The first half of 2024 has been marked by mega-cap performance and heavy concentration within market cap-weighted benchmarks.

The Fed Funds rate has remained unchanged for longer than the market previously anticipated as inflation continued its stubborn resistance during the first six months of the year.

As a result, many investors have steered capital into benchmark-driven strategies that are dominated by mega-cap companies with extensive cash balances. As this phenomenon has played out, it’s important to analyse risk across client portfolios and consider broadening exposure. We are now starting to see signs that this rotation may be beginning.

Overly concentrated equity market?

The S&P 500 Index has the highest concentration in 30 years within its top 10 names, which contributed to 72% of the total return of the S&P 500 year-to-date up to 30 June.

Overlap has tripled between the S&P 500 Index and the Nasdaq 100 Index over the past two decades and the common holdings represent 95% of the weight of the Nasdaq 100 Index, as at 30 June. Meanwhile, the ‘Magnificent Seven’ contributed to over 50% of total risk in the Nasdaq 100 on a one- and two-year basis.

The S&P 500 Index outperformed its equal-weighted version in the second quarter by 6.9% as mega-caps dominated. This is one of the largest divergences ever (7.1% in the first quarter of 2020 was the greatest).

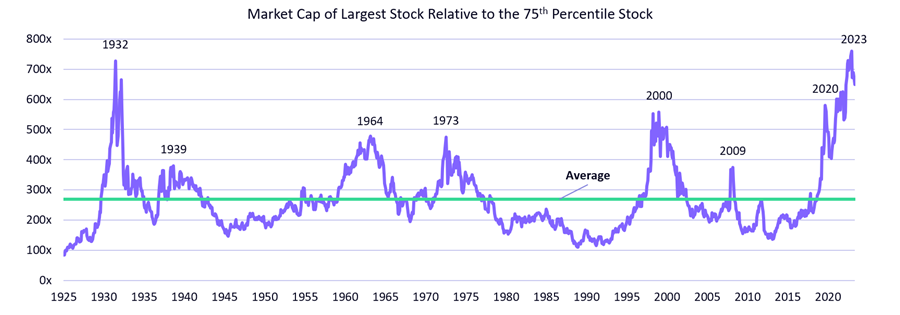

Market imbalance in the US is the highest it has been in 100 years, as measured by the largest US company relative to the 75th percentile by Goldman Sachs research. As seen below, this trend seems to be turning.

Source: ARK Invest

Broadening out?

But is this an anomaly or emblematic of a rotation that is beginning to crystalise? 11 July offered a striking example of this broadening out as CPI came in at -0.1% month-over-month, signalling that the US Federal Reserve could shift more quickly into dovish policy.

The Nasdaq composite – held up by cash-rich mega-caps – lost roughly 2% on the day, while the Russell 2000 – representing small-cap stocks – gained 3.6%; the largest single-day differential in the past 30 years.

Another clear example: stocks associated with multiomic technologies, which tend to be long duration in nature based on the earlier-stage profile of underlying companies, were up 5.6% on the day.

We believe that the broadening out is taking shape and that diversified investment solutions will help portfolios achieve enhanced risk-adjusted returns in various market scenarios.

Where do we go from here?

Importantly, a broadening out trade can be accretive to client portfolios in more than one market scenario.

Catch-up scenario: In this risk-on scenario, the positive momentum of a more diversified set of stocks will lead to a narrowing of the performance gap to mega-cap stocks in an upside market.

Catch-down scenario: On the other hand, investors may be wary of the potential for downside pressure after many market-cap-weighted benchmarks recently hit all-time highs. A market downturn could be triggered by weakness in the Magnificent Six (we exclude Tesla believing it to be more of a robotics company than broader tech), potentially due to the interconnected nature of their sales and earnings and/or a falling rate scenario that no longer rewards companies with extensive cash balances, leading to a narrowing of the gap as a diversified set of stocks loses less than the mega-cap names.

Of course, there is a potential that forthcoming data points, whether related to inflation or employment, may reduce the probability of the number of near-term Fed cuts, which would increase downside risk for this trade.

That said, the economic data, trend in performance, the expected path of Fed dots after September’s action, deeply discounted valuations, and technological tailwinds give us the conviction that the broadening-out trade has increasingly become a nearer-term, if not current, market event.

Thomas Hartmann-Boyce is a client portfolio manager at ARK Invest. The views expressed above should not be taken as investment advice.