Stock markets around the world have hit all-time highs this year, which begs the question of whether investors putting money into equities now are investing at the market’s peak.

Valuations look rich in the US – which makes up the majority of global equity indices – and there are reasons to believe volatility might increase from here, including the US presidential election and rising geopolitical tensions.

Yet despite these factors, financial advisers continue to recommend that most investors place a large chunk of their savings into the equity markets to have the best chance of achieving returns. Are they turning a blind eye to stock market peaks or is this sound advice?

To put that question to the test, Trustnet asked Vanguard what would have happened if an investor had committed capital at the height of every previous bubble, just before the stock market tanked.

If somebody got their market timing as wrong as possible, would they have been better off waiting on the sidelines in cash or did equities eventually reap rewards?

To answer that question, James Norton, head of retirement and managed services at Vanguard, told the story of the fictitious unlucky Jim.

“Jim has a long-term goal to grow his capital. He also understands that markets rise and fall and is committed to holding onto his investments through thick and thin. Unfortunately, Jim is also the world’s unluckiest investor, and has an uncanny habit of investing lump sums at market peaks,” Norton said.

Jim chose a passively managed, global fund tracking the FTSE All World index and made his first investment of £2,500 in September 1997, just in time for the Asian financial crisis. Within a month, he had lost £228.

Undeterred, Jim braced himself to try again and invested another £2,500 in July 1998, just in time for Russia to default on its debt and the US hedge fund Long-Term Capital Management to collapse. “This time he’s down more than £840 in a month, but clings on.”

Markets bounced back and Jim became more confident, putting £10,000 into equities in mid-2000. The dot-com bubble bursting, the 11 September 2001 attacks on the World Trade Center and the war in Afghanistan all contributed to stock markets falling almost 50% by September 2002.

Jim stuck to his guns, did not tinker with his investments and was ultimately rewarded by a stock market boom.

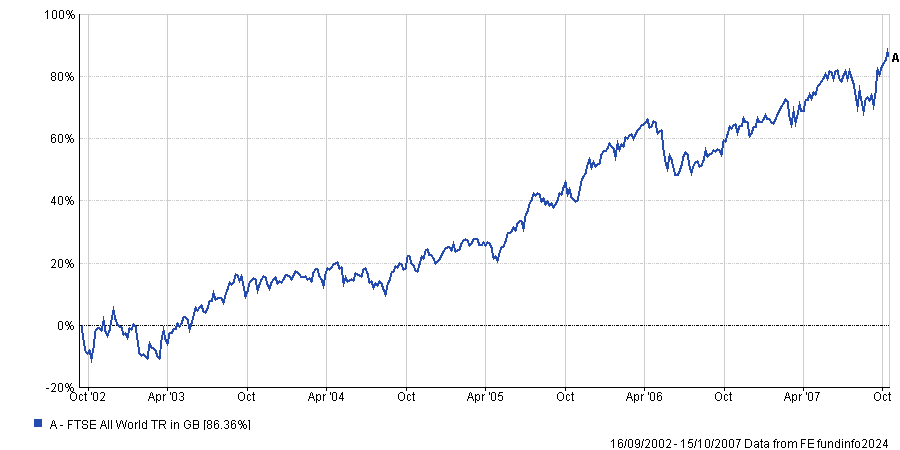

FTSE All World from mid-Sep 2002 to mid-Oct 2007

Source: FE Analytics

By October 2007, when markets peaked again, he had committed £15,000 and his savings were worth £21,153. Not a bad result given that his timing was so awful.

So Jim decided to invest an additional £5,000: “just in time for the US subprime debt crisis to kick off the global financial crisis”, Norton said.

“Jim’s steely calm remains, however, and by late 2019 he’s sitting on a pot of more than £75,000 and is ready to invest a further £10,000. Days later the Covid-19 pandemic unleashes the fastest bear market of modern times.”

By December 2021, markets had recovered, so Jim contributed another £5,000 – “perfectly timing the market peak, ahead of the Russian invasion of Ukraine, rising global inflation and monetary tightening”.

By the end of September 2024, after a 27-year investment journey, Jim had contributed a total of £35,000 and the value of his investments was £146,450, a return of more than 300% on his initial outlay.

Jim’s return was much lower than the FTSE All World index itself, which climbed 518.5% between 1 September 1997 and 30 September 2024. But even with the worst possible luck, his equity portfolio grew his wealth far in excess of anything that more conservative investments such as cash or bonds would have achieved.

The Bloomberg Global Aggregate index, a dollar-denominated bond market proxy, rose 155.3% in the same period.

Whilst market timing is notoriously difficult, the moral of the story is that time in the market counts for more than timing the market. “While no one can possibly know what’s around the corner, a disciplined, diversified, long-term approach can help even the unluckiest amongst us,” Norton said.

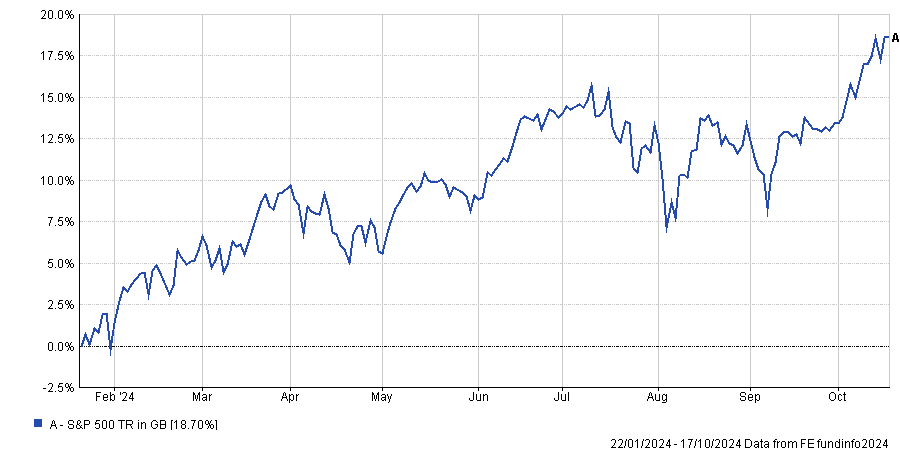

As for trying to ascertain whether the market has reached a peak, that too is extremely hard to tell. The S&P 500 index made headlines on Friday 19 January 2024 by hitting an all-time high, surpassing its previous peak on 3 January 2022.

Anyone trying to sell out at the top – or holding off on a new investment in late January 2024 – would have missed out on the US equity market’s subsequent 18.7% return (in sterling terms).

Performance of S&P 500 since 22 Jan 2024

Source: FE Analytics

Historical highs are not uncommon, according to John Plassard, senior investment specialist at Mirabaud Group. Between 1950 and January 2024, the US equity market hit 1,201 all-time highs, an average of nearly 16 records per year.

“The new highs reached by the markets are not as significant as some people think. They are often linked to continued growth in the economy and corporate profits. Although there are periods of economic and market slowdown, over time improvements in productivity and innovation have continued to propel markets to new heights,” he explained.

“Staying invested in the market for decades and taking full advantage of compound returns, including reinvested dividends, is a much surer route to prosperity than trying to anticipate the ups and downs of the market.”