Artemis Income, Fidelity Special Situations and FTF Martin Currie UK Mid Cap are all strong options for investors who believe the Labour government can provide fresh impetus into the UK market and drive economic growth, according to Joseph Hill, senior investment analyst at Hargreaves Lansdown.

In the upcoming Budget, however, chancellor Rachel Reeves is more likely to focus on the £22bn ‘black hole’ she has inherited from the previous government, with speculation rife for increases to capital gains tax, additional taxation on the rich, income threshold freezes and a wind back of savings on investing.

“Mooted targets for tax raids to fill the gap have led to jitters among investors,” said Hill. Indeed, Hargreaves Lansdown’s investor confidence survey shows sentiment towards investing in the UK has dipped amid the uncertainty.

“Investors’ initial enthusiasm for the potential stability offered by this new government has waned and they now have less faith in its ability to grow the economy, at least until they’ve seen details of the Budget,” he said.

“There’s a fine balance to be struck between resetting expectations and avoiding a self-fulfilling spiral of negative sentiment and weakening confidence.”

Despite this, UK equity fund managers remain upbeat, he added, with falling inflation and interest rates helping the market. Increased merger and acquisition (M&A) deals at an average premium of 40% to the share price suggest there is value if investors know where to look.

As such, if the Budget is less punitive than expected and even contains measures to spur growth, the UK could become one of the most attractive markets in the world.

One fund worth considering in this scenario is Artemis Income, run by the “experienced trio” of Nick Shenton and Andy Marsh alongside “industry stalwart” (and FE fundinfo Alpha Manager) Adrian Frost. Between them, they have a combined 80 years of investment experience.

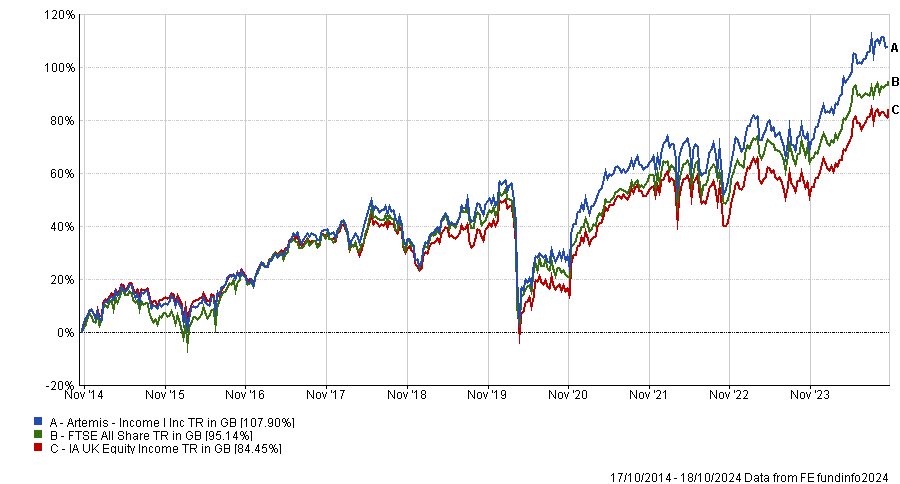

The £4.9bn fund has been a top-quartile performer in the IA UK Equity Income sector over the past 10 years and sits in the second quartile over one, three and five years, showing its consistency.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“We think the Artemis Income team are one of the best in the business and are well placed to make the most of UK income opportunities,” Hill said.

“They mainly invest in large UK businesses but will invest in some medium-sized companies when they find great opportunities. These are companies they believe can pay a sustainable income through the market cycle, whatever the economic backdrop.

“These tend to be businesses with lots of reoccurring revenues, which increases the chance they can retain and grow their customer base, profits, and therefore dividends over time.”

Up next is Alpha Manager Alex Wright’s Fidelity Special Situations, which invests in unloved companies across the market capitalisation spectrum.

Another with a long-term track record, the manager has over 20 years of investment experience and invests in companies that are often ignored by other investors – something he has “never deviated from” in his career.

“Maybe they've missed a profit target, or the management team made some unpopular decisions. Either way, he must believe the company is on the road to recovery,” said Hill.

“As it improves, its share price should rise as other investors recognise the change. As the price rises, Wright gradually takes profits and moves on to the next unloved opportunity.”

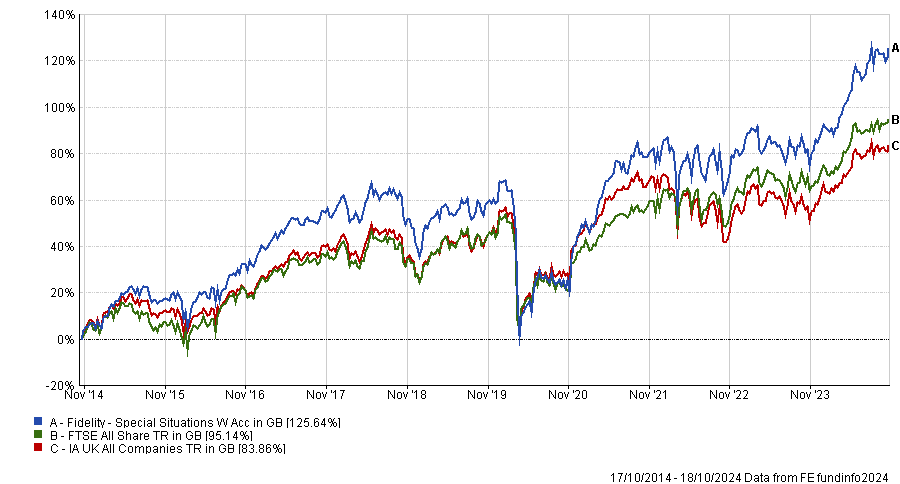

Performance has been even stronger than the Artemis fund, with the Fidelity portfolio sitting in the top quartile of the IA UK All Companies sector over one, three, five and 10 years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Hill’s final selection for funds to benefit from a burgeoning UK economy is FTF Martin Currie UK Mid Cap run by Richard Bullas.

He invests in medium-sized companies within the FTSE 250, which is “often considered the ‘sweet spot’ between company growth potential and maturity”.

“Bullas and his team hunt for businesses with strong growth potential. Their process centres around two key pillars – quality and valuation – which sets a high bar for companies to make it into the fund and aims to mitigate three key risks: business, financial and management,” said Hill.

The FTSE 250 has been a challenging place to be invested recently, as evidenced by the fund’s fourth-quartile performance over three and five years among its IA UK All Companies peers.

However, over 12 months it has been resurgent, up 24.2%, while over 10 years it sits in the second quartile of the peer group.

Last month, Bullas told Trustnet that the recent underperformance of mid-caps over the past few years is an “opportunity” for investors, noting the market is “in the foothills of the recovery”.

“The narrative of out-of-control inflation and the economy contracting or stagnating, has now shifted to one of recovery and growth, and mid-caps will do very well in that environment,” he said.