Defensive funds have a crucial role to play in portfolios, particularly those with short time horizons or with a low tolerance for losses.

Volatility has increased this year, particularly in recent months, and uncertainty remains in many pockets of the market, whether it be due to the upcoming US election, potential central bank policy error or the ongoing wars in Europe and the Middle East.

In this new series, Trustnet looks at funds that have been the steadiest in their respective sectors, measured against the most common benchmark.

Here we look at the UK, taking all the constituents of the IA UK All Companies and IA UK Equity Income sectors, as well as the investment trust equivalent peer groups, to see which portfolios have been the most defensive.

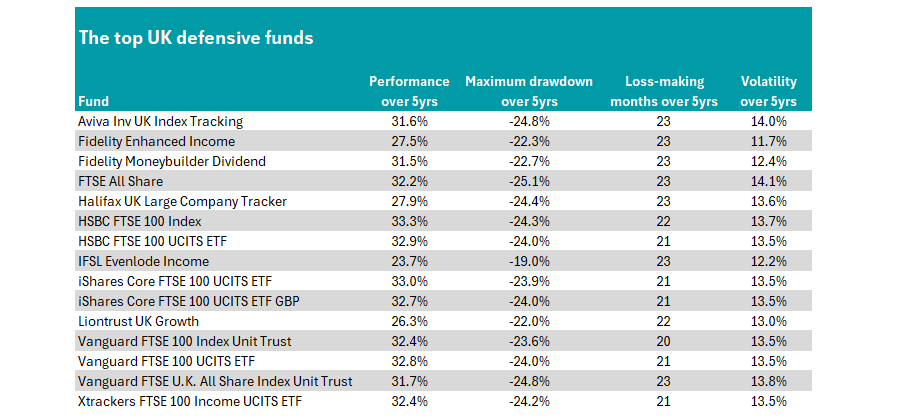

We focused on three metrics over the past five years: maximum drawdown (the most an investor would have lost if buying and selling at the worst possible times); negative periods (how many months the portfolio lost money) and volatility (the most common measure of risk).

We benchmarked this against the FTSE All Share index, which is a lower hurdle rate than the FTSE 100, as evidenced by the numerous FTSE 100 tracker funds in the list below.

Source: FE Analytics

Aside from passive funds, only one active portfolio managed to tick all the boxes of a lower maximum drawdown, fewer negative months and lower volatility. No investment trusts were able to achieve the feat.

That was the Liontrust UK Growth fund, managed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh since 2009. They were joined by fellow co-managers Matthew Tonge and Victoria Stevens in 2023.

The £966m fund has spent 22 of the past 60 months in negative territory, with a five-year maximum drawdown of 22% and volatility of 13%.

This compares favourably to the FTSE All Share, which has made a loss in 23 months over the past five years, has a maximum drawdown of 25.1% and volatility of 14.1%.

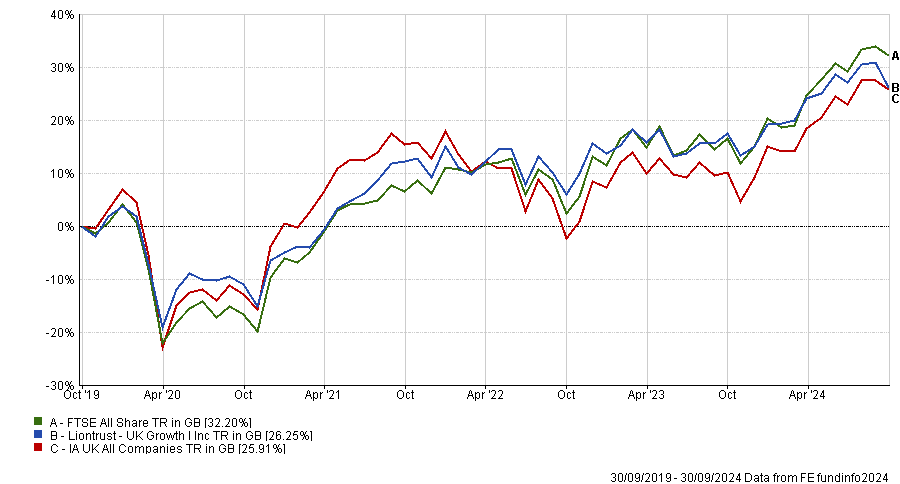

However, Liontrust UK Growth has failed to beat the index on perhaps the most important metric of all – performance.

Over five years the fund has made 26.3%, which is ahead of the average fund in the IA UK All Companies sector (25.9%), but behind the FTSE All Share’s 32.2% gain.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund invests using the team’s ‘Economic Advantage’ principles, which include looking for companies with intangible assets that provide barriers to entry for competitors.

Analysts at FE Investments said: “Due to its focus on high quality, cash generative companies, the fund protects relatively better in weaker market conditions.”

They rated the fund, noting it provides “good core UK equity exposure” because of its large-cap exposure, which gives it less liquidity risk than other portfolios under the team’s management, such as Special Situations and UK Smaller Companies funds.

It was also given an ‘A’ rating by analysts David Holder and John Monaghan at Square Mile Investment Consulting and Research. “The team's ability to hunt out high quality and enduring companies is, in our eyes, one of the most compelling features of this strategy,” they said.

While Liontrust UK Growth was the only fund in the Investment Association universe to achieve the full list of criteria, three more had lower maximum drawdowns and volatility with the same number of negative periods relative to the FTSE All Share, as the below table highlights.

IFSL Evenlode Income was joined by a pair of Fidelity funds – Enhanced Income and Moneybuilder Dividend – in achieving this feat. All three have an income mandate, with the Fidelity funds sitting in the IA UK Equity Income sector, although IFSL Evenlode Income is in the IA UK All Companies peer group, having been ejected from the IA UK Equity Income sector in 2016 for failing to meet the Investment Association’s (IA) yield targets.

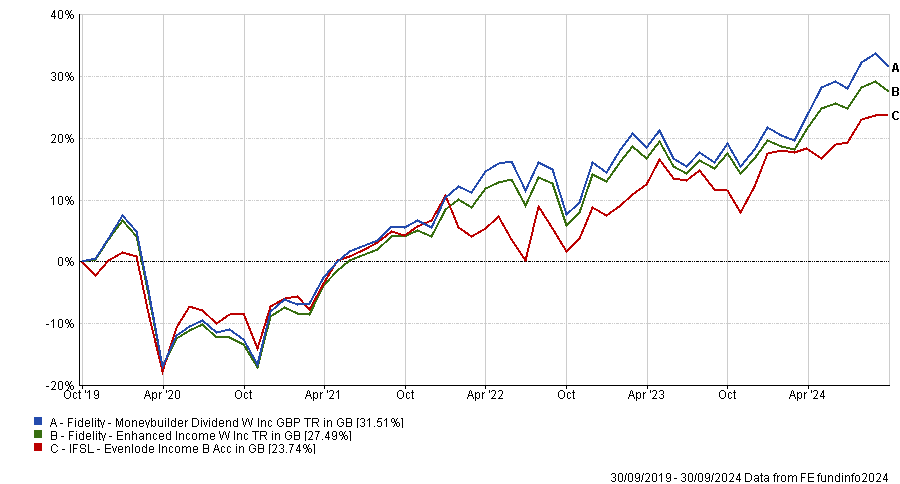

The best performing of the four active funds has been the Fidelity Moneybuilder Dividend, which made 31.5% over five years, 70 basis points behind the FTSE All share index.

Performance of funds over 5yrs

Source: FE Analytics

Both Fidelity Moneybuilder Dividend and Fidelity Enhanced Income have been given ‘Positive Prospect’ ratings from analysts at Square Mile.

On the former, they said: “Manager Rupert Gifford is a conviction-based investor who constructs this portfolio with a clear focus on providing a premium yield over the UK market. To achieve this, he tends not to risk capital by chasing riskier, higher yielding and less income-reliable stocks. Consequently, this strategy may be better suited to the more risk-averse UK equity income investor and/or to complement a more aggressively managed proposition.

The latter is also run by Gifford, who manages the equity portion of the fund. Co-manager David Jehan is responsible for the derivatives part, which is an “options overlay strategy”.

“Whilst it is complex, it has proven successful at delivering additional income to help the fund meet its yield target over time. We think the combination of these two elements is an appealing proposition for investors who have an income requirement,” they said.

Of the active funds, the portfolio to lose the least in one go, however, was IFSL Evenlode Income, which had a maximum drawdown of just 19%, 2 percentage points less than the next-best on the list.

Recommended by analysts at AJ Bell, they said: “The fund benefits from the disciplined nature of the investment process, which the fund manager consistently adheres too.

“Additionally, the long-term nature of the approach is another likeable feature. The growth of the investment team provides us with reassurance in the resource behind the offering.”