Passive global equity funds should theoretically offer broadly diversified exposure to companies around the world, but at the moment, they appear to be putting most of their eggs in one star-spangled basket.

The MSCI All Country World Index had 64% in the US as of 30 September 2024, while the MSCI World, which focuses exclusively on developed markets, had a whopping 71.8% allocation to the American market. In a similar vein, Fidelity Index World, a popular £9bn passive developed markets fund, has 71.5% in the US.

Another dynamic to consider is how concentrated the US equity market – and by extension, global indices – has become. The S&P 500 has 34.6% in its top 10 holdings as of 30 September 2024 and 31.7% in technology.

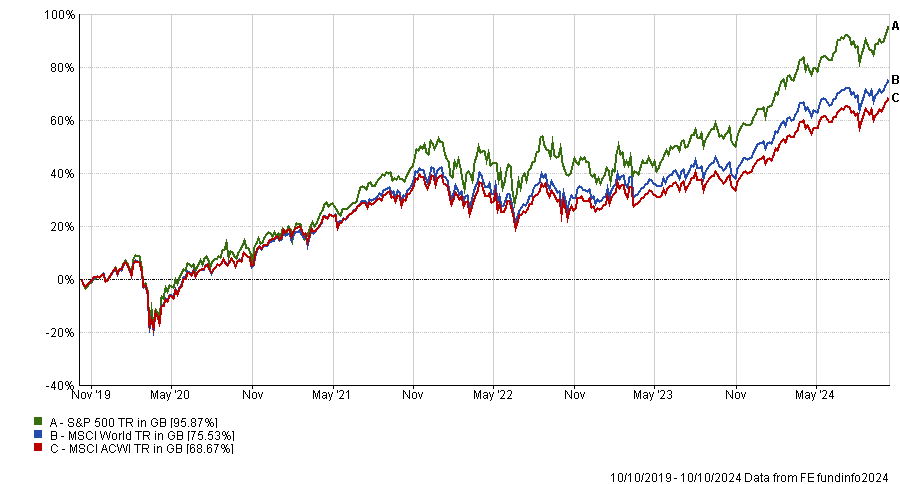

Backing the US has been a phenomenally successful strategy for the past decade or so, but nothing lasts forever and today, investors have reasons to be hesitant.

Performance of US and global indices over 5yrs

Source: FE Analytics

The US election could trigger stock market volatility, some experts are questioning whether the Federal Reserve will successfully pull off a soft landing, US economic data has been somewhat mixed, valuations are looking stretched and fund managers are starting to question whether the ‘Magnificent Seven’ have become over-hyped.

Even the resilient US consumer appears to be under threat, with rising credit card delinquencies and depleted savings.

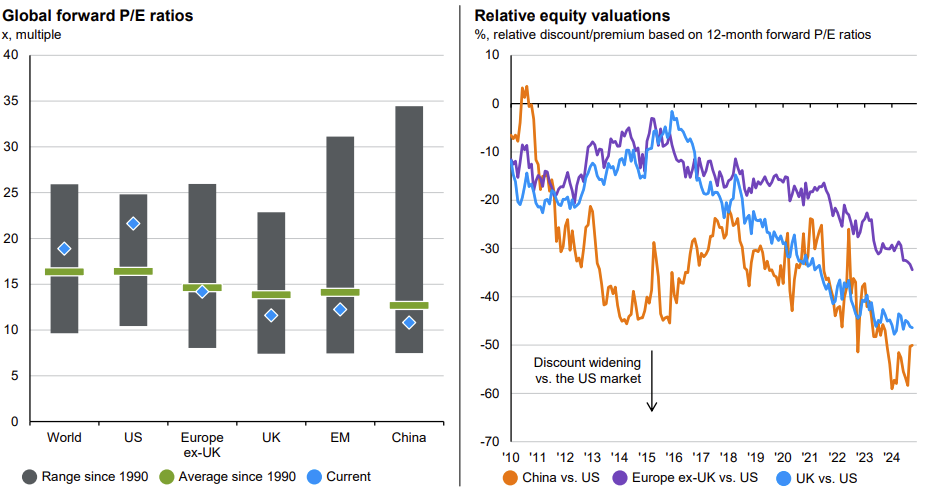

Should investors be concerned about excessive valuations?

James Norton, head of retirement and managed services at Vanguard, acknowledged that valuations are a concern. “We currently believe US equity valuations are towards the top of their range. We still have positive expectations for US equities, but believe prices in some other areas offer better value, such as the UK and emerging markets,” he explained.

US equity valuations vs other regions

Sources: J.P. Morgan Asset Management’s Guide to the Markets, FTSE, IBES, LSEG Datastream, MSCI, S&P Global, data as of 10 Oct 2024

That being said, it is extremely difficult to judge which other regions might outperform and when. “Tactically betting against the US is risky. It’s impossible to predict with certainty when valuations may normalise, and many investors have betted again the US for extended periods much to their regret,” Norton continued.

Gerrit Smit, who manages the $2.6bn Stonehage Fleming Global Best Ideas Equity fund, believes many US companies deserve their loftier price tags because they are high quality and lower risk.

Global capital markets are efficient at finding good companies and valuing them appropriately, he said, arguing that Microsoft would have a similar valuation wherever it was listed.

European indices look comparatively cheaper because their constituents are totally different to the US, said Smit, who has invested three-quarters of his fund in US stocks.

Rob Burgeman, an investment manager at RBC Brewin Dolphin, agreed. Many US tech companies are mature, highly profitable and extremely cash generative, with “deep moats around their businesses” and they are “investing prodigious sums to broaden their offerings and to deepen those moats even further”, he said.

However, James Klempster, deputy head of the Liontrust multi-asset team, warned that sentiment – as well as fundamentals – has driven the valuations of US tech giants ever higher. Share prices could be vulnerable to a reversal if investors’ optimistic expectations are not appeased – as we saw briefly this summer.

“Investors in the US today must adjudge not only the earnings of these massive companies to be sustainable, but also to be able to grow in relatively short order so as to fit their optimistic multiples. If this does not happen there is a risk that the disappointment leads to multiple contraction and underperformance,” he cautioned.

So how much should private investors allocate to the US?

Although there are reasons to be cautious in the short term, Burgeman advised against underweighting the world’s largest market. “Betting against the US is rather like betting against the house in a casino”, he said. “You might win from time to time, but in the long run, there is only one result.”

A market-cap weighting, large though it is, may be justified because “the US hasn’t reached the weighting that it has in global indices by accident”, he continued.

Colin Reedie, head of active strategies at Legal & General Investment Management, concurred: “The US remains the dominant economy by far in the world. It’s got the industries of the future, especially in the context of tech and AI [artificial intelligence]. Its banks are the largest in the world. It’s the largest producer of oil and natural gas, and it has better demographics than any other developed economy.”

Although a 64% allocation to the US may appear “outrageous”, when investors consider that there are good grounds for global indices’ high US weighting, “it feels less scary”, Reedie concluded.

What are the pros doing?

Fund managers are divided on whether this is a good time to stay neutral in the US or even go overweight.

Mark Jackson, a multi-asset strategy investment specialist at JP Morgan Asset Management, has a favourable outlook on the US relative to other regions, “bolstered by our growing confidence in a cycle extension and trend-like growth, supported by the Federal Reserve's rate-cutting cycle”.

“Although valuations are stretched, we do foresee modest gains over the coming quarters, supported by high-quality earnings and robust cash flow generation,” he said.

Conversely, Aviva Investors, Liontrust Asset Management and Neuberger Berman have a more moderate view.

Aviva Investors’ multi-asset portfolio manager Baylee Wakefield recently decided to “take some risk off the table and reassess”. She has taken profits in light of the “uncertainty” surrounding the strength of the US economy and the election.

Meanwhile, Klempster said that “it does not feel right to overweight” the US at present because mega-caps look so expensive.

Neuberger Berman expects the technology sector to continue underperforming relative to the broader market, so has downgraded its US equity allocation from overweight to market weight.

Schroder Global Recovery has one of the lowest US allocations amongst all global funds at 35%. It sets a maximum country limit of 50% so a US underweight is baked in.

Fund manager Simon Adler said: “Can you call a portfolio global if it has more than 50% in one country? We don’t think so.”