Most active equity funds are failing to beat the market in 2024, research by Trustnet has found, despite predictions that this year would be a good one for active managers.

Going into 2024, many expected that the market rally would broaden out from the handful of mega-cap tech names that have dominated in previous years and create an opportunity for active managers to shine.

While the so-called Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) are no longer the only stocks pushing indices higher, many of the same forces that led the market in previous years have continued to do so.

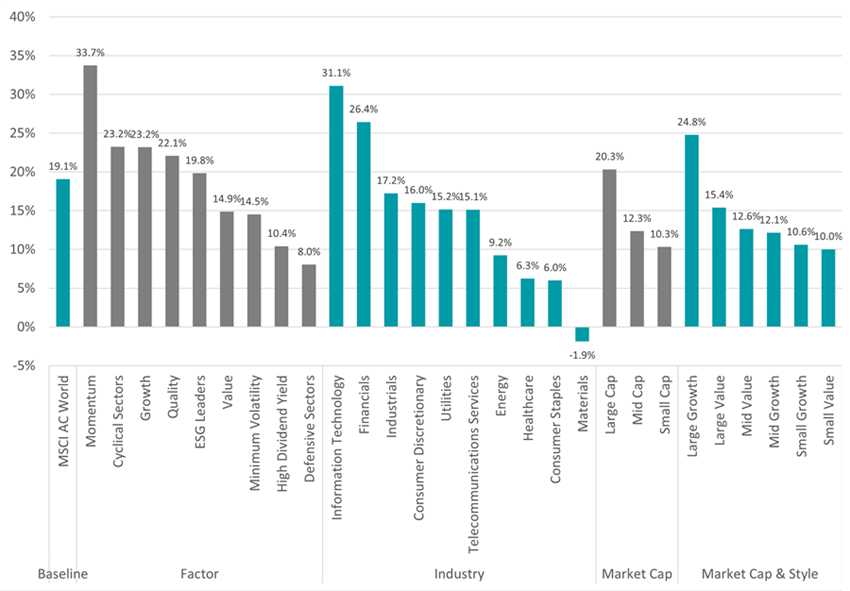

Performance of MSCI AC World and sub-indices in 2024

Source: FinXL

As the chart above shows, global equities have had another strong year with the MSCI AC World index posting a 19.1% total return (in sterling) and the strongest segments – momentum, tech and large-cap stocks – are outpacing other areas by a significant margin.

Against this backdrop, active funds are finding it a challenge to generate alpha on top of the stock market and its limited areas of outperformance.

To see how much of a struggle this is, Trustnet ran the performance of all the funds in the 10 core equity sectors and compared it with the peer group’s most common benchmark over 2024 to date and the past five years.

The sectors examined in this research, in alphabetical order, are IA Asia Pacific Excluding Japan, IA Europe Excluding UK, IA Global, IA Global Emerging Markets, IA Global Equity Income, IA Japan, IA North America, IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies.

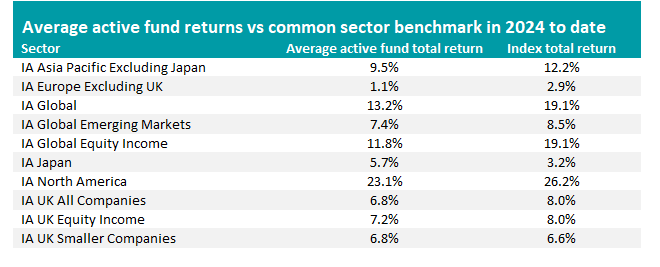

Source: FE Analytics

As the table above shows, the average return made by active funds is trailing the market in almost every peer group.

The gap in the IA Global Equity Income sector is the most stark: active funds have made an average total return of 11.8% in 2024 so far, which is 7.2 percentage points behind the MSCI AC World. The average active fund in the IA Global sector is 5.9 percentage points behind the MSCI AC World, while the gap between active IA North America funds and the S&P 500 is 3.1 percentage points.

There are two sectors where the average active fund has beaten the market: IA Japan, where active funds are 2.5 percentage ahead of the market, and IA UK Smaller Companies, where the average fund has made just 20 basis points more than the Deutsche Numis Smaller Companies Excluding Investment Companies index.

It’s a similarly downbeat picture when we look at the proportion of funds that are outperforming the market. Just 31% of the 1,350 active funds we examined in this research have beaten their sector’s most common benchmark this year.

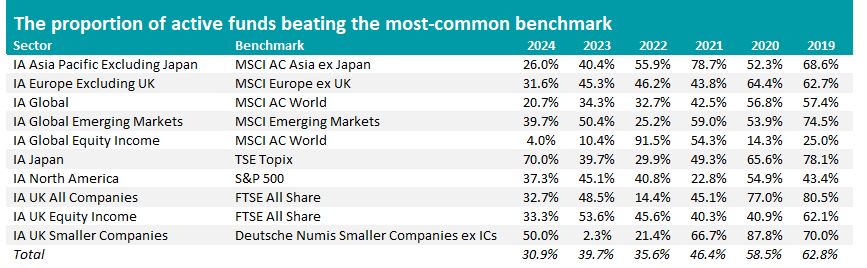

Source: FE Analytics

As can be seen in the table above, this is the weakest showing from active equity funds in at least five years and significantly worse than 2019, when 63% of active funds managed to outperform the market.

Again, it’s the IA Global Equity Income sector that comes bottom as just 4% of its active members have made a higher return than the MSCI AC World this year. This follows only 10.4% beating the market in 2023, although more than 90% outperformed in 2022.

Just 21% of IA Global funds have outpaced the MSCI AC World. This down from 34% last year and 33% in the year before.

Active managers in both sectors have been hampered by concentration in the index and the relatively shallow pool of outperforming areas. Some 65% of the MSCI AC World index is in US companies, combined with a 25% weighting to information technology.

In addition, every member of Magnificent Seven is in the index’s top 10 constituents, along with Taiwan Semiconductor Manufacturing and Broadcom (there were two Alphabet share classes in the top 10, hence only nine companies).

Managers who have avoided these US mega-cap tech names in the hopes of finding opportunities off the beaten track have continued to be punished in 2024.

In the IA UK All Companies and IA UK Equity sector, around one-third of active funds are ahead of the FTSE All Share, down from about half last year. Active UK equity managers tend to be underweight large-caps, which have performed strongly this year, and are more likely to be tilted towards underperforming small- and mid-caps.

The only cause for celebration among active managers is the IA Japan sector, where 70% of active funds are beating the Topix. Japanese equities have enjoyed a strong couple of years, although they were hit by a short but deep sell-off in the summer.

Japan is being touted as something of a stock picker’s market at the moment. The country’s businesses are implementing corporate governance reforms at different paces, which are creating opportunities for managers to pick and choose those prioritising shareholder returns and improving their boards.

In an article later this week, Trustnet will identify the handful of funds that have bucked the trend and beaten the market in recent years.