which is the equivalent of quite a decent single-equity holding, but not much more than that.”

Investors should also not misinterpret the high gold price as being an automatic win for producers, according to Duncan MacInnes, fund manager at Ruffer.

Mining companies should be a leveraged play on gold, but they have achieved somewhat of an “ugly ducklings” status because of “bad environmental, social and governance (ESG) credentials, bad management teams and bad mergers”.

“The last time the gold price was high, in 2021, oil was expensive and mines were facing labour market issues so their profit margins were constrained by cost pressures. This year however, gold has hit new highs but commodity prices are falling and the labour market is not as tight,” he said. “Gold miners are producing gold and printing money. That's just not reflected in the share price, in valuations.”