Absolute return funds have gone through the mire in recent years. Once populated by behemoths such as the abrdn Global Absolute Return Strategy (GARS) and Invesco Global Targeted Returns funds, both were closed in 2023 after prolonged periods of underperformance.

Now, only one strategy of a similar ilk remains: Aviva Investors Multi Strategy Target Return. But the sector is still home to myriad strategies, perhaps the most common being those that are long/short portfolios like the Janus Henderson Absolute Return fund. Both of the funds named above are included in Barclays’ Smart Investor best-buy list.

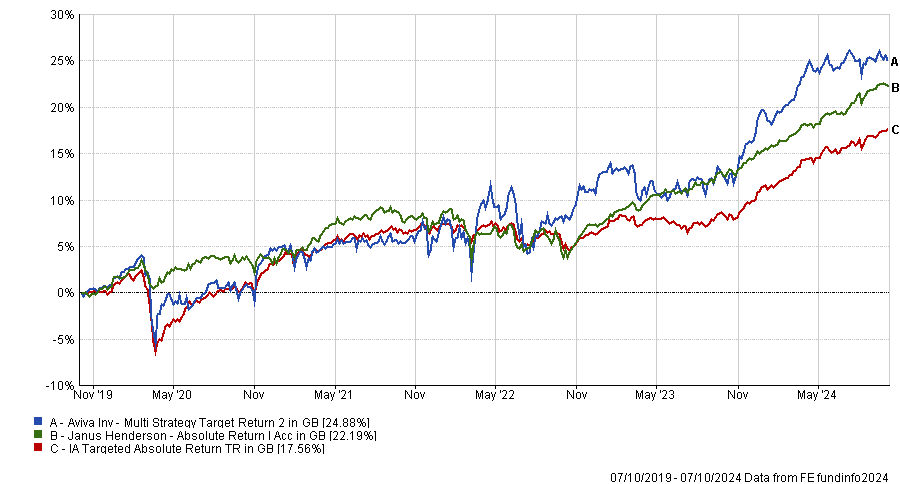

Performance of fund against sector and index over 5yrs

Source: FE Analytics

The Aviva vehicle takes a top-down approach, investing in multiple asset classes based on the team’s view of the global macroeconomic landscape, with a target return of cash plus 5%.

Barclays analysts highlighted it for its relatively low cost in comparison to its peers, its “well-resourced team” and the fact that it is a flagship product for Aviva Investors, which gave them “comfort that Aviva will continue to invest in the resources and talent required to continuously drive performance”.

This fund is more similar to the once-popular GARS, in that it blends a variety of uncorrelated strategies and trades together.

The Janus Henderson option meanwhile is a long/short fund, meaning that the two lead managers, FE fundinfo Alpha Managers Ben Wallace and Luke Newman, can make money not only by selecting winning stocks but also by “shorting” those that they think will fall in value.

“Wallace and Newman effectively run two strategies: The first is a ‘core’ portfolio, where they invest in companies they believe have good long-term growth prospects; and the second is a ‘tactical’ portfolio, which aims to take advantage of short-term market anomalies,” Barclays analysts said.

“What we also like is their distinct styles, which complement each other very well. Together, the duo has fostered a strong team culture as well as a successful performance track record.”

But for investors that only want to add one absolute return fund, which is best? For Rob Morgan, chief analyst at Charles Stanley, Aviva’s approach makes its fund “a little more difficult to understand than a long/short fund, where the approach is more prescriptive”.

Aviva also relies primarily on the managers’ macroeconomic judgments rather than stock selection alpha, both of which can be “ephemeral”, so investors need to bear that in mind.

Janus Henderson Absolute Return has a lower performance target than the Aviva fund and is therefore seen as the more cautious of the two, which also means it has lower volatility and could be of more interest to investors wishing to populate the cautious part of their portfolio. In turn, the Aviva fund is “more of a watered-down equity level of risk”.

Between the two, Morgan opted for Janus Henderson Absolute Return, as the managers have “a good record of [adding] value through stock selection” and the strategy is “straightforward”. However, the charges on the product are “at the upper end” and include a performance fee.

“It’s difficult to pick funds in this sector. Ultimately, investors must weigh up whether it is worth allocating to it versus more predictable sources of return, such as cash and fixed interest in the pursuit of diversification,” he said. “Overall, a small amount is okay, but not necessarily as a structural allocation.”

Morgan’s choice would rather veer towards the capital preservation approaches offered by the Ruffer Investment Company and Personal Assets or their open-ended equivalents Ruffer Total Return and Troy Trojan.

Ben Yearsley, director of Fairview Investing, had a more extreme view – that the whole concept of GARS-style products has been “totally discredited” and he “wouldn't go anywhere near the Aviva product”, which was launched by Colin Monroe, who had previously worked on GARS at abrdn.

“The whole concept of GARS-style products, involving multiple pairs of supposedly uncorrelated trades is flawed and far too complicated,” he said. “Though ironically, in an era where asset classes aren't nearly so correlated, they might do better.”

So, he suggested keeping things simple with absolute return – meaning buying long/short equity funds “and nothing more”.

There were three he was prepared to suggest for investors – Janus Henderson Absolute Return, Argonaut Absolute Return and Tellworth UK Select, two of which he owns in his self-invested personal pension (SIPP).

“All these look for individual equities to go up and individual equities to go down, and that's it. Tellworth is perhaps the lowest risk and Argonaut the highest.”

For Darius McDermott, managing director of Fundcalibre, the absolute return sector should be part of the all-weather section of a portfolio. These funds should give up less on the downside and provide consistent, if more modest returns, on the upside.

GARS did not do that – it initially wowed investors with outsized returns, but when these turned into losses, the complicated investment approach became difficult to explain.

He said: “I want to know exactly what is under the bonnet of any strategy. I believe funds like Janus Henderson Absolute Return are far easier to understand than the GARS-inspired wave of absolute return funds.”

McDermott also highlighted BlackRock European Absolute Alpha as another potential option for investors looking for inspiration in the sector.