Short-dated bonds are “perfectly positioned to benefit from interest rates coming down” and investors should get in “before the next interest rate cut and certainly before Christmas”, according to Stephen Snowden, Artemis’ head of fixed income.

The yield curve is currently flat, with short-dated bonds offering similar yields to longer-dated bonds (which should theoretically be riskier), making them attractive on a risk-adjusted basis.

With yields on short-dated investment-grade corporate bonds over 5% and the potential for prices to rise if interest rates come down further, total returns over the next year could reach the high single digits, Snowden said.

Strategic bond funds will deliver higher returns overall, but on a risk-adjusted basis, short-dated bonds have the edge, he argued.

“I genuinely believe that you will make more money in a full-fat traditional bond fund than you will in a short-dated or a short-duration bond fund, but the risk-adjusted return in short-dated bonds today is much stronger.”

He argued that investors should move their “rainy day” savings out of money market funds, whose returns will fall as rates are cut, into short-dated corporate bonds to take advantage of the current opportunity.

In 18 months’ time or so, once interest rates have come down, when fixed income investors have banked capital gains and the yield curve has steepened, short-dated bonds will not offer as attractive return prospects as they do today, he said.

Unlike many other bond managers, Snowden is not concerned by the historically narrow spreads (the difference between the yields from corporate and government bonds).

The cost of borrowing is now higher so corporations are more reluctant to issue debt but at the same time, investors are eager to by bonds at elevated yields, so there are more buyers than sellers.

“Supply is moderated because debt is a more expensive funding vehicle than it was, but the demand has surged because people want to access these high yields. Something has to give,” he said.

He thinks there is room for spreads to tighten even further: “They’re not in the thin air zone.”

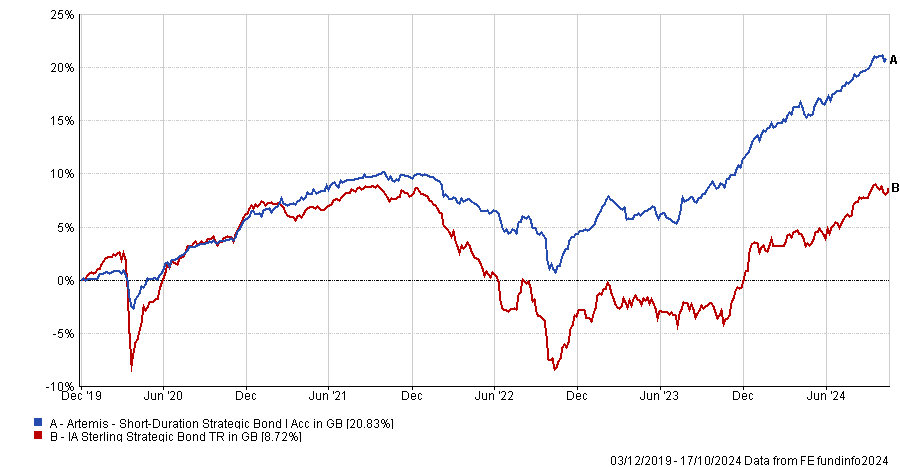

Performance of fund vs sector over 5yrs

Source: FE Analytics

Snowden manages the Artemis Short-Duration Strategic Bond fund but has not always backed his own asset class. In March 2021, he wrote a paper advising investors to stay clear of corporate bonds because they were yielding less than 1%, so any returns would be gobbled up by fund fees. This did not gain him any prizes for popularity amongst his peers, he admitted.

“I cannot defend short-dated corporate bonds with a yield below 1% but I can thump the table and tell people to buy them when they're over 5%,” he said.

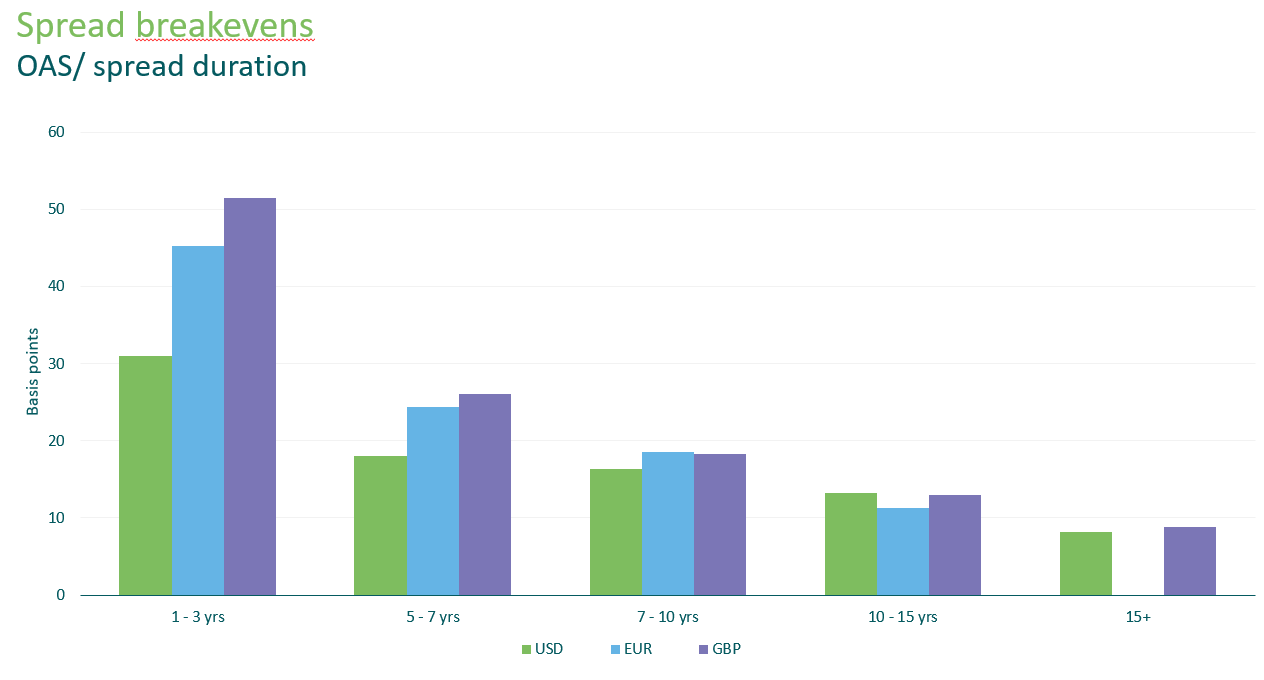

Ben Lord, manager of the £1.3bn M&G Corporate Bond fund, also prefers short-dated bonds but his reasoning is different from Snowden’s. Flat credit spreads mean that the spread breakeven is much better for short-dated bonds, he said.

The breakeven point can be calculated by dividing the credit spread by the duration of the bond. “It gives you a number that tells you how much credit spreads can widen before you’ve lost this year’s spread and you should’ve bought a ‘govvie’,” Lord explained.

Taking the example of a corporate bond yielding around 100 basis points above government bonds, a duration of five years would imply a breakeven rate of 20 basis points. “So if spreads widen by 21 basis points, you’ve lost this year’s spread, you should’ve owned a govvie.”

By contrast, for longer-dated bond with a spread of 100 basis points, divided by 20 years of interest rate risk, the breakeven would be just 5 basis points. “You can lose that in an afternoon,” he said. “You haven’t got a lot in margin of safety.”

Sources: M&G, Bloomberg, data as of 30 Sep 2024

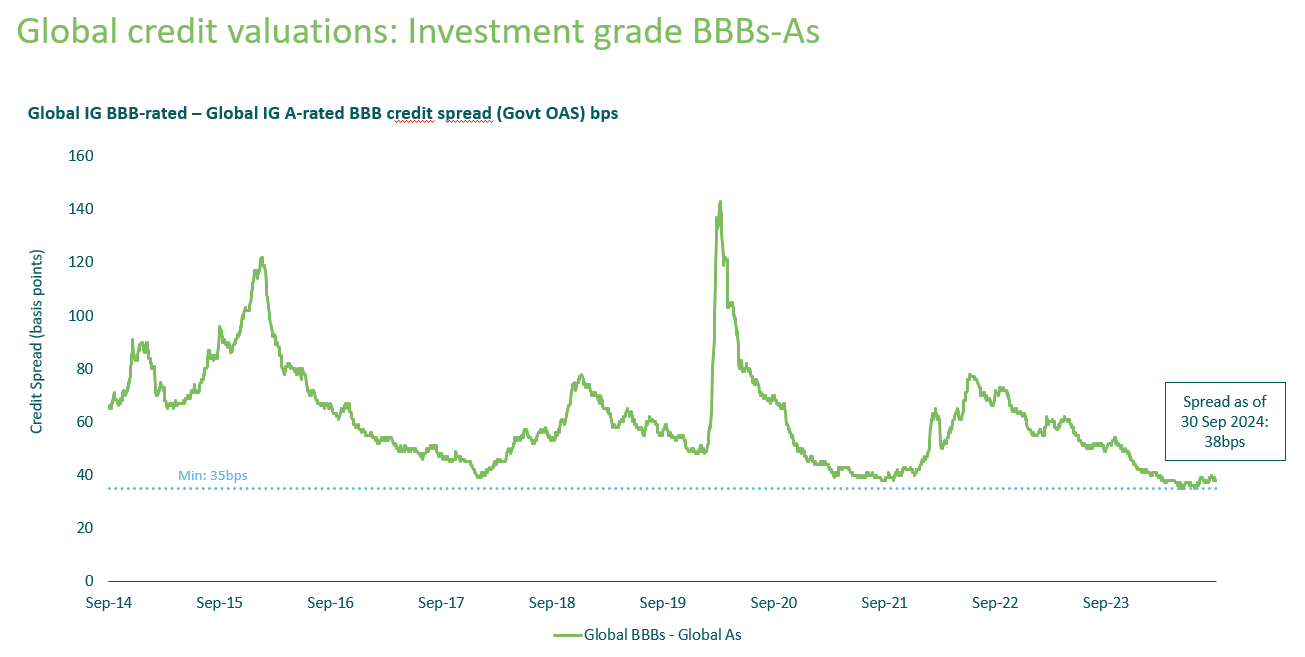

Spreads are not just flat and tight, they are “really compressed”, he continued. The chart below shows the pick-up an investor would get from selling an A-rated bond and buying a BBB-rated bond. “You’re getting paid less than 40 basis points for doing that. It’s easily the tightest it’s been in the past 10 years,” Lord said.

Sources: M&G, ICE BofA indices, Govt OAS spread, data as of 30 Sep 2024

As a result, M&G Investments has reduced risk in its bond portfolios and moved “up in quality, up in liquidity”, he said.