Artemis has a higher percentage of funds outperforming their sectors' average returns than any other large manager, data from FE Analytics shows.

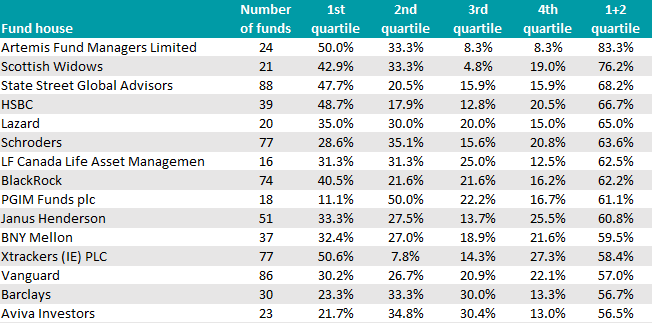

In this study, Trustnet looked at managers with more than 15 funds and calculated the percentage of those funds that were in the first or second quartile of their peers over the past three years. We disregarded sectors where a relative comparison is not possible, such as IA Targeted Absolute Return, IA Unclassified and IA Not Yet Assigned.

Artemis came first, with an impressive 83.3% of funds beating their sector average, while half of its range (12 funds) achieved first-quartile returns.

The house is best known for its UK, multi-asset income and SmartGARP franchises.

Among its best performers were Artemis Global Income, co-managed by Jacob de Tusch-Lec and James Davidson, and Philip Wolstencroft’s SmartGARP European and UK Equity strategies.

The global income fund is highlighted by Square Mile’s analysts for de TuschLec’s “strong understanding and passion” for the strategy. He tends to avoid the traditional mega-cap income stalwarts and instead focuses on large and mid-caps. The fund currently yields 4.2%.

Managers with highest percentage of outperforming funds over three years

Source: Trustnet

Second in line was Scottish Widows, which is mostly known for its pension fund range, run by third-party managers. Three-quarters (76.2%) of its funds outperformed their sectors.

One fund that stood out was SPW UK Equity, which is managed by the Schroder Investment Management team.

In third position, State Street Global Advisors had 68.2% of its 88 funds in the first (42) or second (18) quartile of their peers.

Its top-performing fund over the past three years was SSGA SPDR S&P U.S. Energy Select Sector, a tracker of the large-sized US energy companies in the S&P 500 index which made an 88.7% return by owning companies such as Exxon and Chevron.

Its global equivalent, the SSGA SPDR MSCI World Energy UCITS exchange-traded fund (ETF), added 68.7% over the three-year period, while similar technology and sustainability-focused US and global strategies also outperformed. BlackRock’s strategies also delivered strong returns, with 62.2% of funds in the first or second quartile.

The best active fund houses included HSBC Asset Management, Lazard Asset Management, Schroders, Janus Henderson Investors and BNY Mellon. Passive giants such as Xtrackers and Vanguard also featured with 58.4% and 57% of funds in the first or second quartile, respectively.

When filtering by the highest percentage of funds in the first quartile only, Xtrackers topped the table at 50.6% (39 funds of 77), whereas the leader by sheer number of funds was iShares, with 67 strategies in the top quartile.

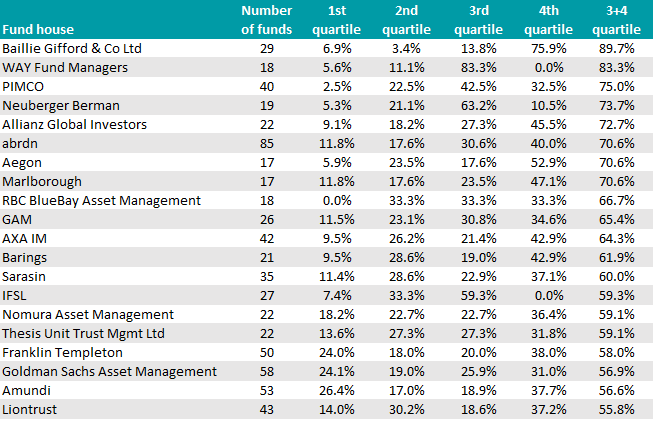

At the bottom of the table, Baillie Gifford had the highest percentage of funds with third or fourth quartile performance (89.7%, or 26 funds of 29). Its woes are often attributed to style, as growth-orientated investments have been suffering since the end of quantitative easing in 2021, but experts also blamed some “dubious stock picking”.

The funds that suffered most were Baillie Gifford Global Discovery, Climate Optimism, Health Innovation and Japanese Smaller Companies, all of which lost more than 40% over three years.

Managers with highest percentage of underperforming funds over three years

Source: Trustnet

Allianz Global Investors was also in the list, with 16 underperforming strategies out of 22 (72.7%).

The most negative results came from a challenged sector, China, with the Allianz China A-Shares Equity and All China Equity strategies losing 40.3% and 31.7% over three years, respectively.

Allianz Strategic Bond lost 23.6% over the past three years and its manager Mike Riddell moved to Fidelity International in August. Several experts suggested selling the fund because of its underperformance.