Scottish Mortgage’s ambitious share buyback programme has reached the board’s target after the investment company bought back £8.6m worth of shares on Friday.

The £11bn trust’s board initially said it would make at least £1bn available for share buybacks during the next two years, but has smashed past this target in less than 12 months.

Ewan Lovett-Turner, head of the investment companies research team at Deutsche Numis, said: “At that time, the board pledged to return ‘at least’ £1bn over the following two years. We expect that the approach to buybacks will be unaffected by crossing the £1bn mark, with ‘at least’ being a key component of the board's strategy.

“The interim results are due to be published in early November and we would expect the board to comment on its ongoing approach.”

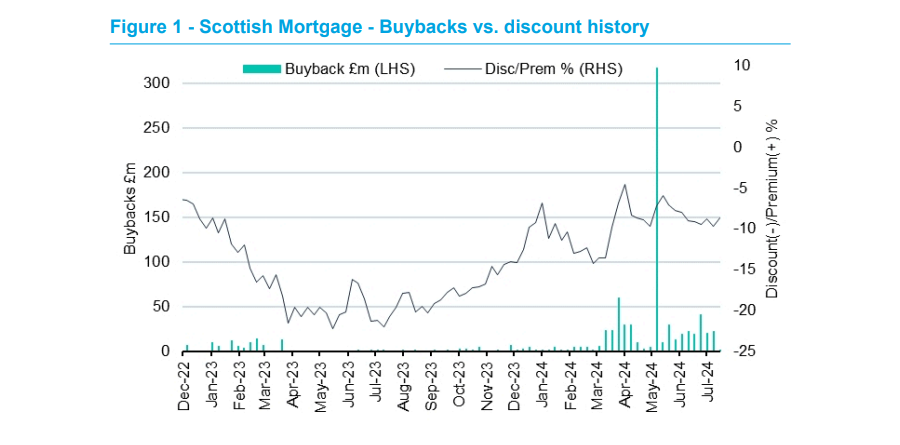

In May, the board bought back some £311m worth of shares in a single day, with 35 million shares taken back into its treasury, a spike that can be seen in the chart below.

Source: Deutsche Numis

Since 15 March, Scottish Mortgage has repurchased £1bn worth of stock, totalling 115 million shares, or 8.3% of the investment company’s share capital. The board has averaged buying approximately £25m worth of stocks per week.

It leaves the number of shares in issue at 1.3 billion, with 203 million held in the firm’s treasury.

Lovett-Turner said this makes it a record for the largest total value of buybacks in a year, topping the £956m from Alliance Trust in 2017 which bought back a stake held by activist investor Elliott Associates.

“In March 2024, Elliott, a US value investor, announced it had a 5% stake in Scottish Mortgage, this fell below 5% in May as Scottish Mortgage undertook a £313m buyback on a single day”, he said.

At the start of its buyback programme, Scottish Mortgage’s shares traded at a circa 15% discount to the net asset value (NAV). Today that figure stands at 11%, still higher than its long-run average but narrower than in March.

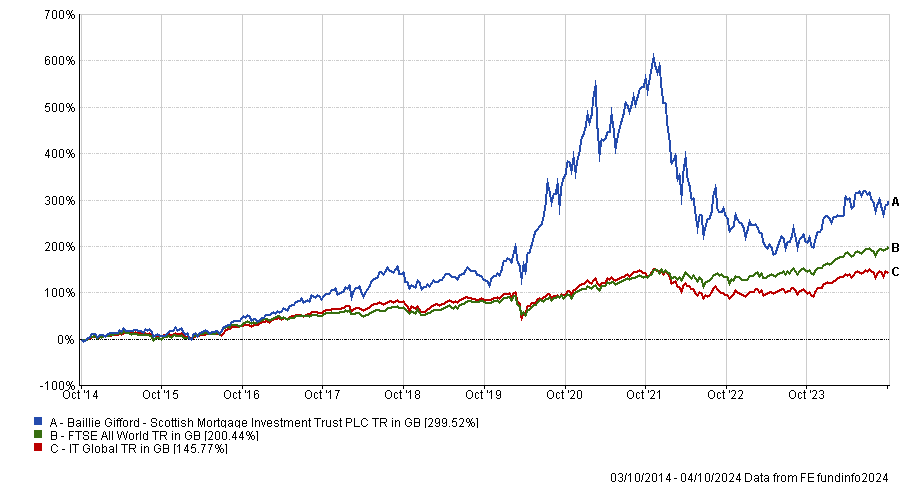

Lovett-Turner said it is now down to the performance of the trust to reduce this discount further. Despite being the best trust in the IT Glboal sector over the past decade, up 299.5%, it has gone through a tough period in recent years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

The high-growth portfolio has been stung by rising interest rates, with investors also nervous about its large private equity sleeve, which currently stands at 23.8% of the fund.

It has lost 35.5% over the past three years – the second-worst return in the peer group over this time – and was the worst trust in the sector in 2022, when it lost 45.7%.

This followed a below-average 10.5% return in 2021 and the trust has failed to beat its average peer in 2023 and so far in 2024 as well.

“We believe that buybacks are useful in limiting discount volatility, demonstrating confidence in the valuations and generating NAV accretion, as well as balancing short-term supply and demand, and ensuring a stable shareholder register [but] ultimately a period of strong performance is likely needed to narrow the discount,” said Lovett-Turner.