Picking the right stocks is only half the battle; knowing when to run your winners and cut your losers can make all the difference to your eventual returns, as can learning from past investment mistakes.

Most equity managers have a similar hit ratio (the percentage of stock picks they get right) between the high forties and 60%, according to Stephen Anness, head of Invesco’s Henley-based global equity team.

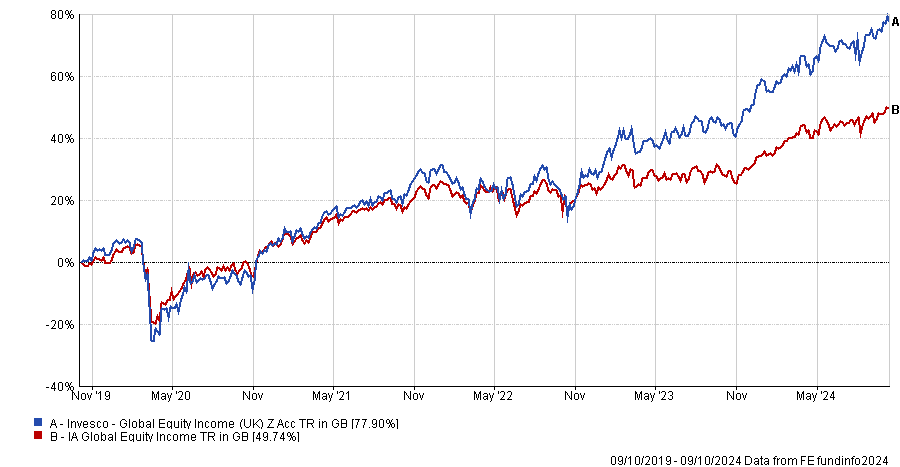

The Invesco Global Equity Income fund falls within this realm, with a hit rate of 55-58%, yet it is the third-best performing strategy in the IA Global Equity Income sector over three and five years to 9 October 2024.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Anness attributes his team’s track record to two things: the payoff, i.e. letting winners win big or cutting losses; and a forensic examination of failures and successes.

When mistakes are made, “as a portfolio manager, it’s really important to almost rub your nose in it”, he said. Otherwise, “you can easily just pretend that things didn't happen or they weren't your fault”.

“We spend a lot of time going back over 15 plus years of data and saying: right, what were we good at? What were we bad at?”

The global equity team conducts a performance review each year during its annual offsite, looking at what decisions proved to be right, what went wrong, and what lessons can be learned.

Then throughout the year, Anness continues to analyse performance. If a position is losing money, he endeavours to “disaggregate what we've got right versus bad luck”.

With Reckitt Benckiser, a poor performer he recently sold, “the mis-analysis of the growth rate of the business was on us” but the litigation challenges facing Abbott’s premature baby milk would have been impossible to forecast.

If something is underperforming, Anness asks an analyst who hasn’t looked at the stock before to do a ‘red hat analysis’. This is a technique originally developed by military forces to help them understand how their enemy is thinking. He asks the analyst to take the other side of the argument by looking for reasons to short the stock.

An open-minded team culture where people challenge ideas and listen to each other is also a crucial part of the investment process. “Team members have said ‘why do we own this? This is a really daft idea’,” he noted.

Anness also spends a lot of time looking at his fund’s payoff, i.e. “how much are you making when you're right and how much are you losing when you're wrong?”

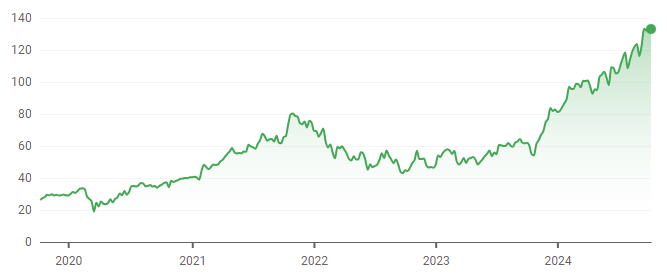

If a stock is performing well and exceeding Invesco’s expectations every quarter, Anness said he doesn’t trim the position, take profits or rebalance. An example would be KKR, the private equity business, which has continued to positively surprise.

Share price performance of KKR over 5yrs

Source: Google Finance, data to 11 Oct 2024 in dollars

Conversely, if a position is losing money, “rather than lament the fact that you might be wrong”, it is more open-minded to recognise the situation as a mistake that is bound to happen.

“We’re going to be wrong 40% of the time and once you actually say that to yourself, that's really powerful because you don't then fret about being wrong as much; you're not as emotionally charged about it. You just say, well, okay, is this one of my 40%? So before I buy more and add to this problem, might I be better just killing it and moving on?”

Another thing Anness realised from looking at data was that “sometimes, it was death by a thousand cuts”. Every time an investee company made an announcement, it was a little worse than he expected, so Invesco was downgrading its views on the company by a few percent each time.

Over the years, that added up to a significant divergence from the team’s initial expectations. “Tracking our estimates of how the thesis is progressing over time has been really important,” he said.