Liontrust Special Situations remains one of the largest funds in the IA UK All Companies sector with around £3.2bn in assets under management (AUM) but recent performance may leave investors wondering if there are better options elsewhere.

Despite an impressive 10-year performance in which it made 131% under FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, its recent results have been lacklustre. It languished in the third quartile of the IA UK All Companies sector over five and three years and is in the bottom quartile over the past year.

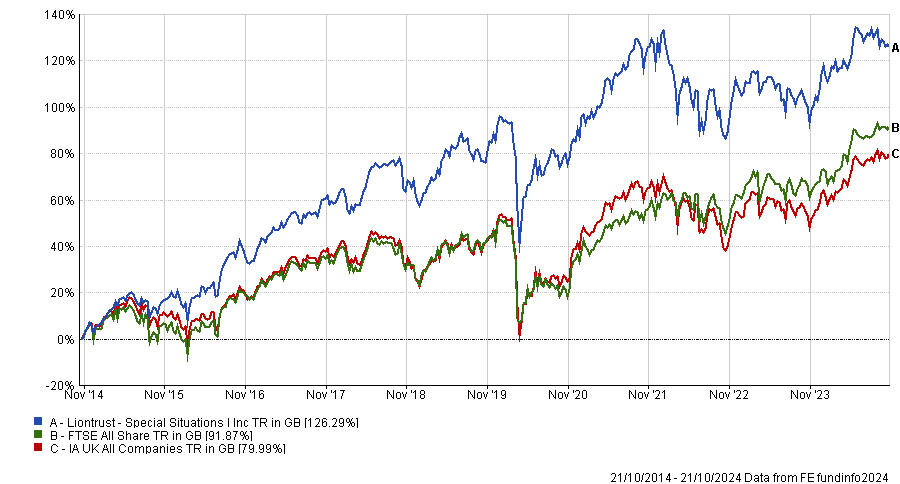

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

This dip in performance could be the result of the portfolio’s high exposure to small and mid-caps, which have struggled recently as interest rates were ramped up. Over the past three years, the FTSE 100 has been the top UK index, up 29.4%, while the FTSE 250 has remained broadly flat (0.1% higher) and the FTSE AIM All-Share index is down some 37.7%. The fund has 32.6% in FTSE 250 names and 21% in AIM stocks, with just 43.3% in FTSE 100 companies.

Up just 0.3% over the past three years, during this time investors would have made far more with a generic UK tracker, with the FTSE All Share gaining 23.5% over this time.

This performance has turned investors off. Since the start of 2022, when the fund had assets under management (AUM) of more than £6.5bn, it has almost halved in size to today’s £3.2bn. Over the past 18 months, it has shrunk by £1.5bn.

Jason Hollands, managing director at Bestinvest said the portfolio has lost some of its lustre, failing to perform despite an experienced team and established strategy.

He attributed this to both wider market challenges, as well as the portfolio being underweight on financials – a major component of the FTSE All Share index – which have done well in recent years.

Hollands added that the portfolio was removed from the Bestinvest ‘Best Funds List’ in 2021, despite many years of inclusion, “principally because we felt the size of the fund and its high weighting in smaller companies would create liquidity challenges”.

However, not all experts were negative on the fund. Samir Shah, senior fund research analyst at Quilter Cheviot, concluded that recent market circumstances made the portfolio a strong play for the future.

While Shah acknowledged the recent poor performance had been challenging and had persisted longer than many investors would have hoped, the strategy remains valid, particularly now as interest rates have begun to fall.

He added: “Investors may be questioning if the team’s strategy remains relevant – to that end, we believe that the fund’s small-cap exposure has been a fantastic source of alpha over the long term and has the potential to be so in the future.”

Indeed, with top-quartile alpha generation of 3.5% over the past 10 years, the fund significantly outperformed the benchmark during its best periods.

Paul Angell, head of investment research at AJ Bell, also cautioned investors against selling the fund, noting that its recent performance had been heavily influenced by wider market circumstances such as interest rates.

Angell said: “Investors should therefore be very careful with the timing of any sell, as they could miss out on a strong period of performance should this section of the market return to favour.”

For investors who were still interested in the Liontrust team and their quality-focused strategy, but keen to reduce their exposure to small and mid-caps, Hollands recommended the £969m Liontrust UK Growth Fund, which is the currently preferred strategy from the Liontrust managers.

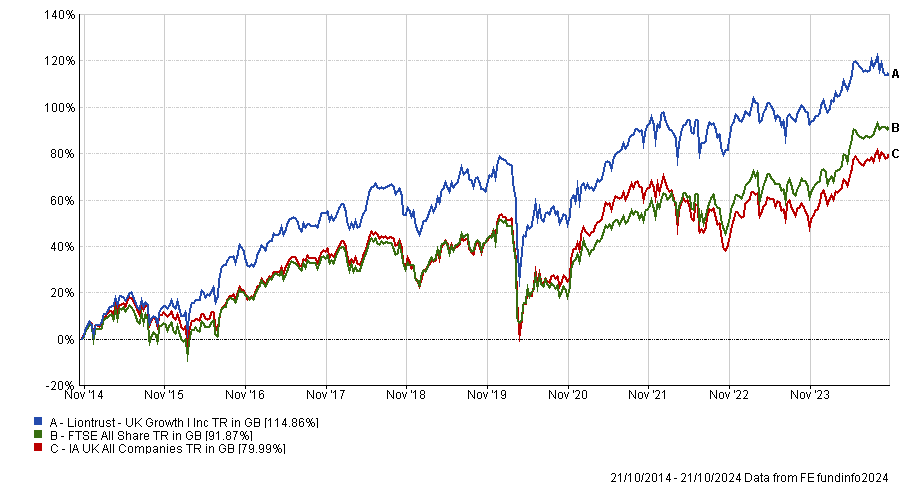

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Over 10 years, the fund has also enjoyed a top-quartile performance of 114.9%, slightly lower than Special Situations, but its five and three-year returns of 31.8% and 12.4%, are better than its larger cousin.

This strategy has also proven popular amongst the team at Square Mile, who have featured the portfolio on their ‘Academy of Funds’.

Analysts at Square Mile said: “In our opinion, this provides investors, especially those who are more market-cap cautious, the opportunity to access the economic advantages team and its formidable work, without having to take on significant exposure to the mid- and smaller-cap strategies that the managers are well known for.”

For quality investors looking beyond Liontrust, Angell recommended the £3.2bn Royal London Sustainable Leaders Trust.

In the long-term, the fund has gone from strength to strength, with the second-best 10-year performance in the peer group of 162.8%.

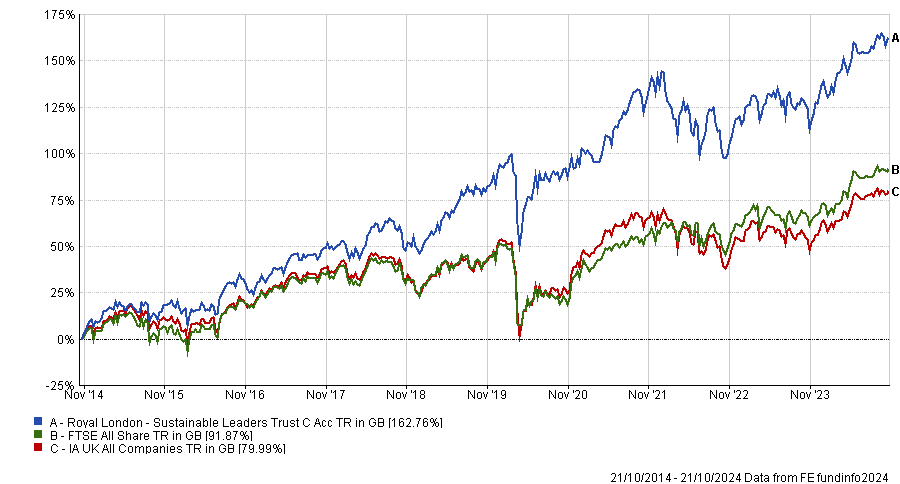

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

It also enjoyed top-quartile returns over the past five years, when it was up by 47%, the 10th best performance in the peer group. Angell attributed this to its similar “quality-based approach” to Liontrust Special Situations, however an emphasis on the large-cap end of the market helped it withstand challenges such as the interest rate hikes in 2022.